Free Florida Motion Terminate Income Deduction Order Form

Understanding Florida Motion Terminate Income Deduction Order

-

What is the Florida Motion to Terminate Income Deduction Order?

The Florida Motion to Terminate Income Deduction Order is a legal request filed to stop the automatic deductions from a person's income for child support or other obligations. This motion is often used when the circumstances surrounding the support obligation have changed significantly, such as a change in employment status or the completion of payments.

-

Who can file this motion?

Any individual who is subject to an income deduction order can file this motion. This typically includes parents who are paying child support or other financial obligations. If you believe your situation warrants a termination of the deduction order, you have the right to file.

-

What are the grounds for terminating an income deduction order?

Common grounds for terminating an income deduction order include:

- Completion of the support obligation.

- Change in financial circumstances, such as job loss or reduced income.

- Changes in custody arrangements that affect the support obligation.

-

How do I file the motion?

To file the motion, you need to complete the appropriate form, which can usually be obtained from the local court or online. After completing the form, submit it to the court where the original income deduction order was issued. Ensure that you provide any necessary supporting documents to strengthen your case.

-

What happens after I file the motion?

Once you file the motion, the court will schedule a hearing. Both parties involved will be notified of the hearing date. During the hearing, you will present your case, and the other party will have the opportunity to respond. The judge will then make a decision based on the evidence presented.

-

Can I represent myself in this process?

Yes, you can represent yourself in court, which is known as being pro se. However, it may be beneficial to consult with a lawyer who specializes in family law to ensure that you understand the process and have the best chance of success.

-

How long does it take to terminate an income deduction order?

The time it takes to terminate an income deduction order can vary. It depends on the court's schedule, the complexity of your case, and whether both parties agree on the termination. Generally, it may take several weeks to a few months from the time you file the motion to when the court makes a final decision.

Common mistakes

-

Incomplete Information: Many people forget to fill out all required fields. Leaving sections blank can delay the process or lead to rejection.

-

Incorrect Case Number: It's crucial to enter the correct case number. An incorrect number can confuse the court and hinder your request.

-

Failure to Sign: Not signing the form is a common mistake. A missing signature means the form is not valid and will not be processed.

-

Wrong Filing Fee: Submitting the wrong amount for the filing fee can lead to complications. Always check the current fee schedule.

-

Not Including Supporting Documents: Some forget to attach necessary documents that support their motion. This can weaken your case.

-

Ignoring Deadlines: Filing after the deadline can result in the motion being denied. It’s essential to keep track of all relevant dates.

-

Using Outdated Forms: Always ensure you are using the most recent version of the form. Outdated forms may not be accepted.

-

Not Proofreading: Failing to review the form for errors can lead to misunderstandings. Simple typos can create significant issues.

How to Use Florida Motion Terminate Income Deduction Order

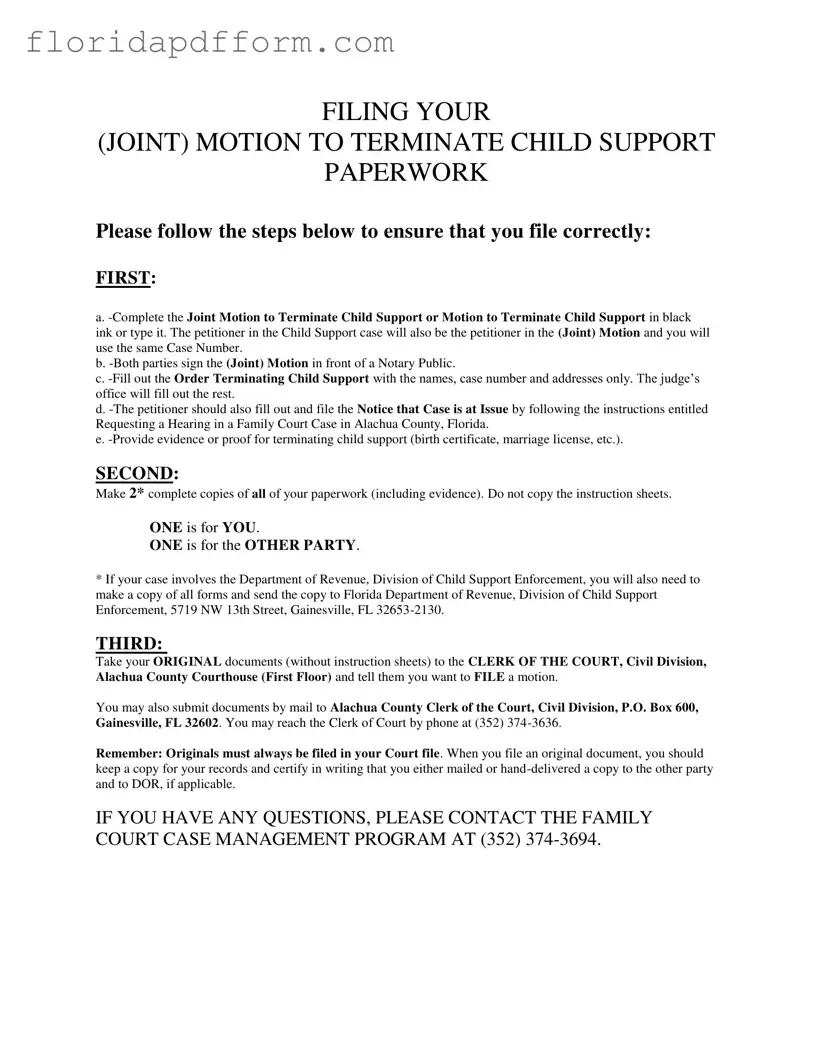

Completing the Florida Motion to Terminate Income Deduction Order form is a straightforward process. This form is essential for individuals seeking to stop income deductions related to child support or other financial obligations. After filling out the form, you'll submit it to the appropriate court, and a hearing may be scheduled to review your request.

- Obtain the Form: Download the Florida Motion to Terminate Income Deduction Order form from the official Florida court website or visit your local courthouse to get a physical copy.

- Fill in Your Information: Start by entering your full name, address, and contact information in the designated sections at the top of the form.

- Provide Case Details: Enter the case number and the name of the opposing party. This information helps the court identify your case quickly.

- State Your Reasons: In the appropriate section, clearly outline the reasons for your request to terminate the income deduction. Be concise and specific.

- Sign the Form: At the bottom of the form, sign and date it. This signature certifies that the information you provided is accurate to the best of your knowledge.

- Prepare Copies: Make several copies of the completed form. You’ll need these for your records and to provide to the other party involved in the case.

- File the Form: Submit the original form and copies to the clerk of the court where your case is filed. Pay any required filing fees, if applicable.

- Serve the Other Party: Ensure that the opposing party receives a copy of the filed motion. This can typically be done through certified mail or a process server.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The Florida Motion to Terminate Income Deduction Order form is used to request the termination of an existing income deduction order for child support. |

| Governing Law | This form is governed by Florida Statutes Chapter 61, which addresses family law and child support matters. |

| Eligibility | Parties may file this motion if there has been a change in circumstances, such as the termination of employment or a change in the child support obligation. |

| Filing Process | The completed form must be filed with the court that issued the original income deduction order. |

| Notice Requirement | The moving party must provide notice to the other party involved in the child support case before the court hearing. |

| Hearing | A court hearing may be scheduled to review the motion and any objections from the other party. |

| Outcome | If granted, the court will issue an order terminating the income deduction, releasing the employer from withholding payments. |

| Form Availability | The form can typically be obtained from the local courthouse or online through the Florida state court system's website. |

| Legal Assistance | It is advisable to seek legal counsel to ensure that the motion is properly completed and filed, especially if there are complex issues involved. |

Additional PDF Forms

Radon Gas Florida - Applicants must be 19 years of age or older to fill out this form.

Hsmv 83330 - Providing false information is considered a criminal offense in Florida.

Florida Business Partner Number - This form includes sections for the tax due on various services within Florida.