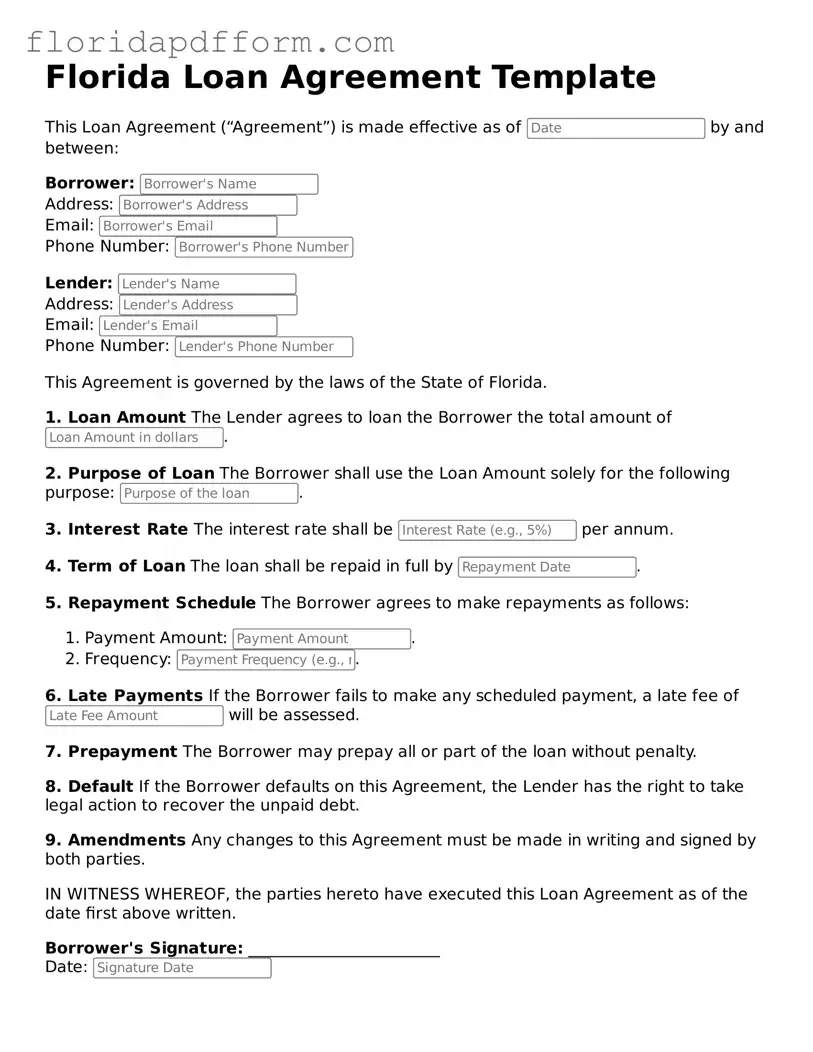

Blank Loan Agreement Template for Florida

Understanding Florida Loan Agreement

-

What is a Florida Loan Agreement form?

A Florida Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. It specifies the amount of money being loaned, the interest rate, repayment schedule, and any collateral involved. This document serves to protect both parties by clearly defining their rights and obligations.

-

Who should use a Florida Loan Agreement form?

This form is suitable for individuals or businesses looking to lend or borrow money in Florida. It can be used for personal loans, business loans, or any situation where money is exchanged with the expectation of repayment. Both parties should consider using this form to avoid misunderstandings and ensure that all terms are agreed upon.

-

What are the key components of a Florida Loan Agreement?

A comprehensive Florida Loan Agreement should include:

- The names and addresses of the lender and borrower.

- The principal amount of the loan.

- The interest rate, including whether it is fixed or variable.

- The repayment schedule, detailing how and when payments will be made.

- Any collateral that secures the loan.

- Default and late payment terms.

- Signatures of both parties to indicate agreement.

-

Is it necessary to have a lawyer review the Florida Loan Agreement?

While it is not mandatory to have a lawyer review the agreement, it is highly recommended. A legal professional can ensure that the terms are fair, comply with state laws, and protect the interests of both parties. Having legal guidance can prevent potential disputes and provide peace of mind.

Common mistakes

-

Incomplete Information: Borrowers often leave sections blank. All fields must be filled out accurately to avoid delays or disputes.

-

Incorrect Personal Details: Mistakes in names, addresses, or Social Security numbers can lead to significant issues. Double-checking this information is crucial.

-

Failure to Understand Terms: Many individuals sign the agreement without fully grasping the terms. It is essential to read and comprehend all clauses before signing.

-

Omitting Signatures: Sometimes, borrowers forget to sign the document. Every party involved must provide their signature for the agreement to be valid.

-

Ignoring the Loan Amount: Borrowers may miscalculate the loan amount requested. This can lead to receiving insufficient funds or incurring unnecessary fees.

-

Neglecting to Include Interest Rates: Not specifying the interest rate can create confusion later. It is vital to clearly state this information in the agreement.

-

Not Reviewing Repayment Terms: Some individuals overlook the repayment schedule. Understanding when payments are due and the consequences of late payments is essential.

How to Use Florida Loan Agreement

Filling out the Florida Loan Agreement form is an important step in formalizing a loan between parties. This process ensures that both the lender and borrower understand their rights and obligations. Following the steps below will help you complete the form accurately and efficiently.

- Begin by downloading the Florida Loan Agreement form from a reliable source.

- Carefully read through the entire document to familiarize yourself with its sections.

- In the first section, enter the names and contact information of both the lender and the borrower.

- Specify the loan amount in the designated area, ensuring it is clear and accurate.

- Next, indicate the interest rate. Make sure to check current rates to remain competitive.

- Provide the repayment terms, including the duration of the loan and the payment schedule.

- If applicable, outline any collateral being offered to secure the loan.

- Include any additional terms or conditions that both parties have agreed upon.

- Once all information is filled in, review the document for accuracy and completeness.

- Both parties should sign and date the form to make it legally binding.

After completing the form, it is advisable to keep copies for both the lender and borrower. This ensures that each party has a record of the agreement, which can be referenced in the future if necessary.

Form Specifications

| Fact Name | Details |

|---|---|

| Governing Law | The Florida Loan Agreement is governed by Florida state law. |

| Purpose | This form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Parties Involved | The agreement typically includes two parties: the lender and the borrower. |

| Loan Amount | The specific amount of money being loaned is clearly stated in the agreement. |

| Interest Rate | The form specifies the interest rate applicable to the loan, which may be fixed or variable. |

| Repayment Terms | Details about the repayment schedule, including due dates and payment methods, are included. |

Other Popular Florida Templates

Roommate Agreement for Friends - Form that can help tenants understand their rights regarding eviction processes.

Florida Notary Acknowledgement Form 2023 - A Notary Acknowledgment ensures clarity in transactions.

Florida Llc Operating Agreement Template - This form is crucial for outlining each member's contribution.