Free Florida F 1065 Form

Understanding Florida F 1065

-

What is the Florida F-1065 form?

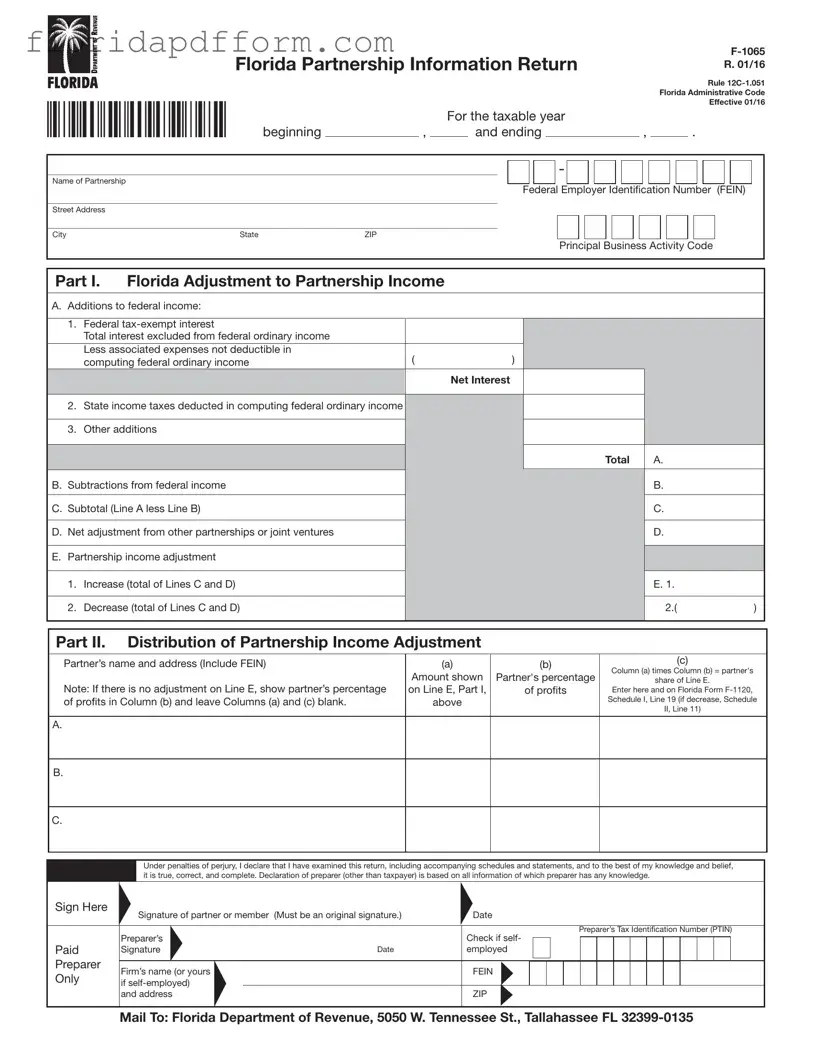

The Florida F-1065 form is the Partnership Information Return that partnerships operating in Florida must file. It reports the partnership's income, deductions, and apportionment factors. This form is essential for determining each partner's share of income and any necessary adjustments for Florida tax purposes.

-

Who needs to file the F-1065 form?

Every Florida partnership with at least one partner subject to the Florida Corporate Income Tax must file this form. This includes limited liability companies classified as partnerships for federal tax purposes. If a foreign corporation is a partner, it must file a Florida Corporate Income/Franchise Tax Return as well.

-

When is the F-1065 form due?

The F-1065 form must be filed on or before the first day of the fifth month following the end of your taxable year. If the due date falls on a weekend or holiday, the return is considered timely if postmarked on the next business day.

-

How can I request an extension for filing the F-1065?

To request an extension, you must complete Florida Form F-7004. This form allows you to extend your filing time by five months. Note that simply filing a federal extension will not suffice for Florida purposes.

-

What should I include with my F-1065 filing?

You may attach additional statements if the lines on the F-1065 are insufficient. These attachments must follow the format of the return and include all required information. However, do not attach a copy of your federal return.

-

What is the purpose of the apportionment information section?

This section is necessary for partnerships doing business both within and outside Florida. It calculates the partnership's income that is subject to Florida tax based on property, payroll, and sales ratios in Florida compared to totals everywhere. Specific rules apply for different types of businesses.

-

What happens if my partnership ceases to exist?

If your partnership is no longer operating, you must write "FINAL RETURN" at the top of the form. This indicates that it is the last return you will file for that partnership.

-

How do I round amounts on the F-1065?

When entering amounts, round to the nearest whole dollar. Drop amounts less than 50 cents and round amounts from 50 cents to 99 cents up to the next dollar. This rounding method should be consistent with your federal return.

Common mistakes

-

Incorrect FEIN Entry: Failing to enter the correct Federal Employer Identification Number (FEIN) can lead to significant processing delays. Ensure that the FEIN matches the one issued by the IRS.

-

Missing Original Signature: The form requires an original signature from a partner or member. A photocopy, facsimile, or stamped signature will not be accepted.

-

Omitting Principal Business Activity Code: Not entering the Principal Business Activity Code can result in processing issues. This code identifies the nature of the business and is crucial for tax purposes.

-

Failure to Complete All Parts: Leaving any sections incomplete can cause delays or rejections. Each part of the form must be filled out accurately and completely.

-

Incorrect Apportionment Calculations: Errors in calculating the apportionment factors for property, payroll, and sales can lead to incorrect tax liability. Review these calculations carefully.

-

Not Following Rounding Rules: Failing to round amounts correctly can result in discrepancies. Always round to the nearest whole dollar as specified in the instructions.

-

Ignoring Filing Deadlines: Missing the filing deadline can incur penalties. Ensure that the form is submitted on or before the due date to avoid unnecessary fees.

-

Neglecting Attachments: If additional schedules or statements are required, they must be attached. Not including these can lead to incomplete submissions and delays in processing.

How to Use Florida F 1065

Completing the Florida F 1065 form requires careful attention to detail. Each section must be filled out accurately to ensure compliance with state tax regulations. Below are the steps to guide you through the process of filling out the form.

- Begin by entering the taxable year at the top of the form. Specify the start and end dates of the taxable year.

- Provide the name of the partnership and its street address, including city, state, and ZIP code.

- Enter the Federal Employer Identification Number (FEIN) for the partnership.

- Input the Principal Business Activity Code that corresponds to the partnership's business activities.

- In Part I, start with Line A for additions to federal income. Fill in the amounts for federal tax-exempt interest, state income taxes, and any other additions.

- Complete Line B for subtractions from federal income. Include any applicable amounts that need to be deducted.

- Calculate the subtotal on Line C by subtracting Line B from Line A.

- If applicable, enter the net adjustment from other partnerships or joint ventures on Line D.

- On Line E, calculate the total partnership income adjustment by summing Lines C and D. Indicate any increases or decreases as required.

- Move to Part II to distribute the partnership income adjustment. List each partner's name and address, and their percentage share of Line E in the appropriate columns.

- Proceed to Part III. If the partnership does business outside of Florida, complete the apportionment information. Fill in the average value of property, payroll data, and sales data as instructed.

- Finally, ensure that the form is signed by a partner or member with an original signature. Include the date and the preparer's tax identification number if applicable.

- Mail the completed form to the Florida Department of Revenue at the specified address.

After completing these steps, the form should be ready for submission. Make sure to review all entries for accuracy before mailing to avoid any potential issues with your filing.

File Specs

| Fact Name | Description |

|---|---|

| Purpose | The Florida F-1065 form is used to report the income, deductions, and other tax-related information of partnerships operating in Florida. |

| Governing Law | This form is governed by Rule 12C-1.051 of the Florida Administrative Code. |

| Filing Requirement | All Florida partnerships with at least one partner subject to the Florida Corporate Income Tax must file this form. |

| Filing Deadline | The F-1065 must be filed by the first day of the fifth month following the end of the partnership's taxable year. |

| Extension of Time | Partnerships can request an extension by filing Florida Form F-7004, which grants an additional five months for filing. |

| Signature Requirement | An original signature from a partner or authorized person is required for the form to be valid; photocopies are not accepted. |

| Apportionment Information | Part III of the form requires partnerships to report their apportionment factors if doing business both within and outside Florida. |

Additional PDF Forms

Florida Oversize Permit Login - Correctly identifying your business type helps streamline the administrative process.

Florida Realtors Lease Agreement Pdf - Radon gas disclosure outlines potential health risks associated with natural gas exposure in buildings.

Florida State Board of Nursing - Nursing programs from other jurisdictions may qualify if recognized by the board.