Free Florida F 706 Form

Understanding Florida F 706

-

What is the Florida F 706 form?

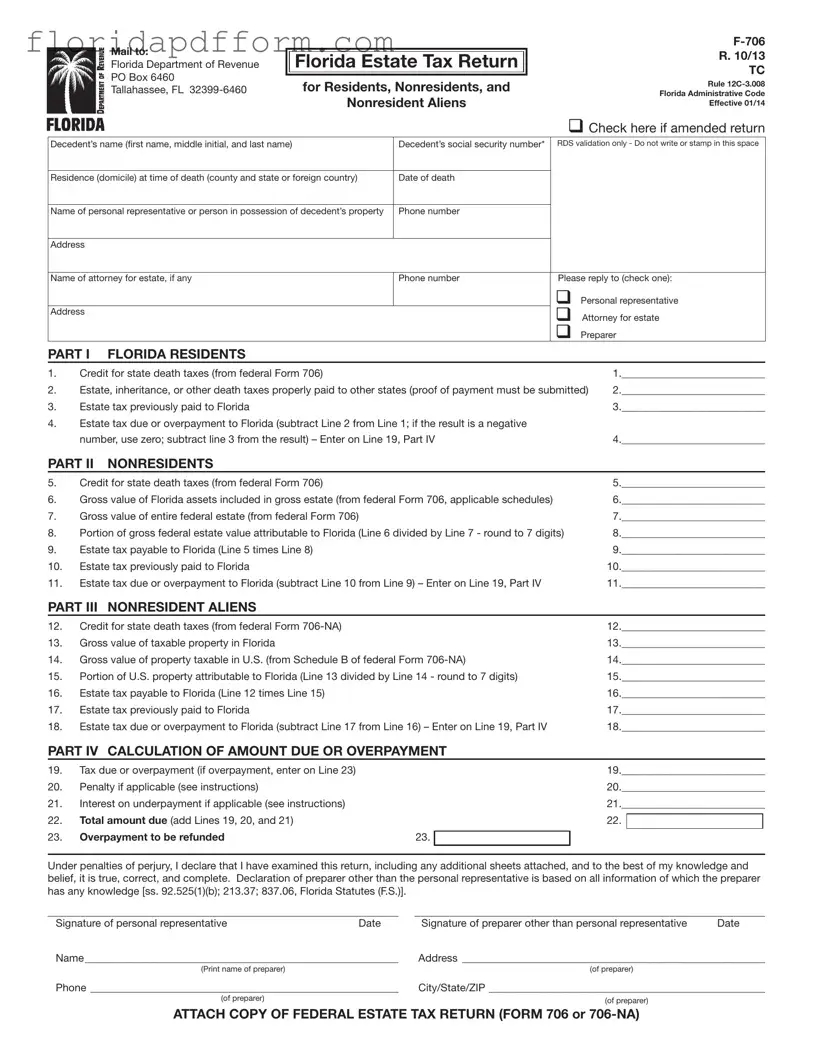

The Florida F 706 form is the Florida Estate Tax Return. It is used to report and calculate estate taxes owed to the state of Florida for estates that meet certain federal filing requirements.

-

Who needs to file the F 706 form?

Filing is required for estates of Florida residents, nonresidents, and nonresident aliens with Florida property if a federal estate tax return (Form 706 or 706-NA) is required. If the date of death is on or before December 31, 2004, the form must be filed. For deaths on or after January 1, 2005, no filing is necessary unless federal requirements apply.

-

When is the F 706 form due?

The form and payment are due within nine months after the decedent's death, coinciding with the due date for the federal estate tax return. Extensions for filing can be requested through the IRS, but Florida does not have a separate extension process.

-

What happens if I miss the filing deadline?

If the form is not filed by the deadline, penalties and interest may apply. A late payment penalty starts at 10% of the unpaid tax and can increase to 20% after 30 days. Interest accrues from the original due date until the tax is paid.

-

What information is required on the F 706 form?

The form requires details such as the decedent's name, social security number, date of death, and information about the personal representative and any attorneys involved. It also includes sections for calculating state death taxes and any credits applicable.

-

Can I amend my F 706 form after it has been filed?

Yes, if you need to make changes, complete another F 706 form and check the amended return box. If the amendment is due to changes in your federal return, attach a statement explaining the changes and any relevant documents.

-

Where do I send the completed F 706 form?

Mail your completed F 706 form and payment to the Florida Department of Revenue at the following address: PO Box 6460, Tallahassee, FL 32399-6460. If requesting a nontaxable certificate, include a $5.00 fee.

-

What if I have paid estate taxes to other states?

If you have paid estate, inheritance, or other death taxes to other states, you must submit proof of payment with your F 706 form. This proof should include a final certificate of payment showing the specific amounts paid.

-

What is the penalty for not paying the estate tax on time?

A late payment penalty of 10% applies if the tax is not paid by the due date. After 30 days, this penalty increases to 20%. Additional penalties may apply for negligence or fraud, which can significantly increase the total amount due.

-

Where can I find more information or assistance?

For more information, visit the Florida Department of Revenue's website at floridarevenue.com. You can also contact Taxpayer Services at 850-488-6800, Monday through Friday, for assistance.

Common mistakes

-

Neglecting to Check the Amended Return Box: If you are submitting an amended return, it is crucial to check the appropriate box. Failing to do so can lead to processing delays or complications.

-

Incorrect Social Security Number: Providing the wrong Social Security Number for the decedent can result in significant issues. Always double-check this information for accuracy.

-

Omitting Required Attachments: Remember to attach a copy of the federal estate tax return (Form 706 or 706-NA). Not including this document can lead to rejection of your filing.

-

Failing to Submit Proof of State Taxes Paid: If you have paid estate, inheritance, or other death taxes to other states, proof of payment must accompany your return. Without it, your claim for credit may be denied.

-

Incorrect Calculation of Tax Due: Ensure that all calculations are accurate, especially when determining the estate tax due or any overpayment. Errors in math can lead to penalties and interest.

-

Missing Signatures: Both the personal representative and the preparer must sign the return. Omitting signatures can delay processing and create additional complications.

-

Not Meeting Filing Deadlines: The F-706 form must be filed within nine months of the decedent's death. Be mindful of this timeline to avoid late penalties.

-

Ignoring Instructions for Penalties and Interest: Familiarize yourself with potential penalties for late payment and ensure that any interest accrued is calculated correctly. Ignoring these details can lead to unexpected financial burdens.

How to Use Florida F 706

Completing the Florida F 706 form requires careful attention to detail to ensure that all necessary information is accurately provided. After filling out the form, you will need to submit it to the Florida Department of Revenue along with any required documentation. Below are the steps to guide you through the process of completing the form.

- Begin by marking the box if you are submitting an amended return.

- Enter the decedent’s full name, including first name, middle initial, and last name.

- Provide the decedent’s social security number in the designated space.

- Indicate the residence (county and state or foreign country) of the decedent at the time of death.

- Fill in the date of death.

- List the name of the personal representative or the person in possession of the decedent’s property.

- Include the phone number of the personal representative.

- Provide the address of the personal representative.

- If applicable, enter the name of the attorney for the estate and their phone number.

- Choose who should receive replies by checking the appropriate box (personal representative, attorney for estate, or preparer) and provide the relevant address.

For Part I, if the decedent was a Florida resident, fill in the required lines regarding credits for state death taxes and any estate taxes previously paid. If the decedent was a nonresident, complete Part II, and if a nonresident alien, complete Part III. Finally, in Part IV, calculate the total amount due or any overpayment. Make sure to sign and date the form before mailing it to the Florida Department of Revenue at the address provided.

File Specs

| Fact Name | Details |

|---|---|

| Form Title | The form is officially known as the Florida Estate Tax Return, designated as F-706. |

| Governing Law | This form is governed by Chapter 198 of the Florida Statutes. |

| Filing Requirement | Form F-706 is required for estates of individuals who passed away on or before December 31, 2004, if they are subject to federal estate tax filing requirements. |

| Filing Deadline | The completed form and any payment are due within nine months of the decedent's death. |

| Amended Returns | If changes are needed, a new F-706 must be completed, and the amended return box should be checked. |

| Social Security Numbers | Social Security Numbers are used for identification purposes and are kept confidential under Florida law. |

| Penalties for Late Payment | A late payment penalty of 10% applies if the tax is not paid by the due date, increasing to 20% after 30 days. |

| Where to File | Mail the completed F-706 and payment to the Florida Department of Revenue at PO Box 6460, Tallahassee, FL 32399-6460. |

Additional PDF Forms

Florida Franchise Tax - Partnerships engaging in business outside of Florida must ensure their apportionment on the F 1065 is accurately calculated.

Florida Unemployment Tax - The form collects Social Security Numbers for tax administration, aiding in the identification of employers and employees.