Blank Promissory Note Template for Florida

Understanding Florida Promissory Note

-

What is a Florida Promissory Note?

A Florida Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender. It includes details such as the amount borrowed, interest rate, repayment schedule, and any consequences for defaulting on the loan.

-

Who can use a Promissory Note in Florida?

Any individual or business can use a Promissory Note in Florida. This includes personal loans between friends or family, business loans, and more formal lending arrangements between institutions.

-

What information is typically included in a Florida Promissory Note?

A typical Promissory Note includes:

- The names and addresses of the borrower and lender

- The principal amount of the loan

- The interest rate and how it is calculated

- The repayment schedule, including due dates

- Any late fees or penalties for missed payments

- Conditions under which the lender can demand full repayment

-

Is a Promissory Note legally binding in Florida?

Yes, a Promissory Note is legally binding in Florida as long as it meets certain criteria. It must be signed by both parties and include clear terms regarding the loan. If either party fails to adhere to the terms, the other party may seek legal remedies.

-

Do I need a lawyer to create a Promissory Note?

While it is not required to have a lawyer draft a Promissory Note, it is often advisable. A legal professional can help ensure that the document meets all necessary legal requirements and protects your interests.

-

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is best to document any modifications in writing and have both parties sign the amended note to avoid confusion later on.

-

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take legal action to recover the owed amount. This may include filing a lawsuit or seeking to collect through other means, depending on the terms outlined in the Promissory Note.

-

Are there any specific state laws governing Promissory Notes in Florida?

Florida law does provide certain guidelines regarding Promissory Notes, particularly concerning interest rates and collection practices. It's important to familiarize yourself with these laws to ensure compliance and protect your rights.

-

Can I use a Promissory Note for a business loan?

Absolutely. A Promissory Note can be used for both personal and business loans. It is a common tool for documenting loans between business partners or for loans taken out to fund business operations.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as names, addresses, and the loan amount, can lead to confusion and potential legal issues down the line.

-

Incorrect Dates: Entering the wrong date can affect the enforceability of the note. Ensure that the date of signing is accurate to avoid disputes.

-

Missing Signatures: Both the borrower and lender must sign the document. Omitting a signature can render the note invalid.

-

Ambiguous Terms: Vague language regarding repayment terms, interest rates, or penalties can lead to misunderstandings. Be specific to ensure clarity.

-

Ignoring State Laws: Not adhering to Florida's specific requirements for promissory notes can result in unenforceability. Familiarize yourself with local laws.

-

Failure to Include Payment Schedule: Not outlining how and when payments should be made can lead to confusion. A clear schedule helps both parties understand their obligations.

-

Neglecting to Keep Copies: After filling out the form, failing to make copies for both parties can lead to disputes regarding the terms of the agreement. Always retain a copy for your records.

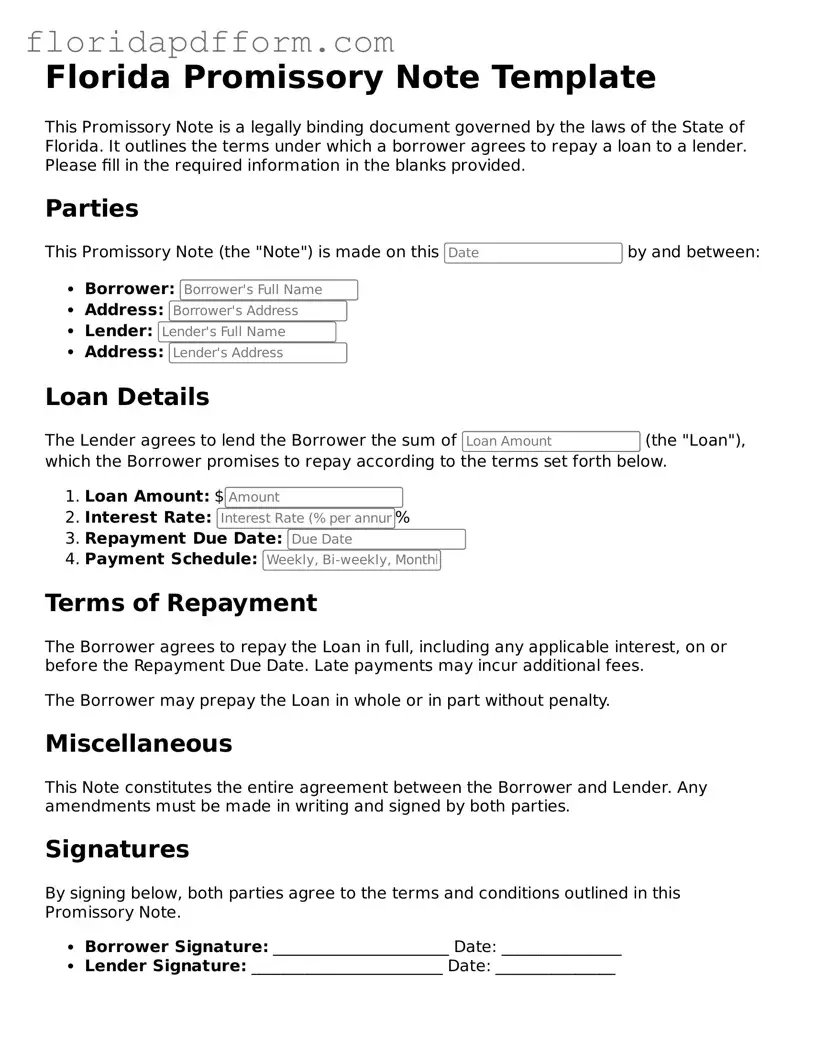

How to Use Florida Promissory Note

After you have gathered all necessary information, you can begin filling out the Florida Promissory Note form. Make sure to provide accurate details to ensure the document is valid and enforceable.

- Begin by entering the date at the top of the form. Use the format Month, Day, Year.

- Fill in the name of the borrower. This is the person or entity receiving the loan.

- Next, enter the name of the lender. This is the person or entity providing the loan.

- Specify the principal amount. This is the total amount being borrowed.

- Indicate the interest rate. This is the percentage charged on the principal amount.

- Fill in the payment terms. This includes the frequency of payments (e.g., monthly, quarterly) and the duration of the loan.

- Include any late fees or penalties for missed payments, if applicable.

- Sign the document. The borrower must sign to acknowledge the terms.

- Have the lender sign the document as well. This confirms their agreement to the terms.

- Finally, date the signatures to indicate when the agreement was executed.

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Florida Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date. |

| Governing Law | Florida Statutes, Chapter 673, governs promissory notes in Florida. |

| Parties Involved | The two primary parties are the borrower (maker) and the lender (payee). |

| Interest Rates | Interest rates can be fixed or variable, and they must be clearly stated in the note. |

| Repayment Terms | The repayment schedule, including due dates and payment amounts, should be explicitly outlined. |

| Default Clause | A default clause may be included, detailing the consequences if the borrower fails to make payments. |

| Signatures | Both parties must sign the note for it to be legally binding; witnesses or notarization may also be required. |

Other Popular Florida Templates

Simple Bill of Sale Florida - Buyers should always request a Bill of Sale to ensure that they are legally recognized as the new owners.

Non Compete Template - This agreement helps protect a company's trade secrets and confidential information from competitors.