Free Florida Lottery Claim Form

Understanding Florida Lottery Claim

-

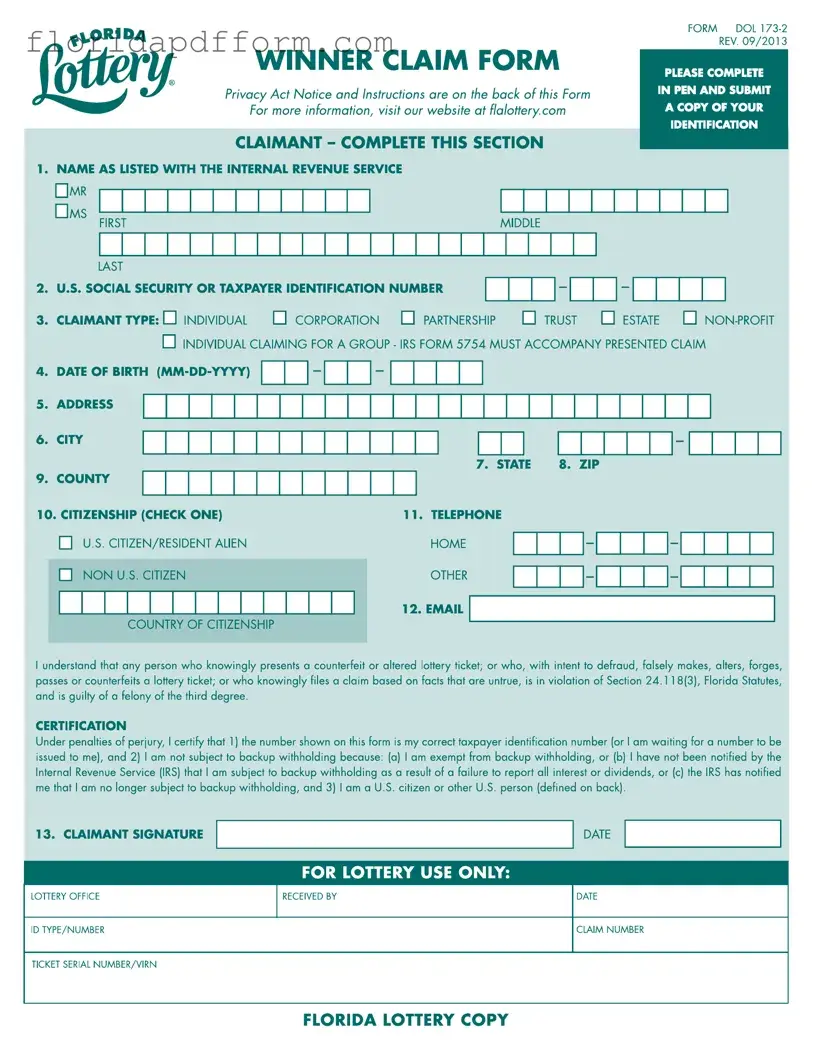

What is the Florida Lottery Claim Form?

The Florida Lottery Claim Form is a document that individuals must complete to claim lottery prizes. This form gathers essential information about the claimant, including their name, identification number, and details about the winning ticket. It is crucial for processing claims accurately and efficiently.

-

Who needs to complete the Claim Form?

Any individual or entity claiming a lottery prize must complete the Claim Form. This includes individuals, corporations, partnerships, trusts, and estates. If claiming on behalf of a group, IRS Form 5754 must accompany the claim.

-

What identification is required when submitting the Claim Form?

For claims of $600 or more, a copy of one form of identification is required. Acceptable forms include a Florida driver's license, U.S. passport, or military ID. The identification must be current or issued within the last five years and contain a serial or identifying number.

-

How do I submit my Claim Form?

The Claim Form can be submitted in person at any Lottery office or retailer. For prizes up to $250,000, claims can also be mailed. When mailing, include the original ticket, the completed Claim Form, and a copy of acceptable identification. Ensure that the envelope is postmarked within the required time frame.

-

What are the deadlines for claiming lottery prizes?

For online terminal game prizes, the ticket must be validated within 180 days of the winning drawing. If not paid at that time, the ticket must be submitted for payment within 210 days. Scratch-off game prizes have a 60-day validation period and a 90-day payment submission period. Missing these deadlines will result in forfeiture of the prize.

-

What happens if my ticket is damaged?

If a ticket is damaged but the barcode or ticket number is still legible, a Retailer or Lottery Office may be able to redeem it. It is important to store your ticket safely and avoid exposure to elements that could cause damage.

-

What should I know about taxes on lottery winnings?

Federal income tax withholding will be deducted from prizes exceeding $5,000. Additionally, certain debts, including unpaid child support or debts owed to state agencies, may be deducted from prizes of $600 and above. It is advisable to consult a tax professional for detailed guidance.

-

Can I claim my prize anonymously?

In Florida, the names of lottery winners are generally public information. However, there are specific circumstances under which a winner may remain anonymous. Consulting with legal counsel can provide clarity on the options available for privacy when claiming a prize.

Common mistakes

-

Failing to complete the form in pen. The form must be filled out using a pen to ensure clarity and legibility.

-

Not providing a current copy of identification. A valid ID must accompany claims of $600 or more, and it should be issued within the last five years.

-

Using a name that does not match IRS records. The name entered on the form must align with the name registered with the Internal Revenue Service.

-

Neglecting to sign and date the form. The claimant must sign and date the Winner Claim Form in the designated area to validate the claim.

-

Overlooking the requirement for backup withholding. If the claimant has been notified of backup withholding, they must cross out item 2 in the Certification Statement.

-

Not following the submission timeline. Claims must be submitted within specific timeframes: 180 days for online terminal game prizes and 60 days for scratch-off game prizes.

How to Use Florida Lottery Claim

Filling out the Florida Lottery Claim Form is an important step in claiming your prize. Make sure you have your winning ticket and the necessary identification ready. Follow these steps to complete the form accurately.

- Write your name as it appears with the Internal Revenue Service. Select the appropriate title (Mr. or Ms.) and fill in your first, last, and middle names.

- Enter your Social Security Number or Taxpayer Identification Number.

- Choose your claimant type from the options provided: Individual, Corporation, Partnership, Trust, or Non-Profit.

- Provide your date of birth in the format MM-DD-YYYY.

- Indicate your country of citizenship and whether you are a U.S. citizen or resident alien.

- Fill in your email address.

- Read the certification statement and ensure you understand the implications of false claims.

- Sign and date the form where indicated. If you are signing on behalf of an entity, include your title.

- Attach a copy of your identification. Ensure it is current or issued within the last five years.

- If applicable, cross out item 2 in the Certification Statement if you are subject to backup withholding.

Once you have completed the form, you can submit it along with your winning ticket and identification. Ensure that you follow the guidelines for submission to avoid any delays in receiving your prize.

File Specs

| Fact Name | Fact Details |

|---|---|

| Form Title | The official name of the form is the Florida Lottery Winner Claim Form, designated as DOL 173-2. |

| Submission Requirement | Claimants must complete the form in pen and provide a copy of their identification when submitting a claim. |

| Claimant Types | The form accommodates various claimant types, including individuals, corporations, partnerships, and trusts. |

| Tax Identification | Claimants must provide their U.S. Social Security or taxpayer identification number, as required by federal law. |

| Legal Consequences | Violations related to fraudulent claims are governed by Section 24.118(3) of the Florida Statutes, which classifies such actions as a third-degree felony. |

| Prize Amounts | For prizes of $600 or more, disclosure of Social Security numbers is mandatory for tax withholding and reporting, per 26 U.S.C. s. 3402 and s. 6109. |

| Claim Process | Claimants must follow specific timelines for submitting winning tickets based on the type of game, with deadlines ranging from 60 to 180 days. |

Additional PDF Forms

What Age Can You Legally Move Out in Florida - The petition must clearly explain the reasons for requesting emancipation.

Sf 95 - Your signature indicates your agreement with the provided information.