Blank Small Estate Affidavit Template for Florida

Understanding Florida Small Estate Affidavit

-

What is a Florida Small Estate Affidavit?

A Florida Small Estate Affidavit is a legal document that allows heirs to claim the assets of a deceased person without going through the formal probate process. This option is available when the total value of the estate is below a certain threshold, making it a simpler and quicker way to settle an estate.

-

Who can use the Small Estate Affidavit?

Typically, the surviving spouse, children, or other close relatives of the deceased can use the Small Estate Affidavit. It is important to note that all heirs must agree to use this method. Additionally, the estate must meet specific criteria, such as having a total value that does not exceed $75,000, excluding certain exempt assets.

-

What information is required to complete the Small Estate Affidavit?

To complete the Small Estate Affidavit, you will need to provide several key pieces of information. This includes:

- The name and date of death of the deceased.

- A description of the assets and their estimated values.

- Details about the heirs, including their relationship to the deceased.

- A statement confirming that no probate proceedings are pending.

All information must be accurate and truthful to avoid any legal issues later on.

-

How do I file the Small Estate Affidavit?

Filing the Small Estate Affidavit involves a few steps. First, complete the affidavit form accurately. Then, gather any necessary supporting documents, such as a death certificate and proof of the heirs' identities. Once everything is ready, you can file the affidavit with the clerk of the circuit court in the county where the deceased lived. There may be a small filing fee, so check with the court for specific requirements.

Common mistakes

-

Not including all required information. The Florida Small Estate Affidavit requires specific details about the deceased, such as their full name, date of death, and a description of the estate. Omitting any of this information can lead to delays or rejections.

-

Failing to sign the affidavit. It’s essential that the individual completing the form signs it. Without a signature, the affidavit is considered incomplete and cannot be processed.

-

Incorrectly estimating the value of the estate. The total value of the estate must not exceed $75,000, excluding certain exemptions. Overestimating can disqualify the estate from using the Small Estate Affidavit process.

-

Neglecting to provide supporting documents. Attachments such as a death certificate and proof of ownership for the assets are necessary. Failing to include these documents can result in complications.

-

Not understanding the eligibility requirements. The Small Estate Affidavit is only applicable under specific conditions, such as when there are no pending debts or claims against the estate. Misunderstanding these requirements can lead to inappropriate use of the affidavit.

How to Use Florida Small Estate Affidavit

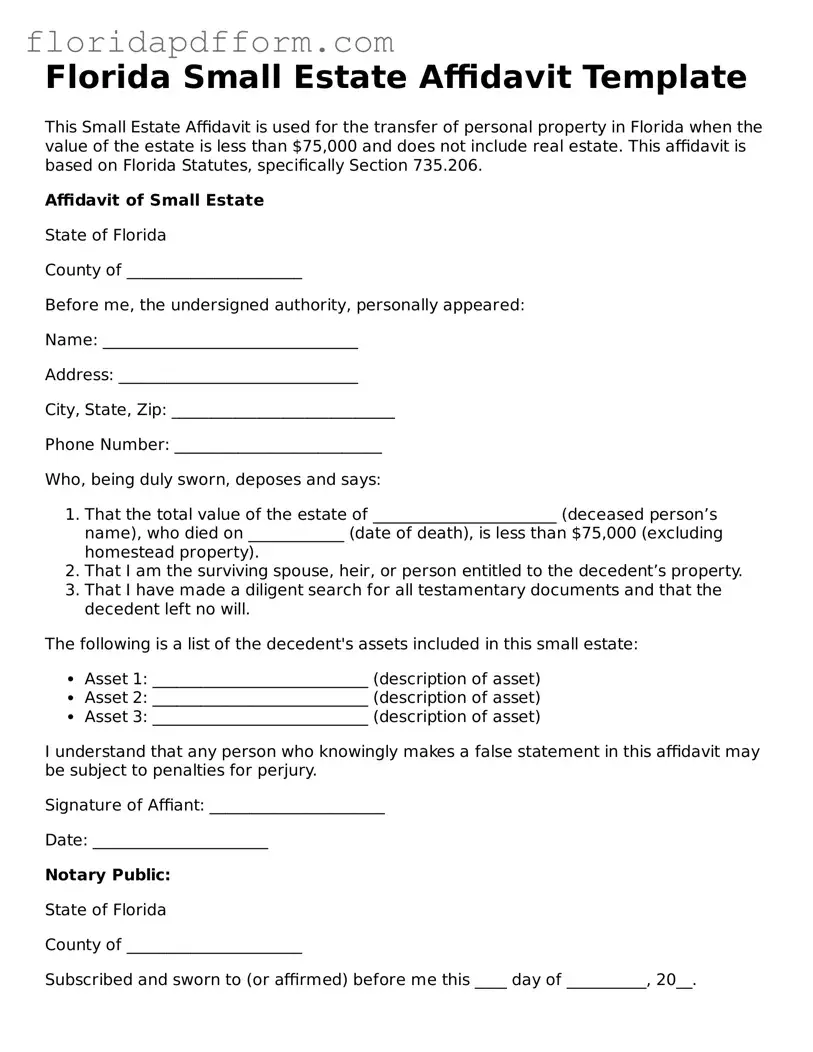

After gathering the necessary information and documents, you are ready to fill out the Florida Small Estate Affidavit form. This process involves providing details about the deceased person's estate and the heirs. Follow these steps carefully to ensure accuracy and completeness.

- Obtain the Florida Small Estate Affidavit form. You can find it online or at your local courthouse.

- Fill in the name of the deceased person at the top of the form.

- Provide the date of death. Make sure this is accurate, as it is crucial for the process.

- List the names and addresses of all heirs. Include their relationship to the deceased.

- Detail the assets of the estate. Include a description of each asset and its approximate value.

- Indicate any debts or liabilities of the deceased that may affect the estate.

- Sign the affidavit in front of a notary public. This step is essential for the affidavit to be legally valid.

- Make copies of the completed form for your records and for the heirs.

- File the affidavit with the appropriate court in the county where the deceased lived.

Once you have submitted the affidavit, the court will review it. If everything is in order, you will receive a court order allowing you to manage the estate according to the details provided in the affidavit.

Form Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Florida Small Estate Affidavit allows heirs to claim property without going through probate if the estate's value is below a certain threshold. |

| Value Limit | As of 2023, the total value of the estate must not exceed $75,000, excluding exempt property. |

| Governing Law | The use of the Small Estate Affidavit is governed by Florida Statutes, specifically Section 735.201. |

| Eligibility | Only heirs or beneficiaries named in the will or by law can use this affidavit to claim assets. |

| Required Information | The affidavit must include details about the deceased, the heirs, and the assets being claimed. |

| Filing Process | The completed affidavit is typically presented to the financial institutions or entities holding the deceased's assets. |

Other Popular Florida Templates

Florida Premarital Agreement - The agreement should be signed well in advance of the wedding date.

Lease Agreement Florida Template - The agreement could specify terms under which landlords can conduct property inspections, ensuring landlord rights are recognized.