Free Florida Dr 157 Form

Understanding Florida Dr 157

-

What is the Florida DR-157 form?

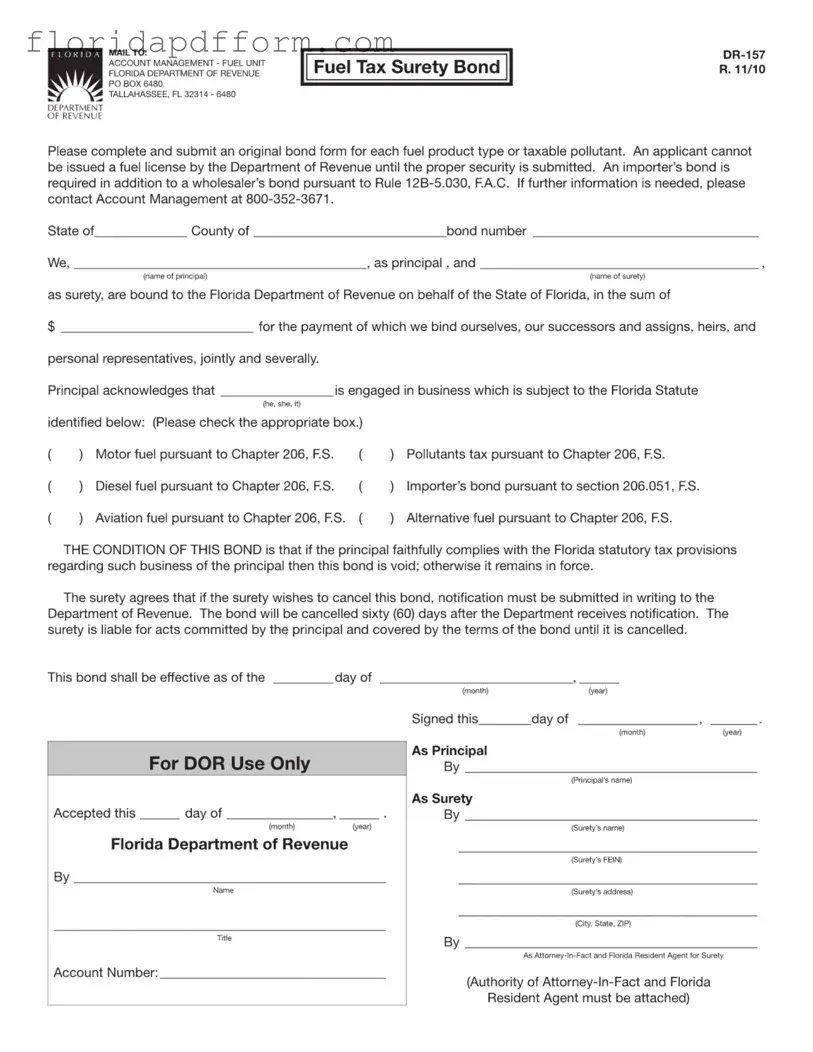

The Florida DR-157 form is a Fuel Tax Surety Bond required by the Florida Department of Revenue. It ensures that businesses engaged in the sale or distribution of fuel products comply with state tax laws. This bond acts as a guarantee for the payment of fuel taxes.

-

Who needs to submit the DR-157 form?

Any business that deals with fuel products or taxable pollutants in Florida must submit this form. This includes businesses involved in motor fuel, diesel fuel, aviation fuel, alternative fuel, and those acting as importers.

-

How many bonds do I need to submit?

You must submit a separate bond for each type of fuel product or taxable pollutant. If you are both a wholesaler and an importer, you will need to submit both types of bonds.

-

What happens if I do not submit the DR-157 form?

If you do not submit the DR-157 form, you cannot obtain a fuel license from the Florida Department of Revenue. This means you will not be able to legally sell or distribute fuel products in the state.

-

How do I complete the DR-157 form?

To complete the form, fill in your business information, including the bond number, the type of fuel or pollutant, and the amount of the bond. Ensure that both the principal and surety sign the form. It is important to check the appropriate box for the type of business you are engaged in.

-

Where do I send the completed DR-157 form?

Send the completed form to the following address:

Account Management - Fuel Unit

Florida Department of Revenue

PO Box 6480

Tallahassee, FL 32314-6480 -

Can the surety cancel the bond?

Yes, the surety can cancel the bond. However, they must submit a written notification to the Florida Department of Revenue. The bond will be canceled 60 days after the Department receives this notification.

-

What is the bond's condition?

The bond remains in force as long as the principal complies with Florida's tax laws related to their business. If the principal fulfills all obligations, the bond becomes void.

-

What should I do if I need more information?

If you need further information, you can contact the Account Management at the Florida Department of Revenue by calling 800-352-3671.

-

What is the effective date of the bond?

The bond is effective from the date specified in the form. Ensure that you fill in the correct month and year when completing the form.

Common mistakes

-

Incomplete Information: Failing to fill in all required fields can lead to delays. Ensure every section of the form is completed, including the bond number, names of the principal and surety, and the amount of the bond.

-

Incorrect Bond Type: Selecting the wrong type of bond can result in the rejection of the application. Carefully review the options and check the appropriate box that matches your business activity.

-

Missing Signatures: Both the principal and surety must sign the form. Omitting one or both signatures will invalidate the bond, so double-check before submission.

-

Improper Notification for Cancellation: If the surety wishes to cancel the bond, they must provide written notification to the Department of Revenue. Not following this procedure can lead to continued liability.

-

Failure to Attach Required Documents: Certain documents, such as the authority of the Attorney-In-Fact and Florida Resident Agent, must accompany the form. Neglecting to include these can delay processing.

How to Use Florida Dr 157

Filling out the Florida Dr 157 form is an important step in securing a fuel tax surety bond with the Florida Department of Revenue. Completing this form accurately ensures compliance with state regulations and facilitates the issuance of the necessary fuel license. Follow these steps carefully to ensure that all required information is provided.

- Begin by obtaining the Florida Dr 157 form from the Florida Department of Revenue website or by contacting their office.

- In the designated area, enter the bond number assigned to your application.

- Fill in the name of the principal and the name of the surety in the appropriate fields.

- Specify the sum for which the bond is being issued.

- Indicate the type of business by checking the appropriate box for one of the following options:

- Motor fuel pursuant to Chapter 206, F.S.

- Pollutants tax pursuant to Chapter 206, F.S.

- Diesel fuel pursuant to Chapter 206, F.S.

- Importer’s bond pursuant to section 206.051, F.S.

- Aviation fuel pursuant to Chapter 206, F.S.

- Alternative fuel pursuant to Chapter 206, F.S.

- Enter the effective date of the bond by filling in the month and year.

- Sign the form in the designated area as the principal, including the date of signing.

- The surety must also sign the form, providing their name, FEIN, and address, along with the city, state, and ZIP code.

- Attach the authority of the Attorney-In-Fact and Florida Resident Agent to the form, as required.

- Submit the completed form to the Florida Department of Revenue at the address provided on the form.

After submitting the form, you will await confirmation from the Department of Revenue regarding the acceptance of your bond. It is advisable to keep a copy of the completed form for your records. If you have any questions or need further assistance, contacting the Account Management at the Department of Revenue is recommended.

File Specs

| Fact Name | Details |

|---|---|

| Form Purpose | The Florida DR-157 form is used to submit a fuel tax surety bond to the Florida Department of Revenue. |

| Governing Law | The bond is governed by Florida Statutes, specifically Chapter 206, F.S. |

| Submission Requirement | An original bond form must be completed and submitted for each fuel product type or taxable pollutant. |

| License Issuance | The Department of Revenue will not issue a fuel license until the appropriate security is submitted. |

| Bond Types | Various bond types are required, including importer’s and wholesaler’s bonds, as per Rule 12B-5.030, F.A.C. |

| Cancellation Notification | If the surety wishes to cancel the bond, they must notify the Department of Revenue in writing. |

| Cancellation Period | The bond will be canceled 60 days after the Department receives the cancellation notification. |

| Liability of Surety | The surety remains liable for acts committed by the principal until the bond is officially canceled. |

Additional PDF Forms

Florida Durable Power of Attorney - This form can aid in resolving issues related to vehicle registration promptly.

How Long Does Clemency Take in Florida - Be mindful of eligibility requirements for the various types of clemency.