Blank Lady Bird Deed Template for Florida

Understanding Florida Lady Bird Deed

-

What is a Lady Bird Deed?

A Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer their property to beneficiaries while retaining the right to live in and control the property during their lifetime. This type of deed helps avoid probate and can simplify the transfer of property upon the owner's death.

-

How does a Lady Bird Deed work?

With a Lady Bird Deed, the property owner retains full control over the property. They can sell, mortgage, or change the beneficiaries at any time without needing the consent of the beneficiaries. Upon the owner's death, the property automatically transfers to the named beneficiaries without going through probate.

-

What are the benefits of using a Lady Bird Deed?

- Avoids probate, which can be a lengthy and costly process.

- Allows the property owner to maintain control over the property during their lifetime.

- Can provide tax benefits for beneficiaries, as the property receives a step-up in basis upon transfer.

- Offers flexibility, as the owner can change beneficiaries at any time.

-

Are there any limitations to a Lady Bird Deed?

Yes, there are some limitations. A Lady Bird Deed can only be used for real estate, not personal property. Additionally, it may not be suitable for all situations, especially if there are complex family dynamics or if the property is subject to liens or debts. Consulting with a legal professional is recommended to determine if this deed is appropriate for your situation.

-

How do I create a Lady Bird Deed in Florida?

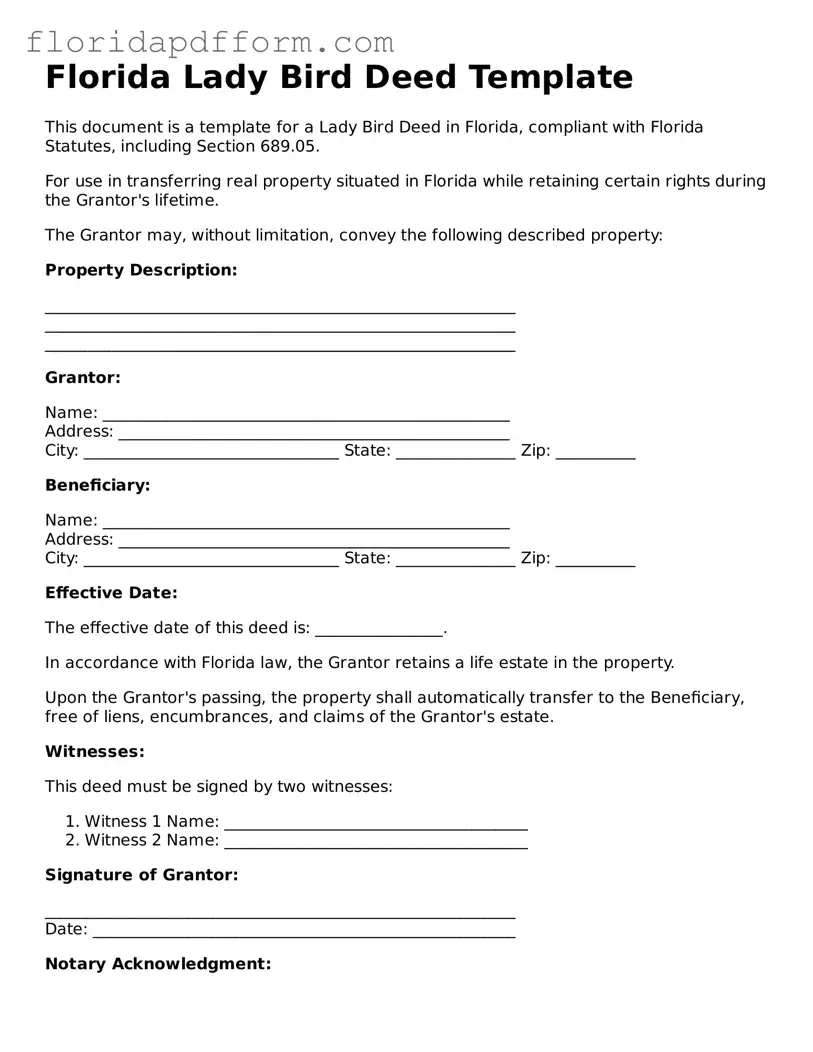

To create a Lady Bird Deed in Florida, you need to draft the deed, which includes the property description and the names of the beneficiaries. It must be signed by the property owner and notarized. After that, the deed should be recorded with the county clerk's office where the property is located. It is advisable to seek assistance from a legal professional to ensure the deed is properly executed and complies with state laws.

Common mistakes

-

Incorrect Property Description: One of the most common mistakes is failing to accurately describe the property. Ensure that the legal description matches what is on the title deed. This includes the parcel number and physical address.

-

Not Including All Owners: If multiple people own the property, all owners must be listed on the deed. Omitting an owner can lead to legal disputes in the future.

-

Improper Witness Signatures: The deed requires two witnesses to sign. Not having witnesses present during the signing can invalidate the deed.

-

Failure to Notarize: A Lady Bird Deed must be notarized to be legally binding. Skipping this step can result in the deed being unenforceable.

-

Confusing Life Estate Terms: Misunderstanding the terms of a life estate can lead to errors. It’s crucial to clearly state the rights of the life tenant and the remainderman.

-

Not Recording the Deed: After completing the deed, it must be recorded with the county clerk’s office. Failing to do so means that the deed may not be recognized by third parties.

-

Ignoring Tax Implications: Some individuals overlook the potential tax consequences of transferring property through a Lady Bird Deed. Understanding how this transfer affects property taxes is essential.

How to Use Florida Lady Bird Deed

Filling out the Florida Lady Bird Deed form requires careful attention to detail. After completing the form, you will need to sign it in front of a notary public and then record it with the appropriate county clerk's office. This process ensures that your intentions regarding property transfer are legally recognized and enforceable.

- Begin by obtaining the Florida Lady Bird Deed form. You can find it online or through legal stationery stores.

- Fill in the names of the current property owners at the top of the form. This should include the full legal names as they appear on the property deed.

- Next, provide the address of the property being transferred. Ensure that the address is complete and accurate.

- Identify the beneficiaries who will receive the property upon your passing. Write their full names and relationship to you.

- Indicate whether the property will be transferred to multiple beneficiaries. If so, specify how the property will be divided among them.

- Review the form for any errors or omissions. It is crucial that all information is correct to avoid complications later.

- Sign the form in the designated area. This signature must be done in front of a notary public to validate the document.

- After notarization, take the completed form to the county clerk’s office where the property is located. There, you will need to record the deed.

Once the form is recorded, it becomes part of the public record. This means that your wishes regarding the property transfer are now legally binding. It is advisable to keep a copy of the recorded deed for your personal records.

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Florida Lady Bird Deed allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by Florida Statutes, specifically Chapter 731 and Chapter 732. |

| Benefits | It helps avoid probate, allowing for a smoother transition of property upon the owner's death. |

| Revocability | The deed can be revoked or modified at any time by the property owner, providing flexibility. |

| Tax Implications | There are generally no immediate tax implications for the property owner when executing a Lady Bird Deed. |

Other Popular Florida Templates

Cease and Desist Letter Template - Each letter should be tailored to the particular circumstances of the situation at hand.

Marital Settlement Agreement for Simplified Dissolution of Marriage - Facilitates a quicker resolution by providing clear guidelines.