Blank Quitclaim Deed Template for Florida

Understanding Florida Quitclaim Deed

-

What is a Quitclaim Deed in Florida?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties. This means the grantor (the person transferring the property) does not guarantee that they own the property free and clear of any claims. Instead, they simply transfer whatever interest they may have in the property to the grantee (the person receiving the property).

-

When should I use a Quitclaim Deed?

Quitclaim Deeds are commonly used in specific situations, such as:

- Transferring property between family members.

- Clearing up title issues.

- Transferring property into a trust.

- Divorce settlements where one spouse transfers their interest to the other.

-

What are the requirements for a Quitclaim Deed in Florida?

To be valid in Florida, a Quitclaim Deed must meet certain criteria:

- It must be in writing.

- It must include the names of the grantor and grantee.

- The legal description of the property must be included.

- The grantor must sign the deed in front of a notary public.

- It should be recorded in the county where the property is located.

-

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed offers no such guarantees. This makes Quitclaim Deeds riskier for the grantee since they may inherit any existing liens or claims against the property.

-

Do I need an attorney to prepare a Quitclaim Deed?

While it is not legally required to have an attorney prepare a Quitclaim Deed, it is often advisable. An attorney can ensure that the deed is properly drafted and complies with Florida law, reducing the risk of future disputes or complications.

-

How do I record a Quitclaim Deed in Florida?

To record a Quitclaim Deed, follow these steps:

- Complete the Quitclaim Deed with all necessary information.

- Have the grantor sign the deed in front of a notary public.

- Visit the county clerk's office in the county where the property is located.

- Submit the deed along with any required fees for recording.

-

Are there any tax implications when using a Quitclaim Deed?

Transferring property via a Quitclaim Deed may have tax implications. While the transfer itself may not trigger a tax, it could affect property taxes or capital gains taxes in the future. It is advisable to consult with a tax professional to understand any potential liabilities.

-

Can I revoke a Quitclaim Deed after it has been executed?

Once a Quitclaim Deed has been executed and recorded, it cannot be revoked unilaterally. However, the grantor can create a new deed that transfers the property back or to another party. This process should be handled carefully to ensure legal compliance.

-

What happens if the grantor has no legal claim to the property?

If the grantor does not have a legal claim to the property, the Quitclaim Deed will still transfer whatever interest the grantor may have, but it may not confer any actual ownership rights to the grantee. This situation can lead to disputes, so thorough research on property titles is essential before proceeding with a Quitclaim Deed.

Common mistakes

-

Incorrect Property Description: Failing to provide a complete and accurate description of the property can lead to issues. Ensure that the legal description matches what is on the current deed.

-

Missing Signatures: All parties involved must sign the deed. Omitting a signature can invalidate the document and delay the transfer process.

-

Improper Notarization: The deed must be notarized to be legally binding. A missing notary seal or signature can render the deed ineffective.

-

Incorrect Names: Names must be spelled correctly and match the identification documents of the individuals involved. Any discrepancies can cause complications in ownership transfer.

-

Failure to Include Consideration: While a quitclaim deed does not require a monetary exchange, stating the consideration, even if it is nominal, is important for legal clarity.

-

Not Recording the Deed: After completing the quitclaim deed, it must be recorded with the county clerk’s office. Failing to do so can lead to disputes over property ownership in the future.

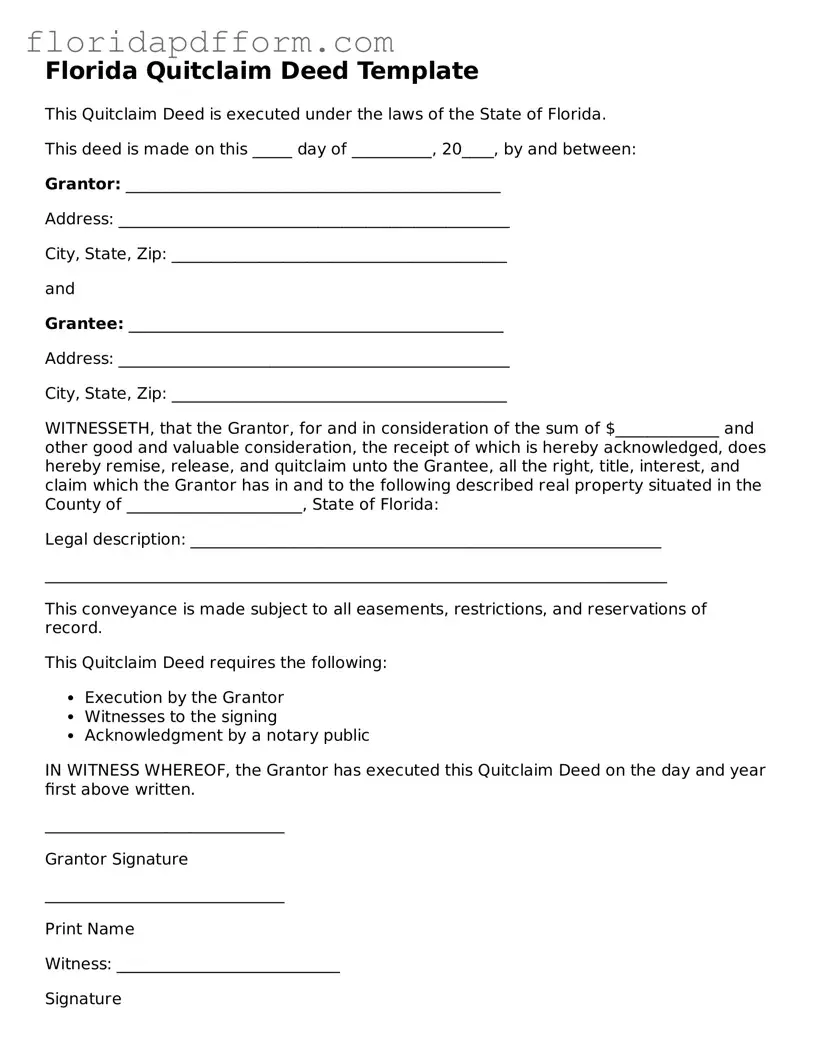

How to Use Florida Quitclaim Deed

After you have gathered the necessary information and documents, you will be ready to fill out the Florida Quitclaim Deed form. This form is essential for transferring property ownership. Once completed, the deed must be signed, notarized, and filed with the appropriate county office to ensure the transfer is legally recognized.

- Begin by obtaining the Florida Quitclaim Deed form. You can find this form online or at your local county clerk's office.

- At the top of the form, fill in the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Next, provide the address of the property being transferred. Include the street address, city, state, and zip code.

- In the designated area, describe the property. This may include the legal description, which can often be found on the current deed or tax records.

- Indicate the consideration, or payment, for the property transfer. If no money is exchanged, you may state "for love and affection" or a similar phrase.

- Both the grantor and grantee must sign the form. Ensure that the signatures are dated and that they match the names listed at the top.

- Have the signatures notarized. This step is crucial, as it verifies the identities of the signers and the authenticity of the document.

- Finally, submit the completed Quitclaim Deed to the county clerk’s office in the county where the property is located. Pay any required filing fees.

Form Specifications

| Fact Name | Details |

|---|---|

| Definition | A quitclaim deed transfers ownership interest in property without guaranteeing the quality of the title. |

| Governing Law | The Florida Quitclaim Deed is governed by Florida Statutes, Chapter 689. |

| Use Cases | Commonly used for transferring property between family members or clearing up title issues. |

| Requirements | The deed must include the names of the grantor and grantee, a legal description of the property, and the signature of the grantor. |

| Notarization | The grantor's signature must be notarized for the deed to be valid. |

| Recording | To protect the grantee's interest, the quitclaim deed should be recorded with the county clerk's office. |

| Tax Implications | Transfer taxes may apply, and it is advisable to consult a tax professional regarding potential liabilities. |

| Revocation | A quitclaim deed cannot be revoked once executed, unless a new deed is created. |

| Limitations | This type of deed does not protect the grantee against claims or liens on the property. |

Other Popular Florida Templates

General Affidavit Form Florida - Failure to correct errors may lead to legal challenges or misunderstandings.

Florida Standard Lease Agreement - It helps to clarify expectations around common areas and shared facilities.