Blank Transfer-on-Death Deed Template for Florida

Understanding Florida Transfer-on-Death Deed

-

What is a Florida Transfer-on-Death Deed?

A Florida Transfer-on-Death Deed is a legal document that allows a property owner to transfer their real estate to a designated beneficiary upon their death. This deed does not require the beneficiary to go through probate, simplifying the transfer process.

-

Who can use a Transfer-on-Death Deed in Florida?

Any individual who owns real property in Florida can use a Transfer-on-Death Deed. The owner must be of legal age and mentally competent to execute the deed. Additionally, the beneficiary must be a person or an entity that can legally receive property.

-

How does a Transfer-on-Death Deed work?

When the property owner executes a Transfer-on-Death Deed, they name one or more beneficiaries. The deed is recorded with the county clerk's office. Upon the owner’s death, the property automatically transfers to the beneficiary without going through probate, provided the deed is valid and properly executed.

-

What are the benefits of using a Transfer-on-Death Deed?

There are several advantages to using a Transfer-on-Death Deed:

- It avoids the probate process, saving time and money.

- It allows the property owner to retain full control of the property during their lifetime.

- The owner can revoke or change the deed at any time before their death.

-

Are there any limitations to a Transfer-on-Death Deed?

Yes, there are some limitations. For instance, the deed cannot be used for certain types of property, such as timeshares or property held in a trust. Additionally, if the property has outstanding debts, creditors may still have claims against the property after the owner's death.

-

How do I create a valid Transfer-on-Death Deed?

To create a valid Transfer-on-Death Deed in Florida, the property owner must complete the form, ensuring all required information is included. The owner must sign the deed in the presence of a notary public. After signing, the deed must be recorded with the county clerk’s office where the property is located.

-

Can I change or revoke a Transfer-on-Death Deed?

Yes, a property owner can change or revoke a Transfer-on-Death Deed at any time before their death. To do so, the owner must execute a new deed or a revocation form and record it with the county clerk’s office. This ensures that the most current wishes are reflected.

-

What happens if the beneficiary predeceases the property owner?

If the beneficiary named in the Transfer-on-Death Deed dies before the property owner, the transfer will not occur. The property owner may want to consider naming alternate beneficiaries to ensure the property is transferred as intended.

-

Is legal assistance necessary to create a Transfer-on-Death Deed?

While it is not legally required to seek assistance, consulting with a legal professional can help ensure that the deed is correctly executed and meets all necessary legal requirements. This can prevent potential disputes or issues after the property owner's death.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as the names of the property owners or the beneficiaries, can invalidate the deed.

-

Incorrect Property Description: Not accurately describing the property can lead to confusion or disputes later on. Ensure that the legal description matches public records.

-

Not Signing the Deed: A Transfer-on-Death Deed must be signed by the property owner. Omitting this step renders the deed ineffective.

-

Failure to Notarize: The deed must be notarized to be legally binding. Skipping this step can result in complications during the transfer process.

-

Improper Execution: The deed must be executed in accordance with Florida law. Not following the correct procedures can void the deed.

-

Not Recording the Deed: After completion, the deed must be recorded with the county clerk’s office. Failing to do so means the deed may not be recognized.

-

Conflicting Documents: Having multiple estate planning documents that conflict with the Transfer-on-Death Deed can create legal challenges. Ensure consistency across all documents.

-

Ignoring State-Specific Rules: Each state has its own laws regarding Transfer-on-Death Deeds. Not being aware of Florida’s specific requirements can lead to mistakes.

How to Use Florida Transfer-on-Death Deed

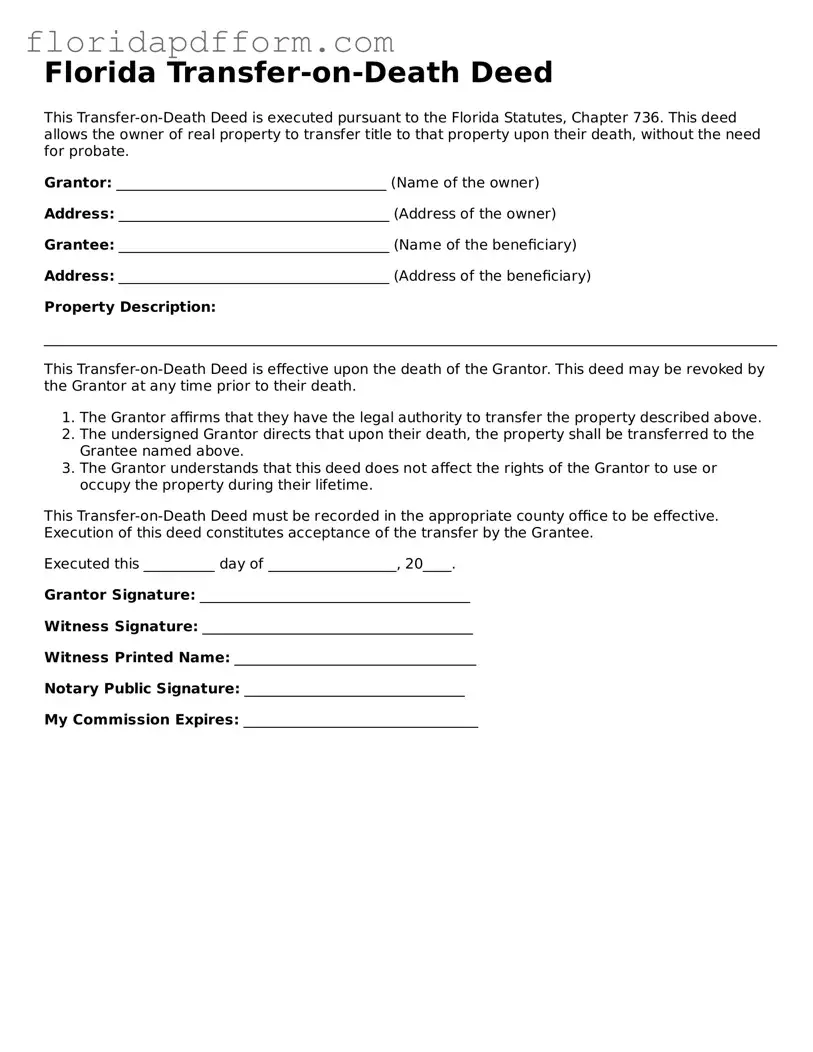

Once you have the Florida Transfer-on-Death Deed form ready, you will need to complete it accurately to ensure it reflects your intentions regarding property transfer. After filling out the form, it must be signed and notarized before being recorded with the appropriate county office.

- Obtain the Florida Transfer-on-Death Deed form from a reliable source or the county clerk’s office.

- Fill in your name as the current property owner in the designated section.

- Provide a complete legal description of the property you wish to transfer. This information can typically be found on your property deed.

- Identify the beneficiary or beneficiaries by including their full names and addresses.

- Indicate whether the transfer is to be shared equally among multiple beneficiaries, if applicable.

- Sign the form in the presence of a notary public. Ensure the notary acknowledges your signature.

- Make copies of the signed and notarized deed for your records.

- File the original deed with the appropriate county clerk’s office where the property is located. Be sure to check for any filing fees.

Form Specifications

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners to transfer their real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Florida Transfer-on-Death Deed is governed by Florida Statutes, Section 732.4015. |

| Eligibility | Any individual who owns real property in Florida can create a Transfer-on-Death Deed. |

| Beneficiaries | Property owners can name one or more beneficiaries in the deed. |

| Revocation | The deed can be revoked at any time before the owner's death by executing a new deed or a revocation document. |

| Filing Requirements | The deed must be signed, witnessed, and recorded in the county where the property is located to be valid. |

| Tax Implications | Beneficiaries may receive a step-up in basis for tax purposes, which can reduce capital gains taxes when they sell the property. |

| Limitations | This deed cannot be used for transferring property held in a trust or for homestead property if there are minor children involved. |

Other Popular Florida Templates

Marital Settlement Agreement for Simplified Dissolution of Marriage - A key step in the separation process that can promote peace of mind.

Simple Bill of Sale Florida - Ending the transaction with a bill of sale can provide peace of mind for both parties.

Deed in Lieu of Forclosure - In exchange for the property, lenders may agree to forgive any remaining mortgage balance, offering potential relief to homeowners.