Free Florida Sales Tax Form

Understanding Florida Sales Tax

-

What is the Florida Sales Tax form?

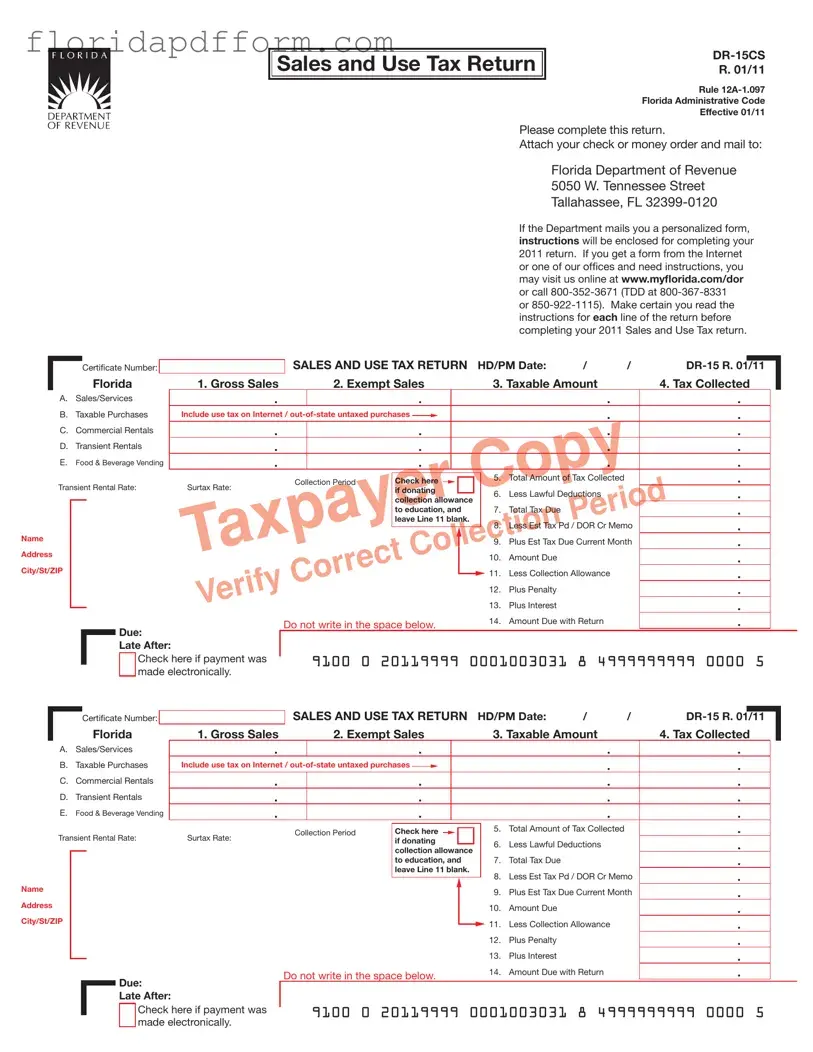

The Florida Sales Tax form, also known as the Sales and Use Tax Return (DR-15CS), is used by businesses to report and pay sales tax collected on taxable sales and services. It must be completed accurately and submitted to the Florida Department of Revenue.

-

How do I submit the Florida Sales Tax form?

After completing the form, attach your check or money order and mail it to the Florida Department of Revenue at 5050 W. Tennessee Street, Tallahassee, FL 32399-0120. Ensure that you follow the instructions provided for each line of the return.

-

What information do I need to fill out the form?

You will need to provide details such as gross sales, exempt sales, taxable amounts, and the tax collected. Additionally, you may need to include information about commercial rentals, transient rentals, and food and beverage vending.

-

What is the general sales tax rate in Florida?

The general sales tax rate in Florida is 6 percent. However, some counties may impose additional discretionary sales surtaxes, which can vary by location.

-

What are lawful deductions?

Lawful deductions refer to specific amounts that can be subtracted from your taxable sales before calculating the total tax due. These may include certain exemptions or allowances as outlined in the form instructions.

-

What happens if I miss the deadline for filing?

If you fail to file your return by the due date, penalties and interest may apply. It is important to submit your return and payment on time to avoid additional charges.

-

How can I obtain instructions for completing the form?

If you receive a personalized form, instructions will be included. For forms obtained online or from an office, you can visit www.mylorida.com/dor or call 800-352-3671 for assistance.

-

What is the purpose of the discretionary sales surtax?

The discretionary sales surtax is an additional tax that some counties impose on taxable sales. The revenue generated is distributed to local governments for various programs and services. It is important to check the specific rates applicable to your county.

-

What are the penalties for fraud related to sales tax?

Penalties for fraud can include fines and other legal consequences. The form includes a declaration under penalties of perjury, emphasizing the importance of providing accurate information.

-

How do I know if I need to collect sales tax on a transaction?

Generally, sales tax must be collected on most sales of tangible personal property and certain services. If you are unsure whether a specific transaction is taxable, refer to the form instructions or consult with a tax professional.

Common mistakes

-

Incorrectly calculating taxable sales: Many individuals miscalculate their gross sales or exempt sales. Ensure that you accurately report all sales and deduct any exempt sales correctly to determine the taxable amount.

-

Failing to include all required information: Some people forget to fill out essential details such as their certificate number or contact information. Missing this information can delay processing and lead to penalties.

-

Not reading the instructions: Ignoring the specific instructions for each line can result in errors. Each section of the form has unique requirements that must be followed closely.

-

Neglecting to check for additional taxes: Many counties impose discretionary sales surtaxes. Failing to include these additional taxes can result in underpayment and potential penalties.

How to Use Florida Sales Tax

Filling out the Florida Sales Tax form is a straightforward process, but it requires attention to detail to ensure accuracy. This guide will walk you through the necessary steps to complete the Sales and Use Tax Return (DR-15CS). Make sure to have your sales records handy, as you will need specific figures to fill out the form correctly.

- Obtain the Florida Sales Tax form (DR-15CS) from the Florida Department of Revenue website or your local office.

- Fill in the Date and Certificate Number at the top of the form.

- In the first section, report your Gross Sales by entering the total amount of sales made during the collection period.

- Next, list any Exempt Sales that apply to your business. This includes sales that are not subject to tax.

- Calculate the Taxable Amount by subtracting the exempt sales from the gross sales.

- Record the Tax Collected in the appropriate fields, including sales/services, taxable purchases, commercial rentals, transient rentals, and food & beverage vending.

- Sum up the total amount of tax collected and enter it in the designated area.

- If applicable, check the box if you are donating a collection allowance to education.

- List any Lawful Deductions that apply to your situation.

- Calculate the Total Tax Due by taking the tax collected and subtracting lawful deductions.

- Complete the sections regarding estimated tax payments and any penalties or interest that may apply.

- Finally, sign and date the form, ensuring all information is accurate and complete.

Once you have filled out the form, attach your check or money order and mail it to the Florida Department of Revenue at the address provided on the form. If you have any questions or need further assistance, you can visit the Florida Department of Revenue website or call their customer service for help.

File Specs

| Fact Name | Description |

|---|---|

| Form Identification | The Florida Sales and Use Tax Return is identified as form DR-15CS, revised in January 2011. |

| Governing Law | This form is governed by Rule 12A-1.097 of the Florida Administrative Code. |

| Submission Instructions | Taxpayers must complete the return and mail it with payment to the Florida Department of Revenue in Tallahassee. |

| Tax Rates | The general sales tax rate in Florida is 6 percent, but different rates may apply depending on the locality. |

| Fraud Penalties | Specific penalties are in place for fraud, including failure to collect or remit taxes, as outlined in Florida Statutes. |

| Online Resources | Taxpayers can access instructions and additional information online at www.mylorida.com/dor or by calling the Department of Revenue. |

Additional PDF Forms

Florida Divorce Decree Sample - The form outlines the steps needed to ensure a smooth divorce process with children involved.

Codicil to Will Florida - Change specific terms or conditions in your will with this document.