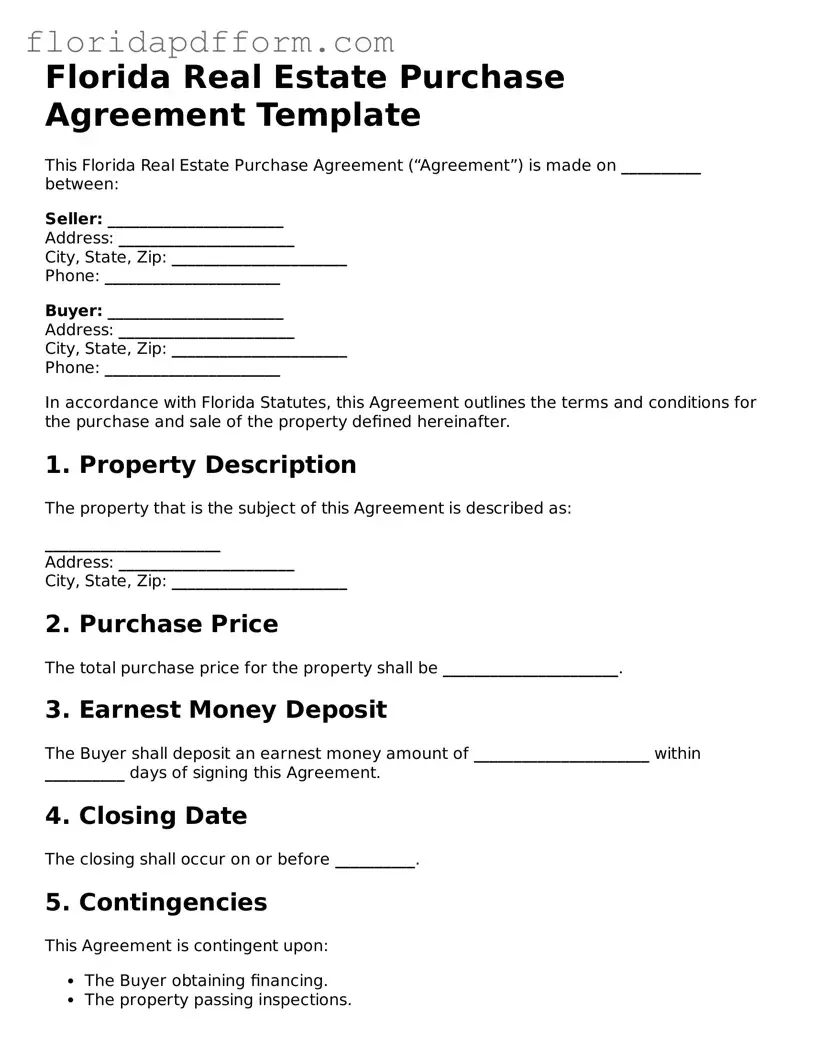

Blank Real Estate Purchase Agreement Template for Florida

Understanding Florida Real Estate Purchase Agreement

-

What is a Florida Real Estate Purchase Agreement?

A Florida Real Estate Purchase Agreement is a legally binding document used in real estate transactions within the state of Florida. It outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement includes details such as the purchase price, closing date, and any contingencies that must be met before the sale can be finalized.

-

What are the essential components of the agreement?

Key components of the Florida Real Estate Purchase Agreement typically include:

- Parties Involved: Names and contact information of the buyer and seller.

- Property Description: A detailed description of the property being sold, including the address and legal description.

- Purchase Price: The agreed-upon price for the property.

- Earnest Money Deposit: An amount paid by the buyer to demonstrate commitment to the purchase.

- Contingencies: Conditions that must be satisfied for the sale to proceed, such as financing or inspections.

- Closing Date: The date when the transaction will be finalized and ownership transferred.

-

How does the agreement protect both buyers and sellers?

The Florida Real Estate Purchase Agreement serves to protect both parties by clearly outlining their rights and obligations. For buyers, the agreement can include contingencies that allow them to withdraw from the transaction if certain conditions are not met, such as a satisfactory home inspection. For sellers, the agreement ensures that buyers are committed to the purchase through the earnest money deposit and stipulates the timeline for closing, which helps avoid delays and misunderstandings.

-

Can the agreement be modified after it is signed?

Yes, the Florida Real Estate Purchase Agreement can be modified after it is signed, but any changes must be agreed upon by both parties. Modifications should be documented in writing and signed by both the buyer and seller to ensure clarity and enforceability. This process helps maintain transparency and can prevent disputes down the line.

Common mistakes

-

Inaccurate Property Description: Many buyers fail to provide a complete and accurate description of the property. This includes the legal description, address, and any specific details about the property boundaries.

-

Missing Signatures: It’s crucial for all parties involved to sign the agreement. Missing signatures can delay the process or even invalidate the contract.

-

Incorrect Dates: Filling in the wrong dates can lead to confusion. Ensure that all dates, including the closing date and effective date, are accurate and clearly stated.

-

Not Specifying Contingencies: Buyers often forget to include important contingencies, such as financing or inspection clauses. These protect the buyer’s interests and should be clearly outlined.

-

Ignoring Earnest Money Deposit: Failing to specify the amount of the earnest money deposit can lead to misunderstandings. Clearly state the amount and how it will be handled.

-

Overlooking Closing Costs: Some buyers neglect to address who will pay for closing costs. This should be clearly defined to avoid disputes later on.

-

Not Reviewing the Entire Document: Skimming through the agreement without thoroughly reviewing each section can lead to mistakes. Take the time to read and understand every part of the document.

How to Use Florida Real Estate Purchase Agreement

Once you have the Florida Real Estate Purchase Agreement form in hand, you are ready to begin the process of filling it out. This form is essential for outlining the terms of a property transaction between a buyer and a seller. Careful attention to detail is crucial to ensure that all necessary information is included and accurately represented.

- Begin with the date: Write the date on which the agreement is being executed at the top of the form.

- Identify the parties: Fill in the names of the buyer(s) and seller(s). Ensure that you include their full legal names as they appear on official documents.

- Property description: Provide a detailed description of the property being sold. This typically includes the address and any relevant legal description.

- Purchase price: Clearly state the agreed-upon purchase price for the property. Make sure to double-check the figures.

- Deposit information: Indicate the amount of the initial deposit and the method of payment. Specify where the deposit will be held.

- Financing details: If applicable, describe the type of financing the buyer will use to purchase the property. Include any necessary contingencies related to financing.

- Closing date: Specify the proposed closing date for the transaction. This is the date when ownership will be officially transferred.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as inspections or repairs.

- Signatures: Ensure that all parties sign and date the agreement. This includes both the buyer(s) and seller(s). If there are multiple buyers or sellers, each must sign.

After completing these steps, review the form carefully for any errors or omissions. Once finalized, the agreement can be presented to the other party for their review and signature. This document will serve as the foundation for the real estate transaction, so accuracy is key.

Form Specifications

| Fact Name | Description |

|---|---|

| Governing Law | The Florida Real Estate Purchase Agreement is governed by Florida state law. |

| Purpose | This agreement outlines the terms and conditions for buying and selling real estate in Florida. |

| Parties Involved | The agreement typically includes a buyer and a seller, both of whom must be identified. |

| Property Description | A clear and detailed description of the property being sold is required. |

| Purchase Price | The total purchase price must be specified, along with any deposit amounts. |

| Contingencies | Common contingencies include financing, inspections, and appraisal conditions. |

| Closing Date | The agreement should include a specified closing date for the transaction. |

Other Popular Florida Templates

Bill of Sale for Trailer Template - Comprehensive details include buyer and seller information.

Cease and Desist Letter Template - Crafting a Cease and Desist Letter requires a clear understanding of your legal rights.