Free Florida Ifta Application Form

Understanding Florida Ifta Application

-

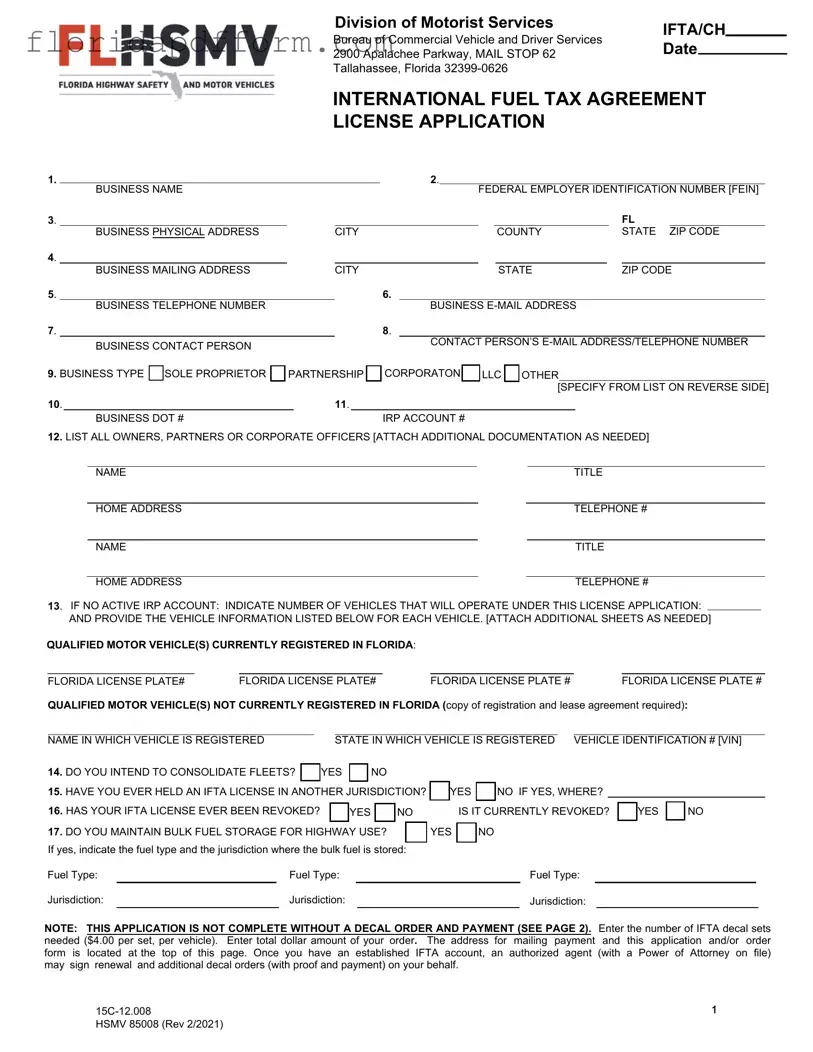

What is the purpose of the Florida IFTA Application form?

The Florida IFTA Application form is designed for businesses that operate qualified motor vehicles across state lines. It allows these businesses to apply for an International Fuel Tax Agreement (IFTA) license. This license simplifies the reporting and payment of fuel taxes by allowing businesses to file a single fuel tax return with the state of Florida, rather than filing in each state where they operate.

-

What information do I need to provide on the application?

When completing the application, you will need to provide several key pieces of information:

- Your business name and Federal Employer Identification Number (FEIN).

- Physical and mailing addresses for your business.

- Contact information, including a business telephone number and email address.

- Details about the type of business ownership, such as whether it is a sole proprietorship, partnership, or corporation.

- Information about all owners, partners, or corporate officers.

- Details about the vehicles that will operate under the IFTA license, including license plate numbers and vehicle identification numbers (VINs).

Be sure to attach any additional documentation as required, such as proof of vehicle registration if applicable.

-

Are there any fees associated with the application?

Yes, there is a fee for the IFTA decals. Each set of decals costs $4.00 per vehicle. When submitting your application, you will need to indicate the number of decal sets required and include payment for the total amount. Make checks payable to the Florida Division of Motorist Services.

-

What happens after I submit my application?

Once you submit your application along with the required payment, the Florida Department of Highway Safety and Motor Vehicles will process it. If approved, you will receive your IFTA license and decals. It is important to ensure that all information provided is accurate and complete, as any discrepancies could delay the processing of your application. Additionally, once you have your IFTA account established, you can authorize an agent to manage your correspondence and decal orders on your behalf.

Common mistakes

-

Incomplete Business Information: Many applicants forget to provide complete details about their business. This includes the business name, physical address, and mailing address. Ensure all fields are filled out correctly to avoid delays.

-

Missing Federal Employer Identification Number (FEIN): Failing to include your FEIN is a common mistake. This number is essential for identifying your business in tax matters. Always double-check that it is entered accurately.

-

Incorrect Vehicle Information: Applicants often neglect to provide accurate vehicle information. If you don’t have an active IRP account, you must list all qualified vehicles and their respective license plate numbers. Missing or incorrect details can lead to complications.

-

Not Indicating Business Type: Some individuals forget to specify their business type, such as sole proprietor, partnership, or corporation. This information is crucial for processing your application correctly.

-

Neglecting to Sign the Application: It’s easy to overlook the signature requirement. The application must be signed by the business owner or an authorized company officer. Without a signature, your application will be considered incomplete.

-

Failure to Include Payment: Many applicants forget to send the payment for the decal order. Ensure that you include the correct amount based on the number of vehicles and that your check is made payable to the Florida Division of Motorist Services.

How to Use Florida Ifta Application

Filling out the Florida IFTA Application form is a straightforward process. Follow the steps below to ensure you complete the form accurately and efficiently.

- Business Name: Write the name of your motor carrier business. If the name is not an individual's name, attach the necessary documentation.

- Federal Employer Identification Number (FEIN): Enter your business’s FEIN.

- Business Physical Address: Provide the physical location of your business in Florida. Avoid using P.O. boxes.

- Business Mailing Address: Fill in the mailing address for your business, which should not be a service provider's address.

- Business Telephone Number: Include your business phone number with the area code.

- Business E-Mail Address: Enter the email address for your business.

- Contact Person: Specify the name of the person who can be contacted regarding this application.

- Contact Person’s E-Mail Address: Provide the email address and phone number for the contact person.

- Business Type: Indicate the type of business ownership.

- U.S. DOT Number: Enter your U.S. DOT number.

- IRP Account Number: If applicable, provide your Florida IRP account number.

- Owners, Partners, or Corporate Officers: List the names, addresses, titles, and phone numbers of all owners or officers. Attach additional documentation if needed.

- Vehicle Information: If you lack an IRP account, indicate the number of vehicles under this application and provide their details.

- Consolidate Fleets: Mark whether you plan to consolidate all vehicles in Florida.

- Previous IFTA License: Indicate if you have held an IFTA license in another jurisdiction and specify where.

- Revoked IFTA License: Check if your IFTA license has ever been revoked.

- Bulk Fuel Storage: Indicate if you maintain bulk fuel storage and provide the fuel type and jurisdiction.

- Decal Order: Specify the number of IFTA decals needed and calculate the total fee.

- Applicant Declaration: Sign and date the application, confirming the accuracy of the information provided.

After completing the form, be sure to mail it along with your payment to the address indicated at the top of the application. This will help you establish your IFTA account and ensure compliance with all necessary regulations.

File Specs

| Fact Name | Description |

|---|---|

| Governing Authority | The Florida International Fuel Tax Agreement (IFTA) application is governed by Florida Statute 206.01. |

| Application Purpose | This form is used to apply for an IFTA license, which allows for the reporting and payment of fuel taxes across multiple jurisdictions. |

| Submission Address | Completed applications should be mailed to the Florida Division of Motorist Services at 2900 Apalachee Parkway, Mail Stop 62, Tallahassee, FL 32399-0626. |

| Required Information | Applicants must provide their business name, Federal Employer Identification Number (FEIN), physical and mailing addresses, and contact details. |

| Vehicle Information | If the applicant does not have an active International Registration Plan (IRP) account, they must provide details about all vehicles that will operate under the IFTA license. |

| Decal Fees | Each vehicle requires a decal fee of $4.00, which must be included with the application for processing. |

| Compliance Agreement | By signing the application, the applicant agrees to comply with all tax reporting and record-keeping requirements outlined in the IFTA. |

| Power of Attorney | If using authorized agents, a notarized Power of Attorney form (HSMV 96440) must be submitted to manage IFTA correspondence. |

Additional PDF Forms

Can I Apply for a Florida Marriage License Online - The form ensures compliance with Florida marriage laws and requirements.

Form R405-2020 - The use of programmable thermostats is mandatory when forced-air systems are in place.