Free Dr 504 Florida Form

Understanding Dr 504 Florida

-

What is the purpose of the DR 504 Florida form?

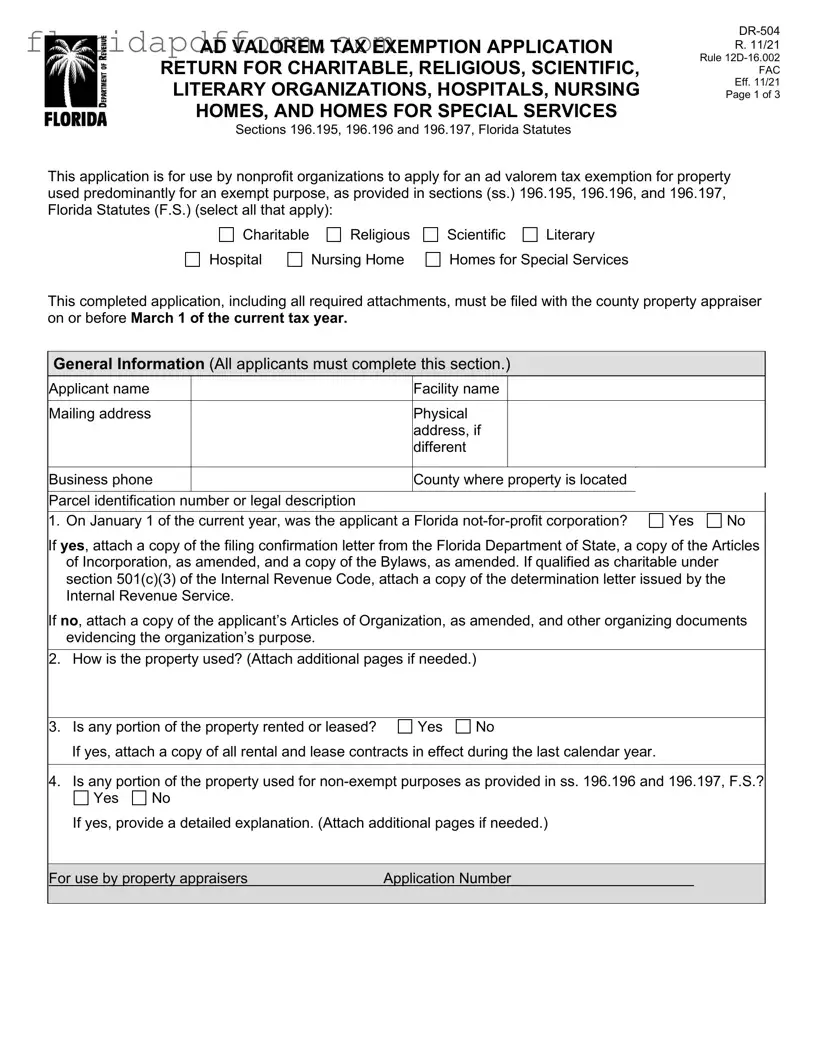

The DR 504 form is an application for ad valorem tax exemption. It is specifically designed for nonprofit organizations that seek exemption for property used predominantly for charitable, religious, scientific, literary, or healthcare-related purposes, as outlined in Florida Statutes.

-

Who is eligible to apply for this exemption?

Nonprofit organizations, including charitable organizations, hospitals, nursing homes, and homes for special services, can apply for this exemption. The organization must be a Florida not-for-profit corporation and must meet specific criteria as defined in sections 196.195, 196.196, and 196.197 of the Florida Statutes.

-

What documents must be submitted with the application?

Applicants must include several documents with the DR 504 form, including:

- A copy of the organization’s most recent financial statement.

- A copy of the most recent federal tax return, if applicable.

- Detailed fiscal records showing the financial condition and operations of the property for the preceding fiscal year.

- Proof of the organization’s not-for-profit status, such as Articles of Incorporation and Bylaws.

-

When is the application due?

The completed DR 504 form, along with all required attachments, must be filed with the county property appraiser by March 1 of the current tax year. Late submissions may not be considered for exemption.

-

What happens after the application is submitted?

Once the application is submitted, property appraisers will review the information to determine eligibility for the exemption. If additional information is needed, the property appraiser will notify the applicant. It is crucial to ensure all information is accurate and complete to avoid delays.

-

Where can I find assistance with the application process?

For help with the DR 504 application, contact the property appraiser in the county where the property is located. They are the primary resource for guidance and can provide specific information about the application process. A list of county property appraiser websites is available at FloridaRevenue.com/Property/Pages/LocalOfficials.aspx.

Common mistakes

-

Incomplete Information: Failing to provide all required information in the General Information section can lead to delays or rejection of the application. Ensure that all fields are filled out completely.

-

Missing Attachments: Not including necessary documents, such as the Articles of Incorporation or the most recent financial statement, can result in an incomplete application. Always double-check the list of required attachments.

-

Incorrect Filing Deadline: Submitting the application after the March 1 deadline will disqualify the organization from receiving the exemption for that tax year. Mark the deadline on your calendar.

-

Inaccurate Property Use Description: Providing vague or inaccurate descriptions of how the property is used may raise questions during the review process. Be specific and detailed in this section.

-

Omitting Non-Exempt Use Information: If any part of the property is used for non-exempt purposes, failing to disclose this can lead to issues. Be transparent about any such uses and provide detailed explanations.

-

Signature and Certification Errors: Neglecting to sign the application or certify the accuracy of the information can result in rejection. Ensure that the signature section is completed correctly.

How to Use Dr 504 Florida

Filling out the DR 504 Florida form is a necessary step for nonprofit organizations seeking an ad valorem tax exemption. This form requires detailed information about the organization and how the property is used. Ensure all sections are completed accurately and all required attachments are included before submitting it to the county property appraiser by the deadline.

- Begin with the General Information section. Fill in the applicant name, facility name, mailing address, physical address (if different), business phone, county where the property is located, and parcel identification number or legal description.

- Answer whether the applicant was a Florida not-for-profit corporation on January 1 of the current year. If yes, attach the filing confirmation letter, Articles of Incorporation, and Bylaws. If no, attach the Articles of Organization and other organizing documents.

- Describe how the property is used. Attach additional pages if necessary.

- Indicate if any portion of the property is rented or leased. If yes, attach all rental and lease contracts from the last calendar year.

- State whether any portion of the property is used for non-exempt purposes. If yes, provide a detailed explanation on an additional page if needed.

- If applicable, answer whether the applicant was qualified as charitable under section 501(c)(3) of the Internal Revenue Code on January 1 of the current year. Attach the determination letter, Articles of Incorporation, and Bylaws if yes.

- For hospitals, nursing homes, and homes for special services, indicate if the organization held a valid license from the Agency for Health Care Administration on January 1. Attach a copy of the license if yes.

- Gather and attach the required documents: the organization’s most recent financial statement, the most recent federal tax return (if filed), and detailed fiscal records showing financial condition and property use.

- Complete the Signature section. Certify that all information provided is true and correct, and sign with your title and date.

After completing the form, review it for accuracy. Ensure all attachments are included before submitting it to the appropriate county property appraiser by March 1 of the current tax year.

File Specs

| Fact Name | Description |

|---|---|

| Purpose of Form | The DR-504 form is used by nonprofit organizations to apply for an ad valorem tax exemption for property used predominantly for exempt purposes. |

| Governing Laws | This form is governed by sections 196.195, 196.196, and 196.197 of the Florida Statutes. |

| Filing Deadline | Applicants must submit the completed form to the county property appraiser by March 1 of the current tax year. |

| Required Attachments | Applicants must include various documents, such as the organization's financial statement and federal tax return, along with proof of nonprofit status. |

Additional PDF Forms

Florida Parenting Plan Pdf - Timelines for school or health-related communication are also critical components of this plan.

Florida Nurse Practitioner Scope of Practice 2023 - The physician must submit notice of the established protocol to the board.