Free Florida F 1120 Form

Understanding Florida F 1120

-

What is the Florida F 1120 form?

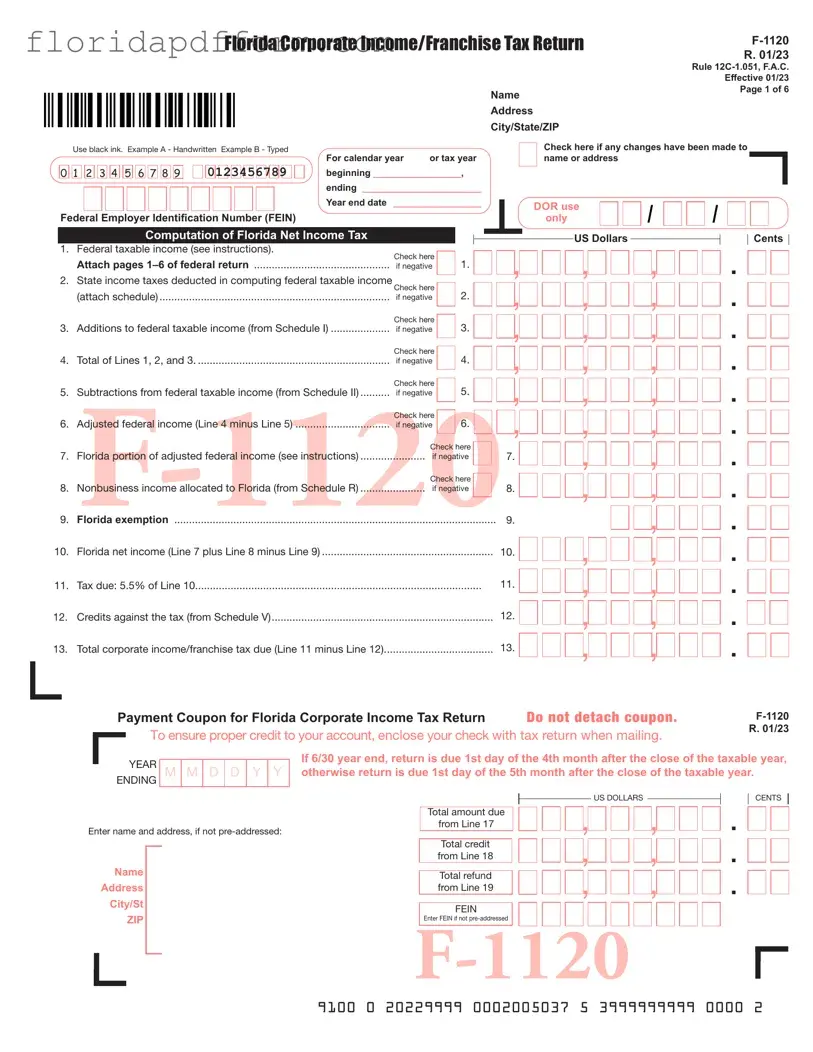

The Florida F 1120 form is the Corporate Income/Franchise Tax Return that corporations operating in Florida must file. It is used to report the corporation's income, calculate the tax owed, and claim any applicable credits. This form is essential for compliance with Florida tax laws.

-

Who needs to file the Florida F 1120 form?

Any corporation that conducts business in Florida is required to file this form. This includes domestic corporations and foreign corporations that have established a presence in the state. If your corporation has a federal employer identification number (FEIN), you will likely need to file the F 1120.

-

What is the due date for filing the Florida F 1120?

The due date for filing the Florida F 1120 form is the first day of the fourth month following the end of your corporation's fiscal year. For most corporations that operate on a calendar year, this means the form is due on April 1st. If you need more time, you can file for an extension, but this must be done before the original due date.

-

What information do I need to complete the Florida F 1120?

To complete the Florida F 1120, you will need your corporation's federal taxable income, details on any state taxes deducted, and information on various additions and subtractions to your federal taxable income. You will also need to provide your FEIN, the principal business activity code, and any applicable schedules that support your income calculations.

-

How is the Florida corporate tax rate calculated?

The Florida corporate income tax rate is currently set at 4.458% of the corporation's net income. To calculate this, you first determine your Florida net income by adjusting your federal taxable income for any state-specific additions and subtractions. The resulting figure is then multiplied by the tax rate to find the amount due.

-

What are the penalties for not filing the Florida F 1120 on time?

If you fail to file the Florida F 1120 by the due date, your corporation may face penalties. These can include fines and interest on any unpaid taxes. Additionally, if the return is not signed properly, it may be considered incomplete, further complicating your tax situation.

-

Can I amend my Florida F 1120 after filing?

Yes, if you discover an error after filing your Florida F 1120, you can amend the return. This is typically done by submitting a new F 1120 form with the corrected information. It’s important to indicate that the return is an amendment and to provide any necessary documentation to support the changes.

-

What should I do if I overpaid my taxes?

If you believe you have overpaid your Florida corporate taxes, you can request a refund. This is done by completing the appropriate section on the F 1120 form and providing details about the overpayment. Ensure that you attach any supporting documentation to expedite the refund process.

-

Are there any credits available to reduce my tax liability?

Yes, the Florida F 1120 form allows corporations to claim various tax credits. These can include credits for capital investments, enterprise zone jobs, and more. Be sure to review the instructions for the F 1120 to see which credits you may qualify for and how to apply them on your return.

-

Where do I send my completed Florida F 1120 form?

Your completed Florida F 1120 form should be mailed to the Florida Department of Revenue. If you are sending a payment, include it with your return. Make sure to write your FEIN on the check and attach a copy of your federal return as required. The address for submissions can be found on the form's instructions.

Common mistakes

-

Neglecting to Attach Required Documents: One common mistake is failing to attach a copy of the federal return. This form is considered incomplete without it, which can lead to delays or penalties.

-

Incorrectly Reporting Federal Taxable Income: Many individuals miscalculate their federal taxable income. This figure is crucial, as it forms the basis for the Florida net income tax computation. Double-checking this line can prevent significant errors.

-

Forgetting to Sign the Return: A return that is not signed, or is improperly signed, is subject to penalties. It is essential to ensure that the signature of an officer is original and present before submitting the form.

-

Ignoring the Apportionment of Income: Taxpayers conducting business outside of Florida often overlook the need to accurately apportion their income. This can lead to incorrect tax calculations and potential compliance issues.

-

Missing Deadlines: Filing the form late can result in penalties and interest charges. Being aware of the due dates and planning accordingly is vital for avoiding unnecessary fees.

How to Use Florida F 1120

Completing the Florida F-1120 form requires attention to detail and accurate information regarding your corporate income and taxes. After filling out the form, it is essential to attach the necessary federal return and any additional schedules as required. Ensure that all information is verified and that the return is signed before submission.

- Obtain the Florida F-1120 form and ensure you have the necessary federal return documents.

- Fill in your corporation's name, address, and federal employer identification number (FEIN) at the top of the form.

- Indicate the tax year by entering the beginning and ending dates in the designated fields.

- Complete the computation of Florida net income tax by filling out the relevant lines:

- Line 1: Enter your federal taxable income. If negative, check the box.

- Line 2: Deduct state income taxes from federal taxable income, if applicable.

- Line 3: Add any additions to federal taxable income from Schedule I.

- Line 4: Calculate the total of Lines 1, 2, and 3.

- Line 5: Subtract any applicable subtractions from federal taxable income from Schedule II.

- Line 6: Calculate adjusted federal income (Line 4 minus Line 5).

- Line 7: Determine the Florida portion of adjusted federal income.

- Line 8: Enter nonbusiness income allocated to Florida from Schedule R.

- Line 9: Enter the Florida exemption amount.

- Line 10: Calculate Florida net income (Line 7 plus Line 8 minus Line 9).

- Line 11: Calculate tax due at the rate of 4.458% of Line 10.

- Line 12: Enter any credits against the tax from Schedule V.

- Line 13: Calculate total corporate income/franchise tax due (Line 11 minus Line 12).

- Fill out Line 14 for any penalties, interest, or other fees that may apply.

- Complete Line 15 by adding Lines 13 and 14.

- On Line 16, enter any estimated tax payments or tentative tax payments.

- Calculate the total amount due on Line 17 by subtracting Line 16 from Line 15.

- Complete Lines 18 and 19 for any overpayment credits or refund amounts.

- Answer questions A through L as required at the bottom of the form.

- Sign the form where indicated, ensuring that it is properly verified.

- Attach a copy of your federal return and any other required schedules before submission.

- Mail the completed form to the appropriate address provided for payments and returns.

File Specs

| Fact Name | Details |

|---|---|

| Form Purpose | The Florida F 1120 form is used for filing the Corporate Income/Franchise Tax Return. |

| Governing Law | Rule 12C-1.051, Florida Administrative Code governs the filing of this form. |

| Effective Date | The current version of the form is effective as of January 2020. |

| Filing Requirement | Corporations operating in Florida must file this form annually. |

| FEIN Requirement | A Federal Employer Identification Number (FEIN) is required on the form. |

| Tax Calculation | The tax due is calculated at a rate of 4.458% of Florida net income. |

| Attachments Needed | A copy of the federal return must be attached for the return to be considered complete. |

| Payment Instructions | Payments should be made to the Florida Department of Revenue and mailed to the specified address. |

Additional PDF Forms

Florida Unemployment Tax - Compliance with RT-6A filing helps maintain the integrity of Florida’s tax system and bolsters civic responsibility.

Florida Ucc1 - The UCC1 form should be completed fully to avoid delays in course approval.