Free Fr44 Florida Form

Understanding Fr44 Florida

-

What is the purpose of the FR44 form in Florida?

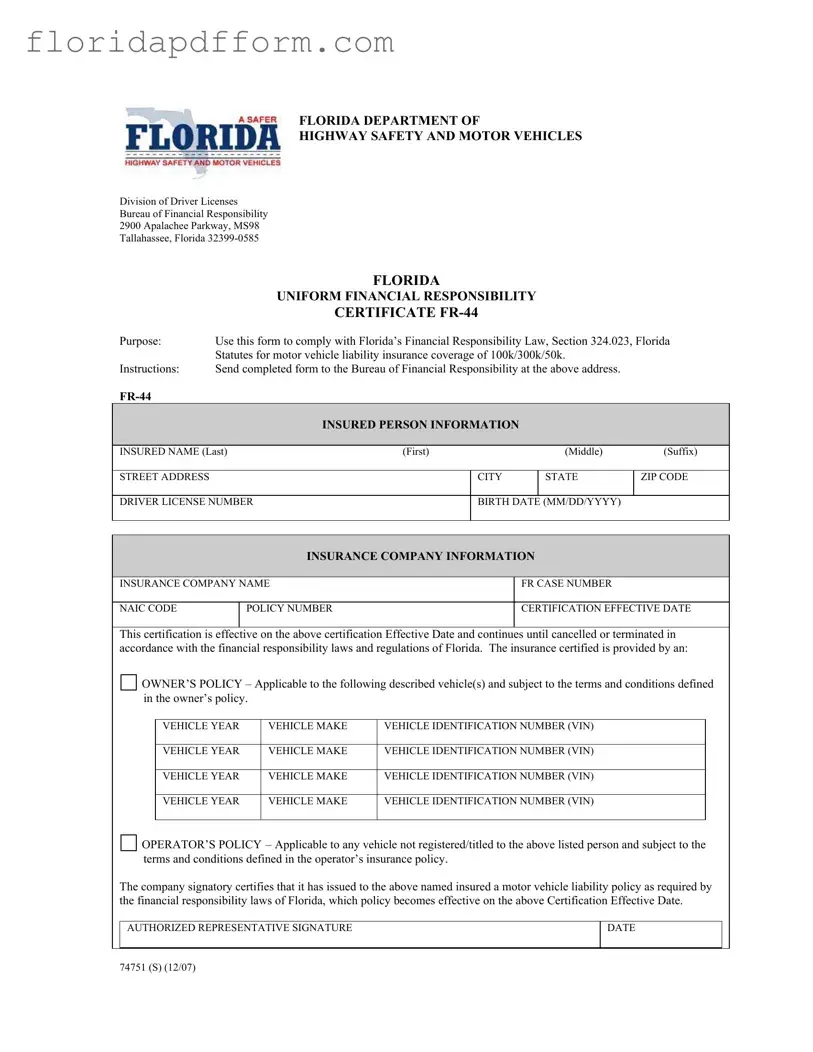

The FR44 form is used to comply with Florida's Financial Responsibility Law. This law requires certain levels of motor vehicle liability insurance coverage, specifically $100,000 for bodily injury per person, $300,000 for bodily injury per accident, and $50,000 for property damage. Completing this form certifies that an individual has the necessary insurance coverage and must be submitted to the Bureau of Financial Responsibility.

-

Who needs to file an FR44 form?

Individuals who have been convicted of specific driving offenses, such as DUI, are required to file an FR44 form. This requirement is part of the conditions for reinstating their driving privileges. The form serves as proof that the individual has obtained the mandated liability insurance coverage.

-

How do I complete and submit the FR44 form?

To complete the FR44 form, you need to provide personal information, including your name, address, driver license number, and insurance details. The form must also include information about the insurance company, such as the company name and policy number. Once completed, the form should be sent to the Bureau of Financial Responsibility at the address listed on the form: 2900 Apalachee Parkway, MS98, Tallahassee, Florida 32399-0585.

-

What happens after I submit the FR44 form?

After submission, the Bureau of Financial Responsibility will review the form to ensure compliance with Florida's financial responsibility laws. The certification becomes effective on the specified date and remains valid until it is canceled or terminated according to state regulations. It is essential to maintain the required insurance coverage to avoid any penalties or issues with your driving privileges.

Common mistakes

-

Incorrect Personal Information: Failing to provide accurate details such as name, address, or birth date can lead to delays or rejections. Always double-check for typos.

-

Missing Insurance Information: Not including the insurance company name or policy number is a common oversight. Ensure all required fields are filled out completely.

-

Improper Certification Effective Date: Entering the wrong effective date can cause confusion. Make sure to use the date when the insurance coverage actually starts.

-

Neglecting to Sign: Forgetting to sign the form is a frequent mistake. The authorized representative's signature is crucial for the certification to be valid.

-

Inaccurate Vehicle Information: Providing incorrect details about the vehicle, such as the year, make, or VIN, can lead to problems. Verify this information before submission.

-

Using an Outdated Form: Submitting an old version of the FR-44 form may result in rejection. Always ensure you have the most current version.

-

Failure to Submit on Time: Not sending the form by the required deadline can lead to penalties. Mark your calendar to avoid missing the submission date.

-

Ignoring State Regulations: Not being aware of Florida’s financial responsibility laws can lead to mistakes. Familiarize yourself with these laws to ensure compliance.

-

Not Keeping a Copy: Failing to keep a copy of the submitted form for your records is a mistake. Always retain a copy for future reference.

How to Use Fr44 Florida

Filling out the FR44 form is an important step in ensuring compliance with Florida's Financial Responsibility Law. This form requires specific information about the insured person and their insurance coverage. Follow the steps below to complete the form accurately.

- Begin by writing the insured person's name in the designated fields: Last name, First name, Middle name, and Suffix.

- Enter the street address, city, state, and zip code of the insured person.

- Provide the driver's license number of the insured person.

- Fill in the birth date of the insured person in the format MM/DD/YYYY.

- Next, write the name of the insurance company providing the coverage.

- Enter the FR case number assigned to the insurance policy.

- Include the NAIC code associated with the insurance company.

- Provide the policy number for the insurance coverage.

- Indicate the certification effective date, which marks when the insurance becomes valid.

- For the owner's policy, list the vehicle year, make, and vehicle identification number (VIN) for each vehicle covered. Repeat this step for up to four vehicles.

- If applicable, indicate that the policy is an operator’s policy for vehicles not registered to the insured person.

- Finally, have an authorized representative sign the form and include the date of signature.

After completing the form, it is essential to send it to the Bureau of Financial Responsibility at the address provided at the top of the form. Ensure that all information is accurate and complete to avoid any delays in processing.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The FR-44 form is used to comply with Florida’s Financial Responsibility Law, ensuring motor vehicle liability insurance coverage of $100,000 per person, $300,000 per accident, and $50,000 for property damage. |

| Governing Law | This form is governed by Section 324.023 of the Florida Statutes, which outlines the requirements for financial responsibility in motor vehicle operation. |

| Submission | Completed forms must be sent to the Bureau of Financial Responsibility at the specified address in Tallahassee, Florida. |

| Insurance Coverage | The FR-44 certifies that the insured has a motor vehicle liability policy that meets Florida’s financial responsibility laws. |

| Effective Date | The certification becomes effective on the date specified and remains valid until it is canceled or terminated according to Florida regulations. |

| Policy Types | The form can certify either an owner's policy, which covers specific vehicles, or an operator’s policy, which covers vehicles not registered to the insured. |

| Authorized Signature | An authorized representative from the insurance company must sign the form to validate the coverage provided. |

Additional PDF Forms

Cpe Audit - This form must be postmarked by July 15th to avoid a late fee.

Florida Hvac Efficiency Card - Understanding the requirements of this form is crucial for the success of HVAC projects.