Free Florida Proof Loss Form

Understanding Florida Proof Loss

-

What is the Florida Proof Loss form?

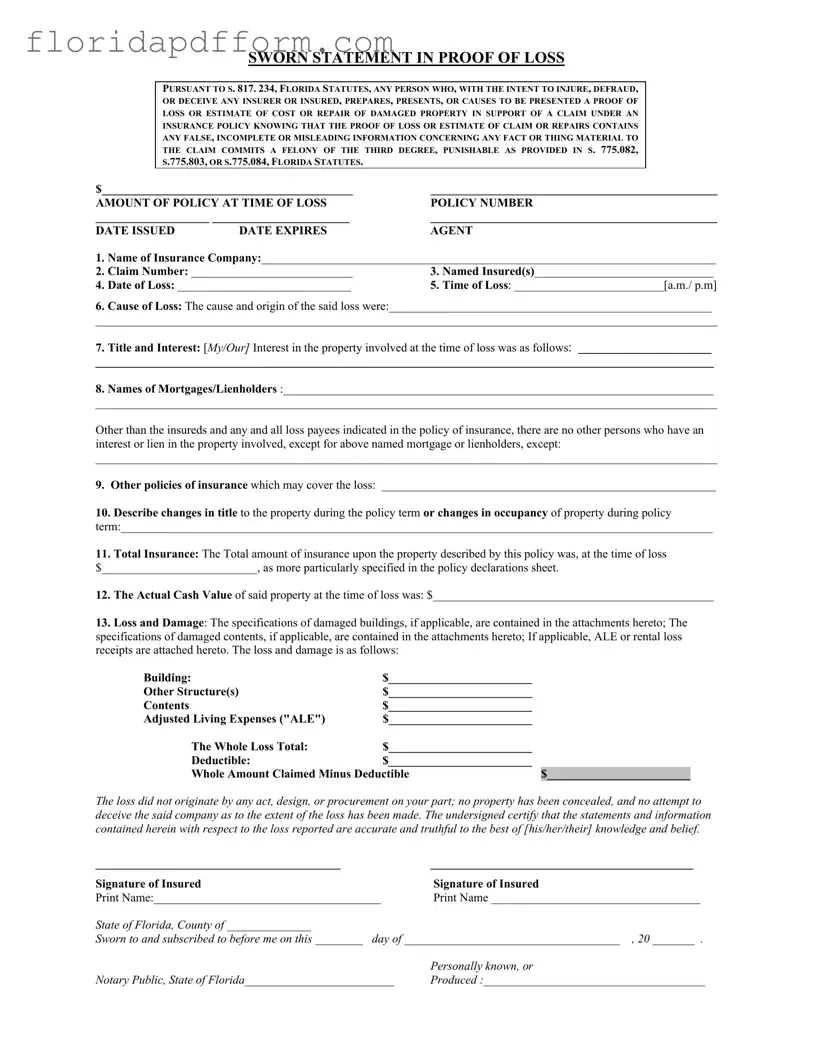

The Florida Proof Loss form is a document used to formally report a loss to an insurance company. It provides detailed information about the loss, including the cause, amount of damage, and any other relevant details. This form is crucial for initiating a claim under an insurance policy.

-

Who needs to complete the form?

The insured party, or the individual who holds the insurance policy, must complete the form. If there are multiple insured parties, all names should be included. This ensures that the insurance company has accurate information about who is making the claim.

-

What information is required on the form?

The form requires several key pieces of information, including:

- Name of the insurance company

- Claim number

- Date and time of loss

- Cause of loss

- Details about any mortgages or lienholders

- Total insurance amount and actual cash value of the property

- Specifications of the loss and damage

-

What happens if false information is provided?

Providing false, incomplete, or misleading information on the form can have serious consequences. Under Florida law, it is considered a felony to intentionally deceive an insurer. This could result in criminal charges and penalties, including fines or imprisonment.

-

How should the form be submitted?

The completed form should be submitted to your insurance company as soon as possible after the loss occurs. It's best to keep a copy for your records. Some companies may allow electronic submission, while others may require a physical copy to be mailed or delivered in person.

-

Is there a deadline for submitting the form?

Yes, there is typically a deadline for submitting the Proof Loss form, which varies by insurance policy. It’s important to review your policy for specific timeframes. Generally, you should submit the form promptly to avoid delays in processing your claim.

-

What if I need assistance completing the form?

If you need help, consider reaching out to your insurance agent or a legal professional. They can guide you through the process and ensure that all necessary information is accurately reported. Additionally, many insurance companies provide resources or customer service to assist with claims.

-

What should I do if my claim is denied?

If your claim is denied, you should first review the denial letter to understand the reasons. You can then contact your insurance company for clarification. If you believe the denial is unjust, you may appeal the decision or seek legal advice to explore your options.

Common mistakes

-

Incomplete Information: One of the most common mistakes is leaving out crucial details. Ensure that every section is filled out completely, especially the date of loss and the amount claimed.

-

Incorrect Policy Number: Double-check the policy number. A simple typo can lead to delays or even denial of your claim.

-

Failure to Specify Cause of Loss: Clearly describe the cause of the loss. Vague descriptions can raise red flags and complicate the claims process.

-

Omitting Other Insurance Policies: If there are other insurance policies that might cover the loss, make sure to disclose them. Not doing so can be viewed as misleading.

-

Neglecting to Include Supporting Documents: Attach all necessary documents, such as receipts or photographs of the damage. This evidence strengthens your claim.

-

Not Signing the Form: It may seem obvious, but forgetting to sign the form can result in delays. Always ensure that all required signatures are present.

-

Misunderstanding the Deductible: Clearly state the deductible amount. Miscalculating this can lead to confusion about the total amount claimed.

Filling out the Florida Proof of Loss form accurately is crucial for a smooth claims process. Avoiding these common mistakes can save you time and frustration, ensuring that your claim is processed efficiently.

How to Use Florida Proof Loss

Filling out the Florida Proof of Loss form is an important step in the insurance claims process. This form helps ensure that all necessary information is provided to your insurance company, allowing them to process your claim efficiently. To get started, follow these steps carefully to complete the form accurately.

- Insurance Company Information: Write the name of your insurance company at the top of the form.

- Claim Number: Enter your claim number, which you should have received from your insurance company.

- Named Insured(s): Fill in the names of all insured individuals on the policy.

- Date of Loss: Indicate the date when the loss occurred.

- Time of Loss: Specify the time of loss, including whether it was a.m. or p.m.

- Cause of Loss: Describe the cause and origin of the loss in detail.

- Title and Interest: Explain your interest in the property at the time of the loss.

- Names of Mortgages/Lienholders: List any mortgage or lienholders related to the property.

- Other Insurance Policies: Mention any other insurance policies that may cover the loss.

- Changes in Title or Occupancy: Describe any changes in title or occupancy of the property during the policy term.

- Total Insurance: State the total amount of insurance on the property at the time of loss.

- Actual Cash Value: Provide the actual cash value of the property at the time of loss.

- Loss and Damage: Detail the loss and damage, including amounts for buildings, other structures, contents, and adjusted living expenses (ALE).

- Deductible: Indicate the deductible amount.

- Final Amount Claimed: Calculate the total amount claimed minus the deductible.

- Certification: Sign and print your name, certifying that all information is accurate and truthful.

- Notary Section: Have the form notarized, including the date and the notary's signature.

Once you have completed the form, review it to ensure all information is accurate. After that, submit it to your insurance company along with any required attachments, such as receipts or documentation related to your claim. This will help facilitate the claims process and ensure you receive the assistance you need.

File Specs

| Fact Name | Fact Description |

|---|---|

| Governing Law | The Florida Proof of Loss form is governed by Florida Statutes, specifically S. 817.234. |

| Purpose | This form serves as a sworn statement to report a loss under an insurance policy. |

| Fraud Penalty | Filing a false Proof of Loss can result in a felony charge of the third degree. |

| Policy Information | The form requires details like the policy number, date issued, and expiration date. |

| Claim Details | Claim number and names of insured individuals must be included in the form. |

| Loss Description | The form asks for a detailed description of the cause of loss and the property involved. |

| Signature Requirement | Both insured individuals must sign the form, certifying the accuracy of the information provided. |

Additional PDF Forms

Divorce Forms Florida - If you agree with everything, you can set a final hearing with the clerk’s office.

Florida F-1120 Instructions - Corporations filing for the first time should indicate this on the F-1120.

Does Florida Have Local Taxes - This form applies to various fuel product types and taxable pollutants.