Blank Tractor Bill of Sale Template for Florida

Understanding Florida Tractor Bill of Sale

-

What is a Florida Tractor Bill of Sale?

A Florida Tractor Bill of Sale is a legal document that records the sale and transfer of ownership of a tractor between a seller and a buyer. This document serves as proof of the transaction and outlines essential details such as the purchase price, the condition of the tractor, and the identities of both parties involved.

-

Why is a Bill of Sale important?

This document is crucial for several reasons. First, it provides legal protection for both the buyer and seller by creating a record of the transaction. Second, it can be used to register the tractor with the state, ensuring that the new owner has the legal right to operate it. Lastly, it can help resolve any disputes that may arise regarding the sale.

-

What information is included in the Florida Tractor Bill of Sale?

The document typically includes:

- The names and addresses of both the buyer and seller

- The make, model, and year of the tractor

- The Vehicle Identification Number (VIN)

- The purchase price

- The date of the transaction

- Any warranties or conditions of sale

-

Do I need to have the Bill of Sale notarized?

While notarization is not strictly required for a Bill of Sale in Florida, having the document notarized can add an extra layer of security. It helps verify the identities of the parties involved and can serve as additional proof of the transaction if needed in the future.

-

Can I use a generic Bill of Sale form for my tractor sale?

Yes, you can use a generic Bill of Sale form, but it’s advisable to use one specifically designed for tractor sales. This ensures that all relevant details are included and that the document complies with Florida laws. Tailored forms often address unique aspects of agricultural equipment transactions.

-

What should I do after completing the Bill of Sale?

Once the Bill of Sale is completed and signed by both parties, each party should retain a copy for their records. The buyer may also need to take the document to the local tax collector’s office to register the tractor and pay any applicable taxes. Keeping the document safe is essential for future reference.

-

What if there are issues after the sale?

If problems arise after the sale, such as undisclosed defects or disputes over the terms, the Bill of Sale can serve as a critical piece of evidence. It is advisable to address any issues promptly and, if necessary, seek legal advice to understand your rights and options based on the terms outlined in the document.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as the buyer's and seller's names, addresses, and contact information, can lead to issues in ownership transfer.

-

Incorrect Vehicle Identification Number (VIN): Mistakes in entering the VIN can create complications when registering the tractor, as this number is crucial for identification.

-

Omitting the Sale Price: Not stating the sale price can raise questions regarding the transaction and may result in tax implications for both parties.

-

Not Including Date of Sale: The absence of a sale date can lead to confusion about when ownership was transferred, affecting liability and insurance matters.

-

Failure to Sign: Both the buyer and seller must sign the document. Neglecting to do so renders the bill of sale ineffective.

-

Not Notarizing the Document: While notarization is not always required, failing to have the document notarized can complicate legal matters in the future.

-

Using Incorrect Form: Utilizing an outdated or incorrect version of the Tractor Bill of Sale form can lead to legal issues, as requirements may change over time.

-

Neglecting to Keep Copies: Not retaining a copy of the signed bill of sale for personal records can create difficulties if disputes arise later.

-

Ignoring Local Laws: Each state may have specific requirements for a bill of sale. Ignoring these can lead to invalidation of the document.

-

Not Disclosing Existing Liens: Failing to mention any liens on the tractor can result in legal consequences, as the buyer may unknowingly purchase an encumbered vehicle.

How to Use Florida Tractor Bill of Sale

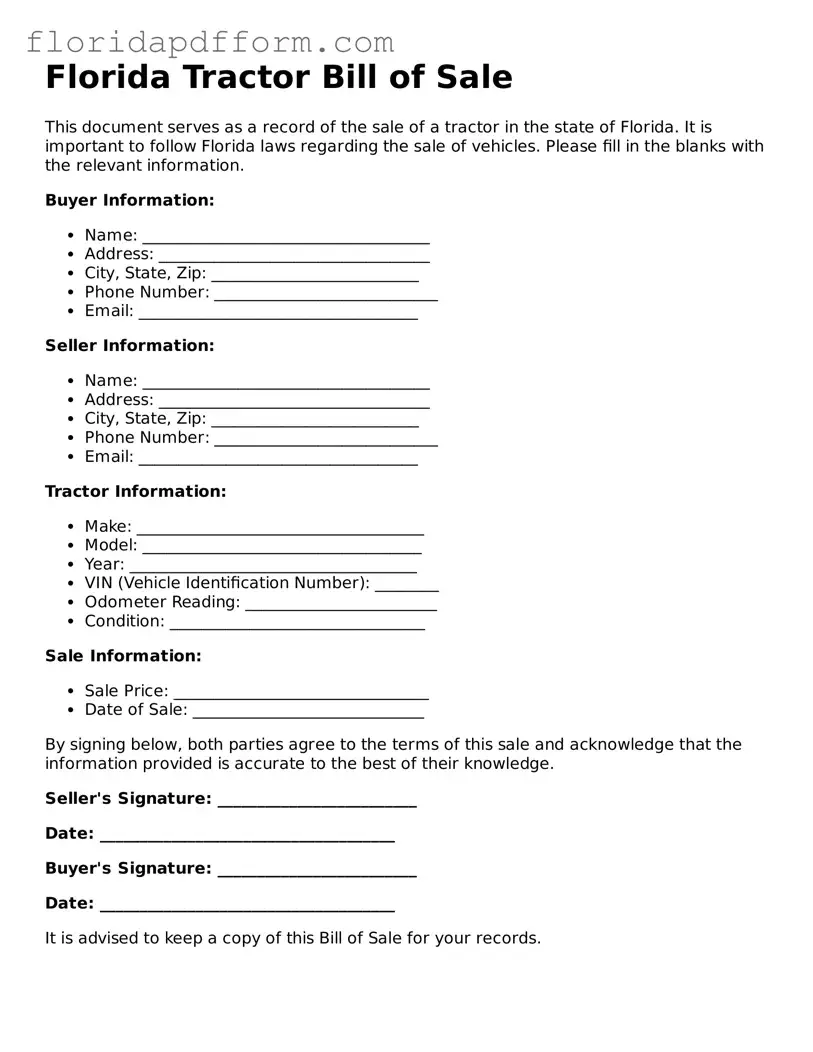

Once you have the Florida Tractor Bill of Sale form ready, it's time to fill it out accurately. This document is essential for transferring ownership of a tractor from one person to another. Follow these steps carefully to ensure all necessary information is provided.

- Seller Information: Write the full name and address of the seller. This includes the street address, city, state, and zip code.

- Buyer Information: Fill in the full name and address of the buyer, including the street address, city, state, and zip code.

- Tractor Details: Provide the make, model, year, and vehicle identification number (VIN) of the tractor. This information is crucial for identification.

- Sale Price: Enter the agreed-upon sale price of the tractor. This should be a clear amount in numbers.

- Date of Sale: Write the date when the sale takes place. Use the format MM/DD/YYYY.

- Signatures: Both the seller and buyer must sign and date the form. This confirms the agreement between both parties.

After completing the form, keep a copy for your records. The buyer should also retain a copy for their records. This will help in any future transactions or registrations related to the tractor.

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Florida Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor. |

| Governing Law | The form is governed by Florida Statutes, specifically Chapter 319 regarding the sale and transfer of motor vehicles. |

| Parties Involved | The form requires the names and addresses of both the seller and the buyer. |

| Vehicle Information | Details about the tractor, including make, model, year, and Vehicle Identification Number (VIN), must be included. |

| Purchase Price | The purchase price of the tractor must be clearly stated on the form. |

| Date of Sale | The date when the sale takes place is an essential part of the document. |

| Signatures | Both the seller and buyer must sign the form to validate the transaction. |

| Notarization | While not mandatory, notarizing the bill of sale can provide additional legal protection. |

| Record Keeping | It is advisable for both parties to keep a copy of the signed bill of sale for their records. |

Other Popular Florida Templates

Corporations in Florida - The Articles outline the procedures for making significant business decisions.

Florida Independent Contractor Agreement - It can provide a framework for changes in the scope of work, detailing the process for adjustments.

Does a Bill of Sale Have to Be Notarized in Florida - Includes details of the boat and the transaction.