Free Florida Rts 6 Form

Understanding Florida Rts 6

-

What is the Florida RTS 6 form?

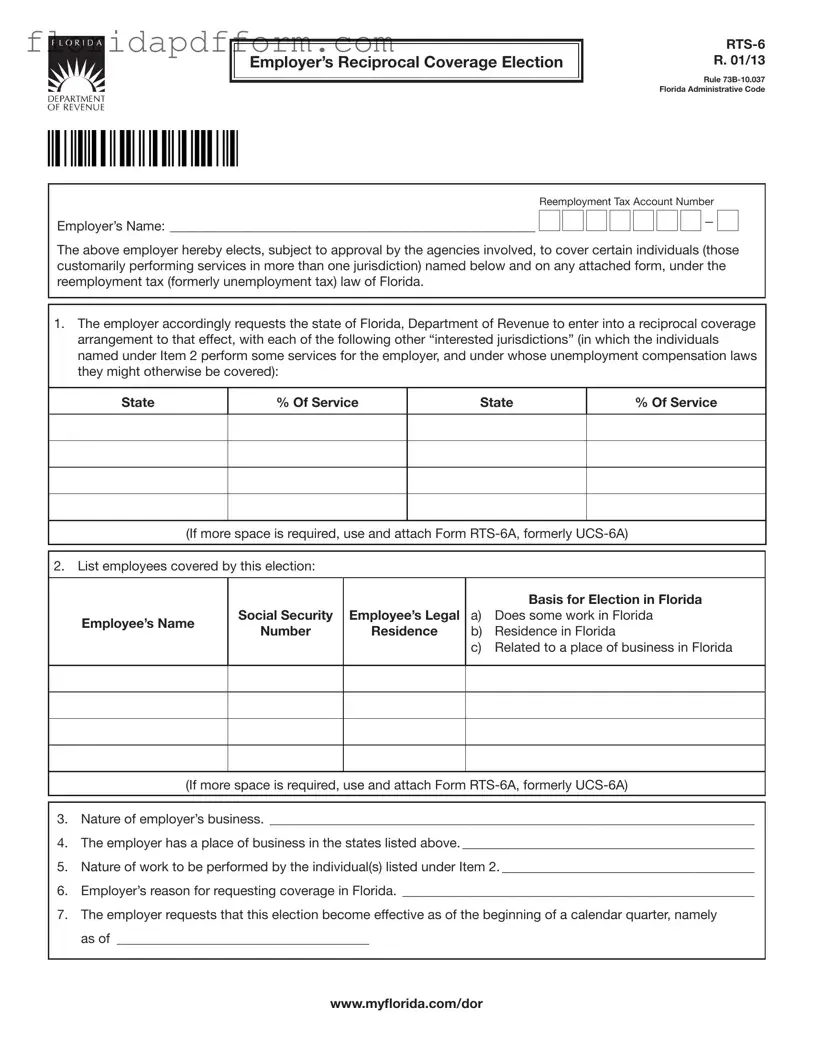

The Florida RTS 6 form, also known as the Employer’s Reciprocal Coverage Election, is a document that allows employers to elect coverage under Florida's reemployment tax law for certain employees who work in multiple jurisdictions. This election is subject to approval by the relevant agencies.

-

Who should fill out the RTS 6 form?

Employers who have employees performing services in more than one state should complete the RTS 6 form. This includes businesses with a presence in Florida and other states where employees may also work. The form helps ensure that these employees are covered under the appropriate tax laws.

-

What information is required on the RTS 6 form?

Employers must provide their reemployment tax account number, name, and the names of employees they wish to cover. Additionally, they need to list the states where these employees work and the percentage of services performed in each state. Details about the nature of the business and work performed by the employees are also required.

-

How does the approval process work?

Once the RTS 6 form is submitted, it is reviewed by the Florida Department of Revenue and the interested jurisdictions listed on the form. Employers will receive notification of the final decision regarding approval or disapproval of the election.

-

How long does the coverage election last?

If approved, the coverage election remains in effect until it is terminated according to the regulations set by the Florida Department of Revenue. Employers must ensure they follow any applicable requirements to maintain the election.

-

What is the purpose of the RTS 6 form?

The primary purpose of the RTS 6 form is to establish a reciprocal coverage arrangement for employees who work in multiple jurisdictions. This helps prevent gaps in unemployment compensation coverage and ensures compliance with tax laws across states.

-

What happens if the election is denied?

If the election is denied, employers will be informed of the decision. They may need to explore other options for ensuring their employees are covered under the appropriate unemployment compensation laws in the jurisdictions where they operate.

-

How should the RTS 6 form be submitted?

Employers must submit two signed copies of the RTS 6 form for each jurisdiction listed, along with two additional copies. All copies should be sent to the Florida Department of Revenue at the specified address. The agency will then forward copies to each interested jurisdiction for their approval.

Common mistakes

-

Incomplete Employer Information: Failing to provide the full name of the employer or the reemployment tax account number can lead to delays in processing.

-

Missing Employee Details: Not listing all employees covered by the election, including their names and Social Security numbers, can cause issues with approval.

-

Incorrect Percentage of Service: Listing incorrect percentages of service for each state can result in misunderstandings about coverage.

-

Failure to Attach Additional Forms: If more space is needed for employees or states, neglecting to attach Form RTS-6A can lead to incomplete submissions.

-

Unclear Nature of Business: Providing vague or incomplete descriptions of the employer’s business can raise questions during the review process.

-

Missing Effective Date: Not specifying the effective date for the election can delay the start of coverage.

-

Not Notifying Employees: Failing to inform employees about their coverage election promptly after approval can lead to confusion.

-

Ignoring Compliance Requirements: Overlooking the agreement to comply with applicable regulations can result in penalties or disapproval.

-

Submitting Insufficient Copies: Not providing the required number of signed copies for each jurisdiction can delay processing and approval.

How to Use Florida Rts 6

Completing the Florida RTS-6 form is a straightforward process that requires careful attention to detail. This form is used by employers to elect coverage for certain employees under Florida's reemployment tax law. Following the steps below will help ensure that the form is filled out correctly and submitted properly.

- Begin by entering your Reemployment Tax Account Number at the top of the form.

- In the next line, write the Employer’s Name clearly.

- For Item 1, list the states where your employees perform services and the percentage of service provided in each state. If you need more space, attach Form RTS-6A.

- In Item 2, provide the names and Social Security Numbers of the employees you are covering. Indicate the basis for election for each employee, choosing from the options provided: a) Does some work in Florida, b) Residence in Florida, or c) Related to a place of business in Florida. Again, use Form RTS-6A if necessary.

- In Item 3, describe the nature of your business succinctly.

- In Item 4, confirm that you have a place of business in the states you listed in Item 1.

- In Item 5, specify the nature of work to be performed by the individuals listed in Item 2.

- In Item 6, state your reason for requesting coverage in Florida.

- For Item 7, indicate the effective date of this election, which should be the beginning of a calendar quarter.

- In Item 8, acknowledge that this election will remain in effect until terminated according to Florida Department of Revenue regulations.

- In Item 9, agree to notify each individual covered by this election promptly after its approval, using the form provided by the Florida Department of Revenue.

- In Item 10, confirm your agreement to comply with all requirements related to this election.

- In Item 11, agree that the election will not deny reemployment assistance or unemployment compensation coverage to any workers not listed.

- Finally, sign the form in the designated area, including the date and your title.

After completing the form, submit two signed copies for each jurisdiction listed in Item 1, along with two additional copies. Send all copies to the Florida Department of Revenue at the specified address. Each interested jurisdiction will review the election and notify you of the final decision.

File Specs

| Fact Name | Detail |

|---|---|

| Form Title | Employer’s Reciprocal Coverage Election RTS-6 |

| Version Date | R. 01/13 |

| Governing Rule | Rule 73B-10.037 Florida Administrative Code |

| Purpose | This form allows employers to elect coverage for employees performing services in multiple jurisdictions. |

| Department Involved | Florida Department of Revenue |

| Effective Date | The election becomes effective at the beginning of a calendar quarter as specified by the employer. |

| Approval Requirement | The election is subject to approval by the Florida Department of Revenue and other interested jurisdictions. |

| Notification Requirement | Employers must notify covered individuals of the election promptly after approval. |

| Confidentiality of SSNs | Social Security Numbers are confidential and protected under Florida Statutes sections 213.053 and 119.071. |

| Submission Instructions | Employers must submit two signed copies for each jurisdiction and two additional copies to the Florida Department of Revenue. |

Additional PDF Forms

How Long Does It Take for Income Withholding for Child Support - Employers listed must comply with the income withholding order for all current and future payors of the obligor.

Whats a Net Listing - It starts on a predetermined date and ends on a specified termination date, while allowing for an automatic extension if a sale contract is executed.

Notice to Vacate Florida - Monthly financial figures should account for sources paid on different schedules.