Free Intent To Lien Florida Form

Understanding Intent To Lien Florida

-

What is the Intent to Lien Florida form?

The Intent to Lien Florida form is a legal document that notifies property owners of a contractor's or subcontractor's intention to file a lien against their property for unpaid work or materials. This notice serves as a warning that if payment is not made, a lien may be recorded, potentially leading to foreclosure proceedings.

-

Who needs to file an Intent to Lien?

Any contractor, subcontractor, or supplier who has not received payment for labor, services, or materials provided for property improvements may file this notice. It ensures that the property owner is aware of the outstanding payment before any formal lien is recorded.

-

How long before filing a lien must the Intent to Lien be sent?

According to Florida law, the Intent to Lien must be sent at least 45 days before the actual lien is recorded. This gives the property owner time to address the payment issue and potentially avoid further legal action.

-

What happens if the property owner does not respond?

If the property owner fails to respond or make payment within 30 days of receiving the notice, the contractor or supplier may proceed to file the lien. This could lead to legal consequences for the property owner, including foreclosure and additional costs such as attorney fees.

-

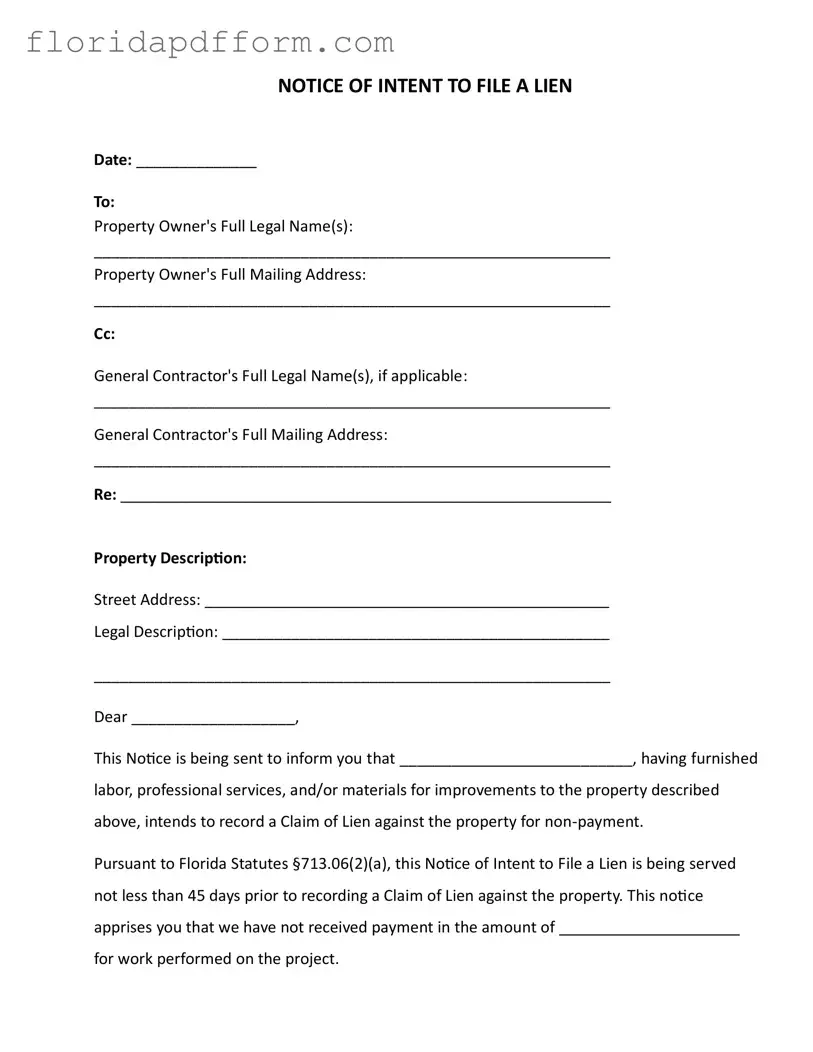

What information is included in the Intent to Lien form?

The form includes details such as the date of the notice, the names and addresses of the property owner and general contractor, a description of the property, and the amount owed. It also states the intention to file a lien and outlines the consequences of non-payment.

-

Is there a way to prevent a lien from being filed?

Yes, the best way to prevent a lien from being filed is to respond promptly to the notice and arrange for payment. Open communication with the contractor or supplier can often resolve the issue before it escalates to a lien or legal action.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields, such as the property owner's full legal name or mailing address, can lead to complications later.

-

Incorrect Dates: Not including the correct date on the form can affect the timeline for filing a lien, potentially leading to legal issues.

-

Missing Amount Due: Leaving the amount owed blank or incorrectly filled out can create confusion and weaken the claim.

-

Improper Recipient: Sending the notice to the wrong property owner or contractor can invalidate the notice.

-

Failure to Serve Properly: Not following the correct method of service, such as using certified mail when required, can lead to disputes over whether the notice was received.

-

Not Allowing Enough Time: Not waiting the required 45 days before filing the lien can result in the lien being dismissed.

-

Ignoring Response Time: Overlooking the 30-day response period can lead to unnecessary complications if the property owner responds after the deadline.

-

Missing Signature: Failing to sign the notice can render it invalid, preventing any legal action from being taken.

How to Use Intent To Lien Florida

Once the Intent to Lien form is completed, it should be sent to the property owner to notify them of the impending lien. This step is crucial in ensuring compliance with Florida statutes regarding lien notifications. Below are the steps to accurately fill out the form.

- Date: Write the current date at the top of the form.

- Property Owner's Full Legal Name(s): Enter the complete legal name(s) of the property owner(s).

- Property Owner's Full Mailing Address: Fill in the full mailing address of the property owner(s).

- General Contractor's Full Legal Name(s): If applicable, include the full legal name(s) of the general contractor.

- General Contractor's Full Mailing Address: Provide the mailing address for the general contractor, if applicable.

- Re: Briefly describe the project or work related to the lien.

- Property Description: Write the street address of the property.

- Legal Description: Include the legal description of the property.

- Dear: Address the property owner by name.

- Furnisher's Name: State the name of the individual or company that provided labor, services, or materials.

- Amount Due: Clearly specify the amount owed for the work performed.

- Contact Information: Fill in your name, title, phone number, and email address at the end of the letter.

- Certificate of Service: Complete the certification section by stating the date of service and how the notice was delivered.

- Name and Signature: Sign the form and print your name beneath your signature.

File Specs

| Fact Name | Details |

|---|---|

| Purpose | The Intent to Lien form notifies property owners of an impending lien for unpaid labor or materials. |

| Governing Law | This form is governed by Florida Statutes §713.06. |

| Notice Period | Notice must be served at least 45 days before recording a Claim of Lien. |

| Response Time | Property owners have 30 days to respond to avoid lien recording. |

| Consequences | Failure to pay may lead to foreclosure and additional costs, including attorney fees. |

| Service Methods | The notice can be served via certified mail, registered mail, hand delivery, or process server. |

| Certificate of Service | A certificate must be included to confirm delivery of the notice. |

Additional PDF Forms

Free Mental Health Services in Florida - Remember, the child's safety is the primary concern in emergencies.

How Do You Get a Copy of Your Birth Certificate - Consider the delivery method that works best for you while applying for the birth certificate.