Blank General Power of Attorney Template for Florida

Understanding Florida General Power of Attorney

-

What is a Florida General Power of Attorney?

A Florida General Power of Attorney is a legal document that allows one person (the principal) to grant another person (the agent) the authority to act on their behalf in financial and legal matters. This document can be used for various purposes, including managing bank accounts, handling real estate transactions, and making investment decisions.

-

Who can create a General Power of Attorney in Florida?

Any adult who is mentally competent can create a General Power of Attorney in Florida. This means the individual must understand the nature of the document and the powers they are granting to their agent.

-

What powers can be granted through a General Power of Attorney?

The powers granted can be broad or limited, depending on the principal's wishes. Common powers include:

- Managing bank accounts

- Paying bills

- Buying or selling property

- Making investment decisions

- Filing tax returns

The principal should clearly outline the specific powers they wish to grant in the document.

-

Is a General Power of Attorney effective immediately?

Yes, a General Power of Attorney is typically effective immediately upon signing, unless the principal specifies a different effective date. If the principal wishes for the powers to take effect only under certain conditions, such as incapacity, they should include that provision in the document.

-

Can I revoke a General Power of Attorney?

Yes, the principal can revoke a General Power of Attorney at any time, as long as they are mentally competent. To revoke, the principal should create a written revocation document and notify the agent and any institutions or individuals that relied on the original document.

-

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated and has not specified that the General Power of Attorney is durable, the authority granted may end. A durable power of attorney remains effective even if the principal becomes incapacitated. It is important to clarify this in the document if this is a concern.

-

Do I need to have the General Power of Attorney notarized?

Yes, in Florida, a General Power of Attorney must be signed in the presence of a notary public. This notarization helps ensure the document's validity and can help prevent disputes regarding its authenticity.

Common mistakes

-

Not Specifying Powers Clearly: One common mistake is failing to clearly outline the powers granted to the agent. The form allows for a range of powers, from managing finances to making healthcare decisions. If the powers are vague or ambiguous, it can lead to confusion and potential disputes.

-

Choosing the Wrong Agent: Selecting an agent who may not act in your best interest is another critical error. It’s essential to choose someone trustworthy, reliable, and capable of handling the responsibilities. Friends or family members may seem like good choices, but consider their ability to manage the tasks effectively.

-

Failing to Update the Document: Life circumstances change, and so should your Power of Attorney. Many people neglect to update their documents after major life events such as marriage, divorce, or the death of a previously chosen agent. Regularly reviewing and updating your Power of Attorney ensures it reflects your current wishes.

-

Not Signing and Notarizing Properly: A Power of Attorney form must be signed and often notarized to be legally valid. Some individuals overlook this crucial step, thinking that merely filling out the form is enough. Without proper signatures and notarization, the document may not hold up in court.

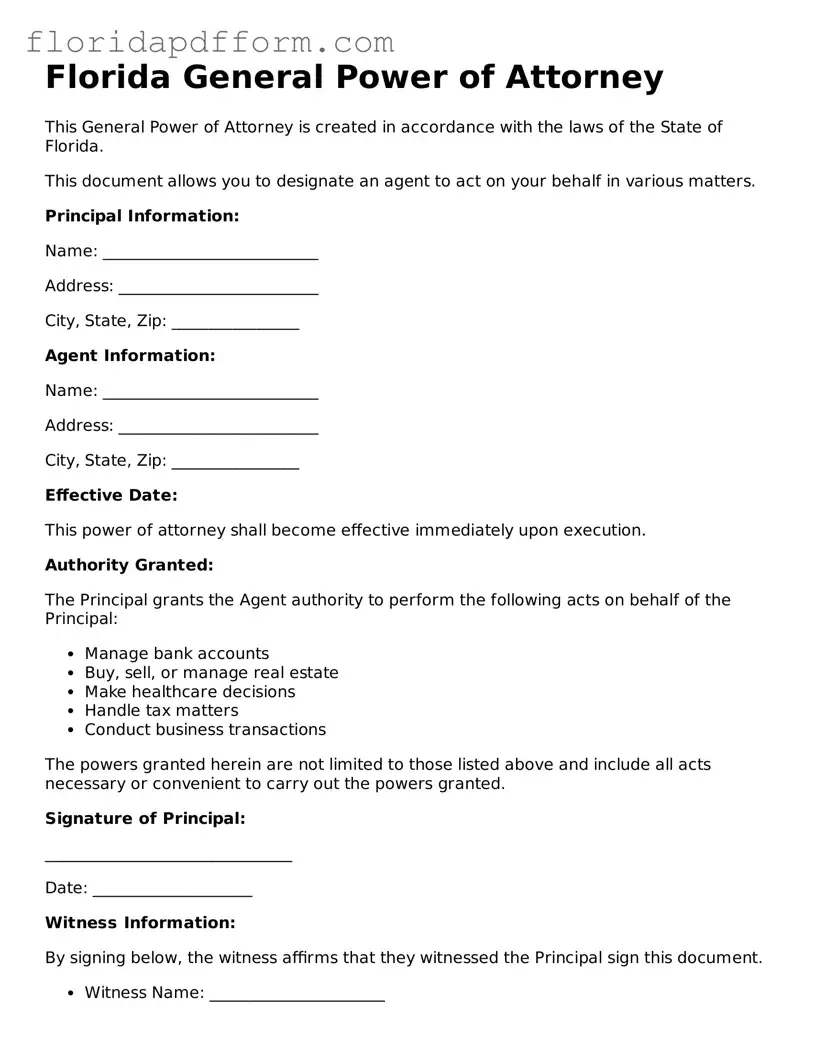

How to Use Florida General Power of Attorney

After obtaining the Florida General Power of Attorney form, it is essential to complete it accurately. This ensures that the document reflects the intentions of the person granting authority. Follow the steps below to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Provide the full name and address of the person granting the power of attorney.

- Clearly state the name and address of the person receiving the power of attorney.

- Specify the powers being granted. This can include financial decisions, real estate transactions, and other specific actions.

- Include any limitations or conditions if applicable. This may help clarify the extent of the authority being granted.

- Sign and date the form in the designated area. The signature should match the name provided at the beginning of the form.

- Have the form notarized. This step is often required for the power of attorney to be valid.

Once completed, the form should be distributed to relevant parties, such as the individual receiving the power of attorney and any institutions that may require it.

Form Specifications

| Fact Name | Details |

|---|---|

| Definition | A General Power of Attorney allows one person to act on behalf of another in a variety of matters, including financial and legal decisions. |

| Governing Law | The Florida General Power of Attorney is governed by Florida Statutes, Chapter 709. |

| Durability | This form can be made durable, meaning it remains effective even if the principal becomes incapacitated, unless stated otherwise. |

| Signing Requirements | The form must be signed by the principal in the presence of a notary public and two witnesses. |

| Revocation | A General Power of Attorney can be revoked at any time by the principal, provided they are competent to do so. |

| Limitations | While it grants broad powers, certain actions, such as making a will or changing beneficiaries, may not be permitted without additional documentation. |

Other Popular Florida Templates

How to Transfer a Property Deed From a Deceased Relative in Florida - A beneficiary named in the deed has no rights to the property until the owner's death.

Lease Agreement Florida Template - Terms related to lease termination and the notice period for ending the agreement are also included.

Florida Small Estate Affidavit Form - In some situations, it may facilitate the quick transfer of life insurance proceeds or retirement accounts.