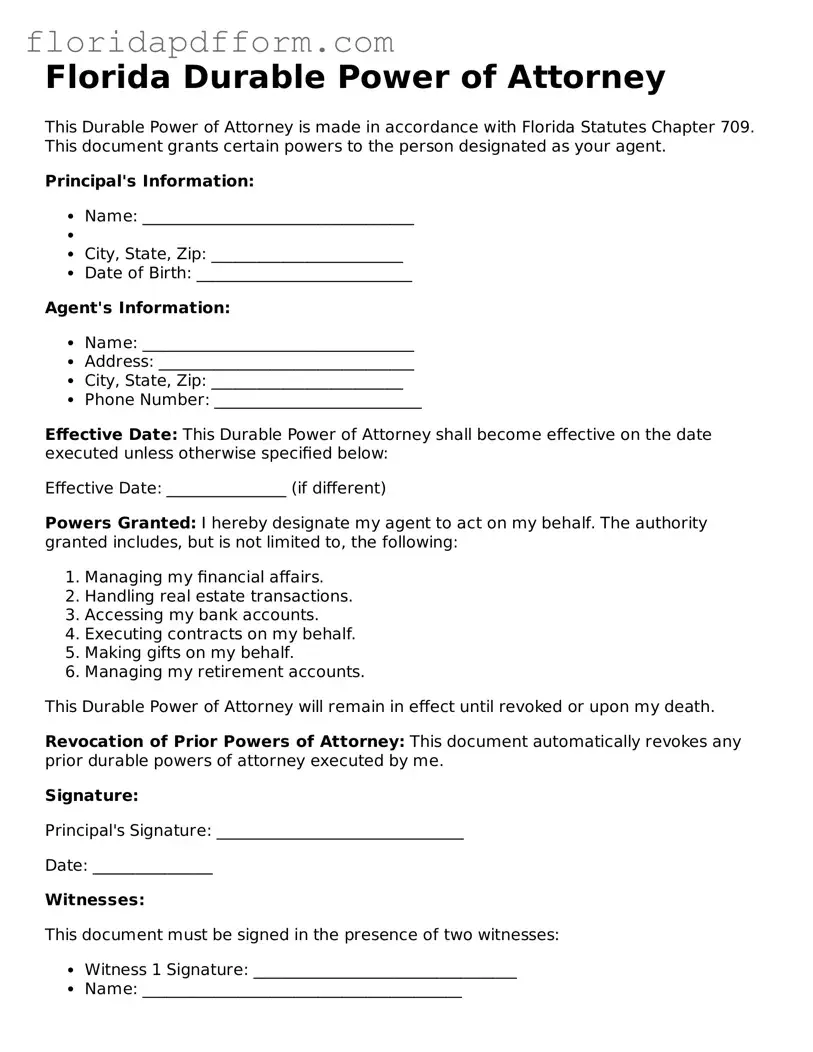

Blank Durable Power of Attorney Template for Florida

Understanding Florida Durable Power of Attorney

-

What is a Florida Durable Power of Attorney?

A Florida Durable Power of Attorney is a legal document that allows you to appoint someone to manage your financial and legal affairs if you become incapacitated. This document remains effective even if you are unable to make decisions for yourself.

-

Who can be appointed as an agent?

Any competent adult can be appointed as your agent. This can include a family member, friend, or a trusted advisor. It's important to choose someone who you trust to act in your best interests.

-

What powers can I grant to my agent?

You can grant a wide range of powers to your agent, including the ability to manage bank accounts, pay bills, make investment decisions, and handle real estate transactions. You can specify which powers you wish to grant, making the document customizable to your needs.

-

How do I create a Florida Durable Power of Attorney?

To create this document, you need to fill out the appropriate form, which can be obtained online or through legal stationery stores. After completing the form, you must sign it in the presence of two witnesses and a notary public to make it legally binding.

-

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time as long as you are mentally competent. To revoke it, you should create a written revocation document and notify your agent and any institutions that may have a copy of the original document.

-

What happens if I do not have a Durable Power of Attorney?

If you become incapacitated without a Durable Power of Attorney, your family may need to go through a court process to have a guardian appointed. This process can be lengthy and costly, making it beneficial to have a Durable Power of Attorney in place.

Common mistakes

-

Not selecting the right agent: Choosing someone who may not act in your best interest can lead to complications. Make sure to select a trusted individual who understands your values and wishes.

-

Failing to specify powers: Leaving the powers vague can create confusion. Clearly outline what decisions your agent can make on your behalf.

-

Not signing the document: A Durable Power of Attorney is not valid without your signature. Ensure you sign and date the document to make it legally binding.

-

Ignoring witness and notarization requirements: In Florida, certain documents must be witnessed and notarized. Failing to meet these requirements can invalidate the form.

-

Not updating the document: Life changes, such as a divorce or the death of an agent, necessitate updates. Regularly review and revise your Durable Power of Attorney to reflect your current situation.

-

Overlooking alternate agents: Designating a backup agent is crucial. If your primary agent is unavailable or unwilling to serve, having an alternate ensures your wishes are still honored.

-

Assuming all powers are included: Not all powers are automatically granted. Be specific about any additional powers you want your agent to have, such as making healthcare decisions.

-

Failing to communicate with your agent: It’s important to have a conversation with your chosen agent about your wishes. This ensures they understand your desires and can act accordingly.

-

Neglecting to keep copies: After completing the form, make sure to keep copies in a safe place. Share them with your agent and any relevant family members to avoid confusion in the future.

How to Use Florida Durable Power of Attorney

Filling out the Florida Durable Power of Attorney form is an important step in designating someone to manage your financial and legal matters. Once the form is completed, it should be signed and notarized to ensure it is legally binding. Here are the steps to guide you through the process of filling out the form.

- Obtain the Florida Durable Power of Attorney form. You can find it online or request a copy from a legal office.

- Begin with your personal information. Fill in your full name, address, and date of birth at the top of the form.

- Identify the agent you are appointing. Write down their full name, address, and relationship to you. This person will act on your behalf.

- Specify the powers you wish to grant. There may be sections where you can check boxes for specific powers, such as managing real estate or handling bank transactions.

- Include any limitations or special instructions. If there are certain actions you do not want your agent to take, clearly state them in the designated area.

- Review the form for accuracy. Ensure all information is correct and complete before signing.

- Sign the form in the presence of a notary public. This step is crucial for the document to be valid.

- Provide copies to your agent and any relevant financial institutions or parties involved. Keep a copy for your records as well.

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to appoint someone to manage their financial affairs if they become incapacitated. |

| Governing Law | The Florida Durable Power of Attorney is governed by Florida Statutes, Chapter 709. |

| Durability | This form remains effective even if the principal becomes incapacitated, unlike a regular Power of Attorney. |

| Agent Authority | The appointed agent can perform various tasks, including managing bank accounts, paying bills, and making investment decisions. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are competent to do so. |

Other Popular Florida Templates

Nondisclosure Agreement - Defines what constitutes confidential information in the agreement.

Whats Dnr - Healthcare providers must honor the DNR wishes in emergency situations.

Difference Between Durable Power of Attorney and Power of Attorney - Having a Medical Power of Attorney can prevent unwanted or unnecessary medical procedures.