Free Rt 6A Florida Form

Understanding Rt 6A Florida

-

What is the RT-6A Florida form?

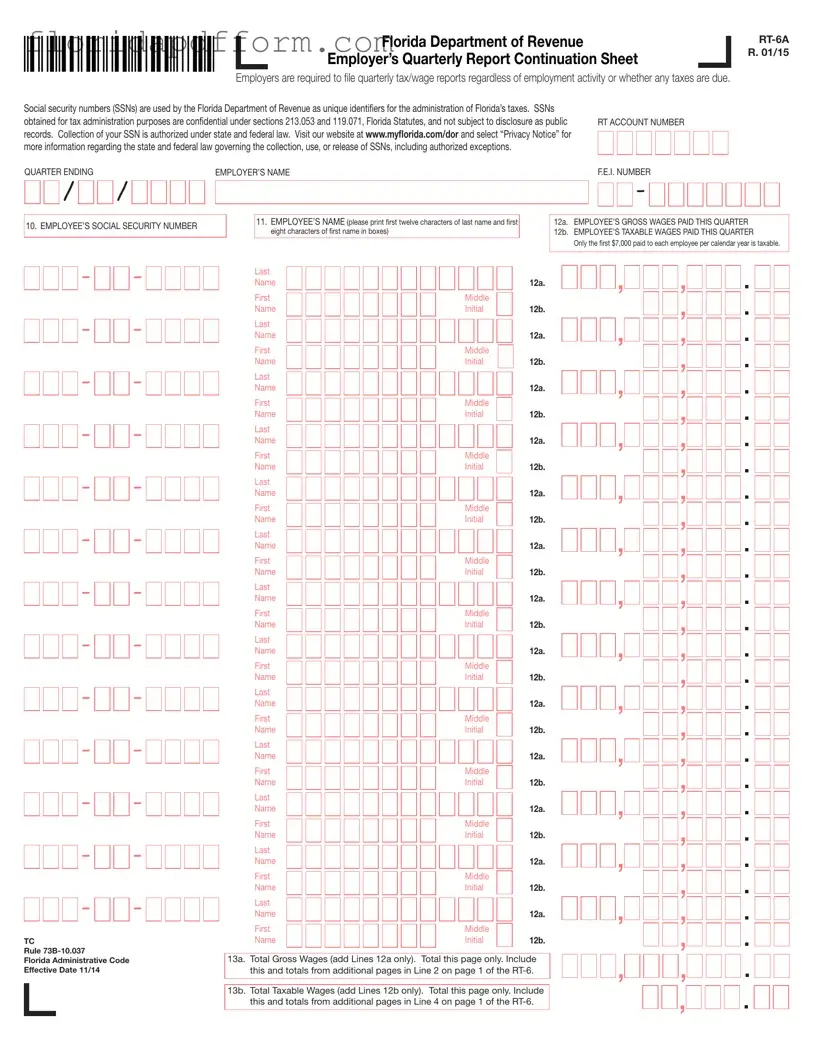

The RT-6A form is the Employer’s Quarterly Report Continuation Sheet required by the Florida Department of Revenue. Employers must file this form quarterly to report wages and taxes, regardless of whether there are employees or taxes due during that period.

-

Who needs to file the RT-6A form?

All employers in Florida are required to file the RT-6A form if they have employees. This includes businesses of all sizes and types, whether they have active employees or not. Filing is mandatory even if no wages or taxes are due.

-

What information do I need to provide on the RT-6A form?

When completing the RT-6A form, you will need to provide the following information:

- Your employer name and Florida Employer Identification Number (FEIN).

- Each employee's Social Security Number (SSN).

- Each employee's name, including the first twelve characters of the last name and the first eight characters of the first name.

- Total gross wages and total taxable wages for each employee.

-

Why is the Social Security Number required?

The Florida Department of Revenue uses Social Security Numbers (SSNs) as unique identifiers for tax administration. The collection of SSNs is authorized under state and federal law, and they are kept confidential according to specific statutes.

-

What are the taxable wage limits?

Only the first $7,000 paid to each employee within a calendar year is considered taxable. Wages exceeding this amount are not subject to state unemployment tax.

-

How do I calculate total gross and taxable wages?

To calculate total gross wages, add the amounts from Line 12a for all employees listed on the form. For taxable wages, sum the amounts from Line 12b. These totals should then be included in the appropriate lines on the main RT-6 form.

-

When is the RT-6A form due?

The RT-6A form must be submitted quarterly. Deadlines typically fall on the last day of the month following the end of each quarter. For example, reports for the first quarter, ending March 31, are due by April 30.

-

Where can I find additional information about the RT-6A form?

For more details, visit the Florida Department of Revenue's website at www.mylorida.com/dor. The site offers resources, including a privacy notice that explains the handling of SSNs and other important information related to tax reporting.

-

What happens if I fail to file the RT-6A form?

Failing to file the RT-6A form can lead to penalties and interest on any unpaid taxes. It is crucial to comply with filing requirements to avoid complications with the Florida Department of Revenue.

-

Can I file the RT-6A form online?

Yes, employers can file the RT-6A form online through the Florida Department of Revenue's e-Services portal. This option simplifies the filing process and allows for quicker processing of your report.

Common mistakes

-

Incorrectly Entering Social Security Numbers: One of the most common mistakes is entering an employee's Social Security Number (SSN) incorrectly. This can lead to significant issues with tax reporting and may cause delays in processing.

-

Missing Employer Information: Failing to provide complete employer details, such as the Employer’s Name or F.E.I. Number, can hinder the processing of the form. Ensure all required fields are filled out accurately.

-

Errors in Employee Names: When filling out employee names, it's crucial to print the first twelve characters of the last name and the first eight characters of the first name correctly. Mistakes here can lead to mismatches in records.

-

Miscalculating Wages: Many individuals miscalculate total gross wages and taxable wages. It’s essential to double-check these figures, as only the first $7,000 paid to each employee per calendar year is taxable.

-

Neglecting to Include Totals: Some people forget to include the totals from additional pages in the appropriate lines on page 1 of the RT-6 form. This oversight can result in incomplete submissions and potential penalties.

How to Use Rt 6A Florida

Filling out the RT-6A form is an important step for employers in Florida to report their quarterly tax and wage information. This process ensures compliance with state regulations, even if there were no employees or taxes due during the quarter. Below are the steps to complete the form accurately.

- Begin by entering the Quarter Ending date at the top of the form. This is typically the last day of the quarter for which you are reporting.

- Fill in your Employer’s Name as it appears on your business registration documents.

- Provide your F.E.I. Number, which is your Federal Employer Identification number.

- For each employee, enter their Social Security Number in the designated boxes. Ensure accuracy to avoid any issues.

- Next, in the EMPLOYEE’S NAME section, print the first twelve characters of the last name and the first eight characters of the first name for each employee in the appropriate boxes.

- In the Total Gross Wages section (Line 13a), add up the gross wages paid to all employees during the quarter. This total should only reflect the wages from this page.

- In the Total Taxable Wages section (Line 13b), calculate the total taxable wages, which includes only the first $7,000 paid to each employee per calendar year. Again, this total is for this page only.

- Once all information is filled out, double-check for accuracy. Ensure that all numbers and names are correct to avoid delays or issues with processing.

- Finally, submit the completed RT-6A form along with any required payments to the Florida Department of Revenue by the due date.

File Specs

| Fact Name | Description |

|---|---|

| Quarterly Requirement | Employers must file quarterly tax and wage reports, regardless of whether they have employees or owe taxes. |

| Form Identification | The form is known as the RT-6A, with an effective date of January 2015. |

| Social Security Numbers | SSNs are used as unique identifiers for tax administration by the Florida Department of Revenue. |

| Confidentiality of SSNs | Under sections 213.053 and 119.071 of the Florida Statutes, SSNs are confidential and not publicly disclosed. |

| Authorized Collection | The collection of SSNs is authorized by both state and federal law. |

| Taxable Wage Limit | Only the first $7,000 paid to each employee in a calendar year is considered taxable. |

| Governing Rules | TC Rule 73B-10.037 of the Florida Administrative Code governs the use of this form. |

Additional PDF Forms

Florida Notice to Vacate Form - Landlords must ensure that properties are equipped with functioning smoke detectors per safety regulations.

Florida Dh 3212 - The form requires personal information such as name, address, and contact details.