Blank Operating Agreement Template for Florida

Understanding Florida Operating Agreement

-

What is a Florida Operating Agreement?

A Florida Operating Agreement is a legal document that outlines the management structure and operating procedures of a Limited Liability Company (LLC) in Florida. This agreement serves as a blueprint for how the LLC will operate, detailing the rights and responsibilities of the members, management, and any other relevant parties.

-

Is an Operating Agreement required in Florida?

While Florida law does not mandate that LLCs have an Operating Agreement, it is highly recommended. Having this document can help clarify the roles of members and managers, reduce misunderstandings, and provide a framework for resolving disputes. Additionally, an Operating Agreement can help protect the limited liability status of the LLC by demonstrating that it is a separate legal entity.

-

What should be included in a Florida Operating Agreement?

An effective Operating Agreement should cover several key components, including:

- The name and purpose of the LLC

- The names and contributions of the members

- Management structure (member-managed or manager-managed)

- Voting rights and decision-making processes

- Distribution of profits and losses

- Procedures for adding or removing members

- Dispute resolution methods

These elements help ensure that all members are on the same page and can facilitate smoother operations.

-

Can the Operating Agreement be amended?

Yes, the Operating Agreement can be amended. The process for making changes should be outlined within the agreement itself. Typically, a certain percentage of members must agree to the amendments for them to take effect. It is essential to keep the Operating Agreement up to date to reflect any changes in the LLC’s structure or operations.

-

How does the Operating Agreement affect liability protection?

Having a well-drafted Operating Agreement can help reinforce the limited liability status of the LLC. By clearly outlining the separation between the members and the business, it demonstrates that the LLC operates as a distinct entity. This distinction is crucial for protecting personal assets from business liabilities.

-

Where can I find a template for a Florida Operating Agreement?

Many online legal resources offer templates for Florida Operating Agreements. These templates can be a helpful starting point, but it is advisable to customize them to fit the specific needs of your LLC. Consulting with a legal professional can also ensure that the agreement complies with Florida laws and adequately addresses your unique circumstances.

Common mistakes

-

Failing to include the names of all members. Each member's name should be clearly stated in the agreement to avoid confusion.

-

Not specifying the percentage of ownership. Clearly outlining each member's ownership stake is crucial for determining profit distribution and decision-making authority.

-

Omitting the purpose of the business. The agreement should detail the nature of the business to provide context for operations and member responsibilities.

-

Neglecting to outline management structure. It is important to specify whether the business will be member-managed or manager-managed, as this affects day-to-day operations.

-

Inadequate provisions for adding or removing members. The agreement should include clear procedures for changes in membership to avoid future disputes.

-

Ignoring dispute resolution methods. Including a process for resolving conflicts among members can save time and resources in the long run.

-

Not addressing profit and loss distribution. The agreement should explicitly state how profits and losses will be allocated among members.

-

Failing to review the document for compliance with state laws. Ensuring that the agreement adheres to Florida's legal requirements is essential for its enforceability.

How to Use Florida Operating Agreement

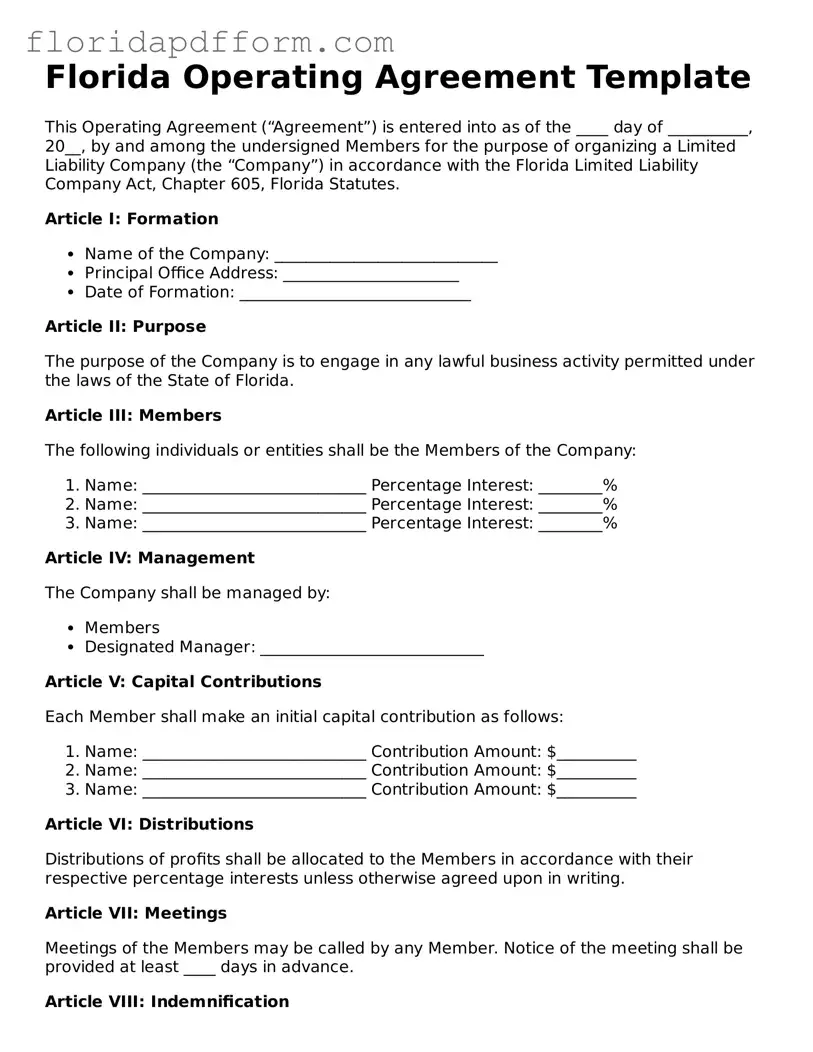

Filling out the Florida Operating Agreement form is an important step for those looking to establish a Limited Liability Company (LLC) in the state. This document outlines the management structure and operating procedures of the LLC. Once completed, it will serve as a foundational document for your business, helping to clarify the roles and responsibilities of members.

- Obtain the Form: Start by downloading the Florida Operating Agreement form from a reliable source or the state’s official website.

- Title the Document: At the top of the form, clearly indicate that this is the Operating Agreement for your LLC.

- Fill in Basic Information: Enter the name of your LLC, the principal address, and the date of formation.

- List Members: Identify all members of the LLC by providing their names and addresses. This may include individuals or other entities.

- Define Ownership Percentages: Specify the percentage of ownership for each member. This reflects their stake in the LLC.

- Outline Management Structure: Decide whether the LLC will be member-managed or manager-managed and indicate this on the form.

- Detail Voting Rights: Describe the voting rights of members, including how decisions will be made and the voting process.

- Address Profit Distribution: Explain how profits and losses will be distributed among members, including any specific percentages.

- Include Additional Provisions: Add any other clauses relevant to the operation of your LLC, such as buy-sell agreements or dispute resolution processes.

- Review and Sign: Carefully review the completed form for accuracy. All members should sign and date the agreement to make it official.

After completing the form, ensure that all members have copies for their records. This document will not only guide your LLC's operations but also protect the interests of its members. Keep it updated as changes occur within the company.

Form Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Florida Operating Agreement outlines the management structure and operating procedures for a limited liability company (LLC) in Florida. |

| Governing Law | The agreement is governed by the Florida Limited Liability Company Act, specifically Chapter 605 of the Florida Statutes. |

| Member Rights | The document defines the rights and responsibilities of each member, including profit distribution and decision-making processes. |

| Flexibility | Florida law allows LLCs significant flexibility in drafting their Operating Agreement, enabling customization to fit specific business needs. |

Other Popular Florida Templates

What Documents Do I Need to Become a Florida Resident - A declaration used for various legal applications involving residency.

Free Promissory Note Template Florida - Borrowers should carefully review the note before signing to ensure understanding of all terms.