Free Florida Commercial Contract Form

Understanding Florida Commercial Contract

-

What is the Florida Commercial Contract form?

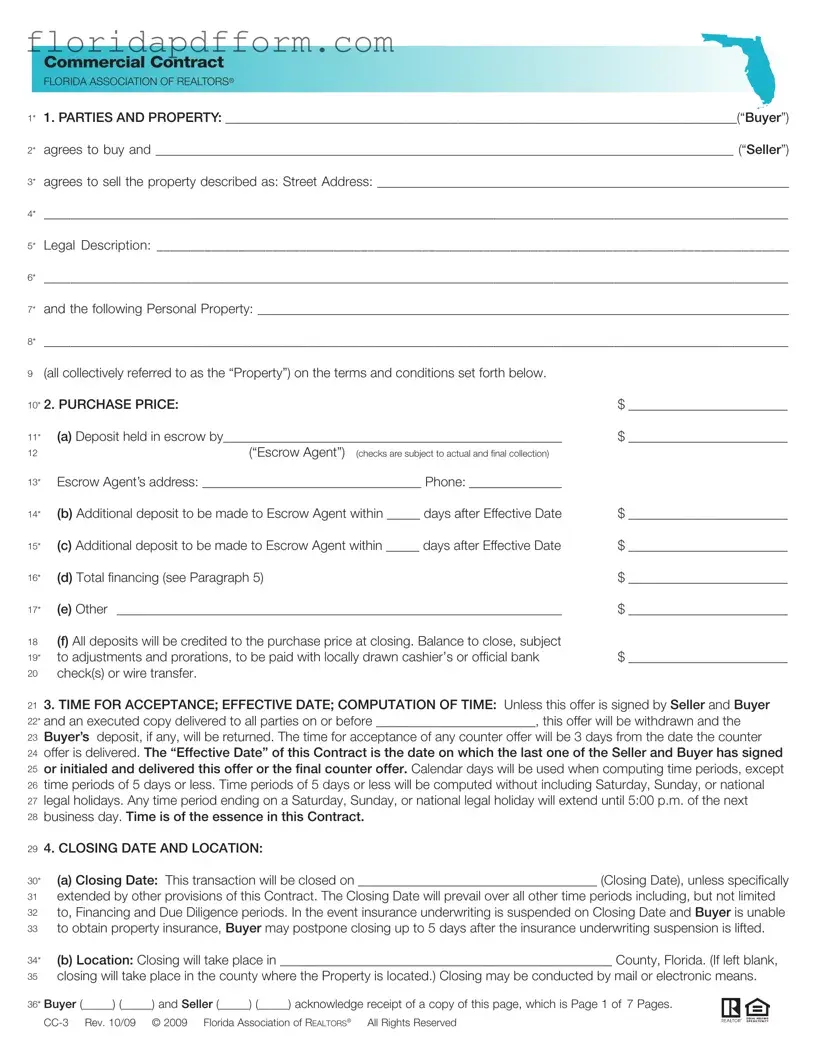

The Florida Commercial Contract form is a legal document used in real estate transactions for the purchase and sale of commercial properties in Florida. This form outlines the terms and conditions of the sale, including details about the parties involved, the property being sold, the purchase price, and any financing arrangements. It serves as a binding agreement between the buyer and seller, ensuring that both parties understand their rights and obligations.

-

Who are the parties involved in the contract?

The contract involves two main parties: the Buyer and the Seller. The Buyer is the individual or entity purchasing the property, while the Seller is the current owner of the property who agrees to sell it. Both parties must sign the contract for it to be valid.

-

What information is required about the property?

The contract requires specific details about the property, including the street address and legal description. This information helps clearly identify the property being sold and ensures that there is no confusion regarding the transaction.

-

How is the purchase price structured?

The purchase price is outlined in the contract and may include various components such as a deposit, additional deposits, and total financing. The contract specifies how these amounts will be handled and credited at closing. It is essential for both parties to understand how the payment will be structured to avoid disputes later on.

-

What is the due diligence period?

The due diligence period is a specified timeframe during which the Buyer can investigate the property to ensure it meets their needs. During this time, the Buyer may conduct inspections, review documents, and assess the property’s condition. If the Buyer finds issues that make the property unsuitable, they can cancel the contract and receive their deposit back.

-

What happens if the Buyer cannot obtain financing?

If the Buyer is unable to secure financing within the specified timeframe, they have the option to either waive the financing contingency or cancel the contract. If the Buyer chooses to cancel, they must notify the Seller in writing. If the Buyer has made a good faith effort to obtain financing, they are entitled to a return of their deposit.

-

What is the closing process like?

The closing process involves the finalization of the transaction, where ownership of the property is transferred from the Seller to the Buyer. This includes the exchange of necessary documents, payment of the purchase price, and the transfer of possession. Both parties should be prepared to provide various documents and pay applicable fees during this process.

-

What are the risks associated with the property?

The contract addresses potential risks, such as damage to the property before closing or issues arising from condemnation. If the property is damaged, the Buyer has the option to cancel the contract or proceed with the purchase and receive any insurance proceeds. Understanding these risks is crucial for both parties to make informed decisions.

-

Can the contract be modified after signing?

Yes, the terms of the contract can be modified, but any changes must be in writing and signed by both parties. It’s important to document any modifications to avoid misunderstandings or disputes in the future. The contract represents the entire agreement between the Buyer and Seller, so clarity is key.

Common mistakes

-

Incomplete Information: Failing to fill in all required fields can lead to delays or complications. Ensure that all sections, especially those for the parties involved, property details, and purchase price, are completely filled out.

-

Missing Signatures: All parties must sign the contract. Omitting a signature can render the contract invalid. Double-check that both the buyer and seller have signed where necessary.

-

Incorrect Dates: Filling in the wrong dates for acceptance, closing, or other time-sensitive sections can cause confusion. Pay close attention to the dates specified in the contract.

-

Neglecting Contingencies: Not addressing important contingencies, such as financing or inspection periods, can lead to misunderstandings. Clearly outline any contingencies to protect both parties.

-

Ignoring Legal Descriptions: Providing an inaccurate or incomplete legal description of the property can create issues later. Ensure that the legal description is precise and matches public records.

How to Use Florida Commercial Contract

Filling out the Florida Commercial Contract form is an important step in the process of buying or selling a commercial property. This form outlines the terms of the agreement between the buyer and seller, ensuring that both parties understand their rights and obligations. To help you navigate this process, here are step-by-step instructions for completing the form.

- Identify the Parties: Fill in the names of the Buyer and Seller in the designated spaces. Make sure to clearly indicate who is buying and who is selling the property.

- Property Description: Enter the street address and legal description of the property being sold. This information is crucial for identifying the property in question.

- Personal Property: List any personal property that is included in the sale, such as equipment or fixtures that will remain with the property.

- Purchase Price: Fill in the total purchase price for the property. Include details about any deposits, financing, or additional payments that may apply.

- Time for Acceptance: Specify the deadline by which the Seller must sign and return the contract for it to remain valid.

- Closing Date and Location: Indicate the planned closing date and the location where the closing will occur. If left blank, it defaults to the county where the property is located.

- Financing Details: If applicable, fill in information regarding third-party financing, including the amount, interest rates, and terms.

- Title and Evidence: Specify how the title will be conveyed and what evidence of title will be provided to the Buyer.

- Property Condition: Choose whether the Buyer accepts the property "as is" or if there will be a due diligence period for inspections.

- Closing Procedures: Outline the responsibilities of both parties regarding costs, documents, and possession of the property at closing.

- Escrow Agent: Identify the escrow agent responsible for holding deposits and disbursing funds according to the contract terms.

- Default and Remedies: Review the provisions regarding what happens if either party defaults on the contract.

- Signatures: Ensure both parties sign and date the contract to make it legally binding.

Once the form is completed, it is essential to review it carefully to ensure all information is accurate and complete. Both parties should retain copies of the signed contract for their records. This contract will serve as the foundation for the transaction, so clarity and thoroughness are key.

File Specs

| Fact Name | Fact Description |

|---|---|

| Parties Involved | The contract identifies the Buyer and Seller who are agreeing to the sale of the property. |

| Property Description | The contract requires a detailed description of the property being sold, including the street address and legal description. |

| Purchase Price | The total purchase price is clearly stated, along with deposit amounts and conditions for payment. |

| Effective Date | The contract specifies an Effective Date, which is crucial for determining deadlines and obligations. |

| Closing Procedures | Details about the closing date, location, and procedures are outlined, ensuring both parties know what to expect. |

| Financing Contingency | There are specific provisions regarding third-party financing, including deadlines for loan approval. |

| Title and Condition | The Seller is required to convey marketable title, and the Buyer accepts the property in its "as is" condition. |

| Governing Law | This contract is governed by Florida law, ensuring compliance with state regulations. |

Additional PDF Forms

Stay Away Order Florida - Obtain certified copies of the new injunction for your records.

Rts-55g - An applicant can be a new or returning individual seeking tax benefits.

Form R405-2020 - Specific insulation values related to floors, walls, and ceilings are required in this form.