Blank Deed in Lieu of Foreclosure Template for Florida

Understanding Florida Deed in Lieu of Foreclosure

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure. This process can be beneficial for both parties, as it allows the homeowner to escape the lengthy and often stressful foreclosure process while providing the lender with a more efficient way to reclaim the property.

-

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility typically includes homeowners who are facing financial difficulties and are unable to make their mortgage payments. However, the lender must also agree to accept the deed in lieu. Homeowners should be current on their mortgage or only slightly behind, as lenders may be reluctant to accept the deed if significant arrears exist.

-

What are the benefits of a Deed in Lieu of Foreclosure?

There are several advantages to a Deed in Lieu of Foreclosure:

- It can help avoid the lengthy and costly foreclosure process.

- Homeowners may have less negative impact on their credit score compared to a foreclosure.

- It allows for a more amicable resolution between the homeowner and lender.

- Homeowners may be able to negotiate for a “cash for keys” arrangement, receiving money to help with relocation.

-

What are the potential drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also some drawbacks to consider:

- Homeowners may still face tax implications, as forgiven debt can be considered taxable income.

- The lender may require the homeowner to be responsible for any remaining mortgage balance if the property’s value is less than the loan amount.

- Not all lenders accept deeds in lieu, so homeowners must verify this option with their lender.

-

How does the process work?

The process generally begins with the homeowner contacting their lender to discuss their financial situation. If the lender agrees to consider a Deed in Lieu, the homeowner will need to provide documentation of their financial hardship. After a review, if approved, the lender will prepare the deed, and the homeowner will sign it, officially transferring ownership.

-

Do I need legal assistance to complete a Deed in Lieu of Foreclosure?

While it is not mandatory to have legal assistance, it is highly recommended. An attorney can help navigate the complexities of the process, ensure that all documents are correctly prepared, and advise on potential tax implications or other legal considerations.

-

Will a Deed in Lieu of Foreclosure affect my credit score?

Yes, a Deed in Lieu of Foreclosure can impact your credit score, but typically less severely than a foreclosure. The exact effect will depend on your overall credit profile and how the lender reports the transaction to credit bureaus. It is advisable to check your credit report after the process is complete to understand its impact.

-

Can I still buy a home after a Deed in Lieu of Foreclosure?

Yes, it is possible to buy a home after a Deed in Lieu of Foreclosure, but it may take some time. Lenders usually require a waiting period, often ranging from two to four years, before you can qualify for a new mortgage. This period can vary based on the lender’s policies and your overall financial situation.

-

What happens to my personal belongings after the Deed in Lieu of Foreclosure?

Once the deed is transferred, the property officially belongs to the lender. It is important for homeowners to remove their personal belongings before the transfer is finalized. Depending on the lender’s policy, they may provide a timeline for vacating the property.

Common mistakes

-

Inaccurate Property Description: One common mistake is failing to provide a precise legal description of the property. This description must match the one on the original deed.

-

Not Identifying All Parties: It’s crucial to include all owners of the property. Omitting a co-owner can lead to complications and potential legal issues later.

-

Missing Signatures: Ensure that all required parties sign the document. A missing signature can invalidate the deed.

-

Not Notarizing the Document: Failing to have the deed notarized can render it ineffective. Notarization adds an extra layer of authenticity.

-

Ignoring Lender Requirements: Each lender may have specific requirements for accepting a deed in lieu of foreclosure. Not adhering to these can lead to rejection of the deed.

-

Failure to Review Tax Implications: People often overlook the potential tax consequences of a deed in lieu. Consulting a tax professional is advisable.

-

Not Keeping Copies: After submitting the deed, individuals should retain copies for their records. This can be important for future reference or disputes.

How to Use Florida Deed in Lieu of Foreclosure

After completing the Florida Deed in Lieu of Foreclosure form, the next step involves submitting it to the appropriate parties. This typically includes the lender and possibly local authorities. Ensure that all necessary documents are included to avoid delays in processing.

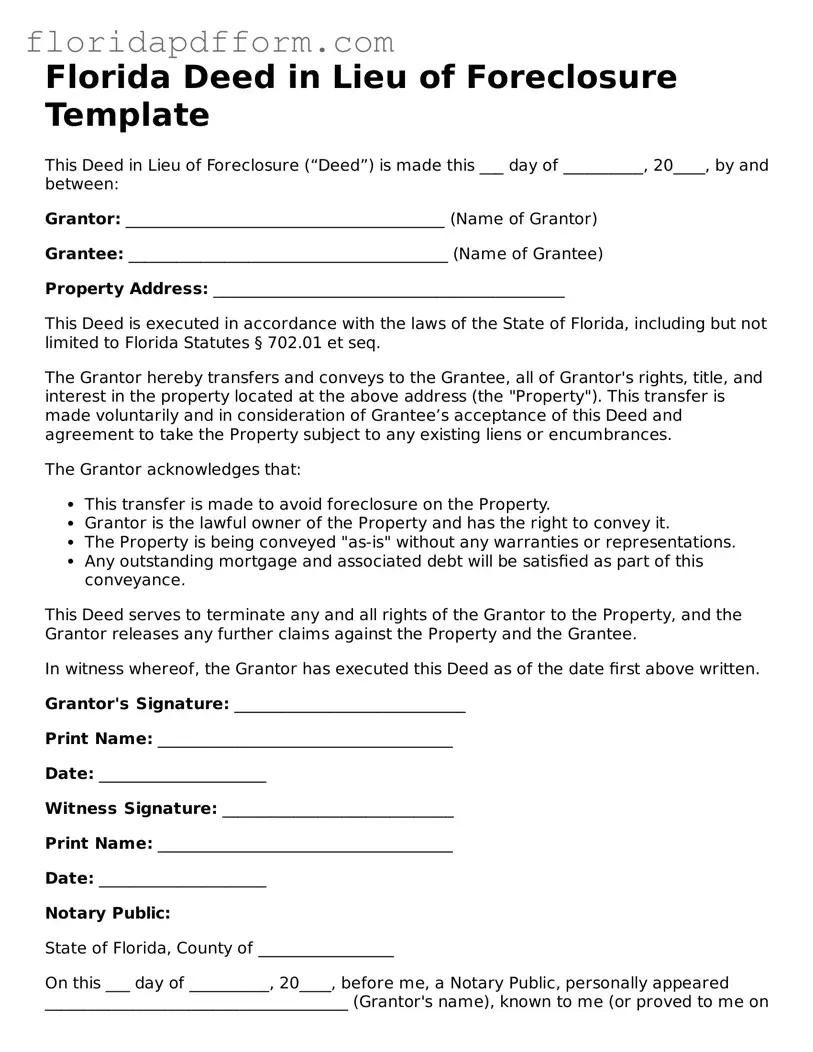

- Obtain the Florida Deed in Lieu of Foreclosure form from a reliable source.

- Fill in the names of the parties involved. This includes the borrower and the lender.

- Provide the property address. Make sure to include the complete address to avoid any confusion.

- Enter the legal description of the property. This can usually be found on the original deed or property tax records.

- Indicate the date of the deed execution. This is the date you sign the document.

- Sign the form in the designated area. Ensure that all required signatures are present.

- Have the document notarized. A notary public must witness your signature for the deed to be valid.

- Make copies of the completed form for your records.

- Submit the original signed and notarized form to the lender and any other required parties.

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal agreement where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | In Florida, the deed in lieu of foreclosure is governed by state laws, particularly under Florida Statutes Chapter 697. |

| Eligibility | Homeowners facing financial difficulties may be eligible for a deed in lieu of foreclosure if they have no other viable options to keep their home. |

| Benefits | This process can help borrowers avoid the lengthy and damaging foreclosure process, allowing for a smoother transition. |

| Process | The borrower must submit a request to the lender, who will then evaluate the situation and determine if a deed in lieu is appropriate. |

| Impact on Credit | While a deed in lieu of foreclosure is less damaging than a foreclosure, it will still negatively impact the borrower's credit score. |

| Deficiency Judgments | In some cases, lenders may pursue deficiency judgments for any remaining balance owed after the property is transferred. |

| Documentation | Proper documentation is crucial. The borrower must ensure all paperwork is completed accurately to avoid future disputes. |

| Legal Advice | Consulting with a legal advisor is recommended to understand all implications and ensure that the deed in lieu is the best option. |

Other Popular Florida Templates

Is Power of Attorney Public Record - This form is critical for planning ahead, making sure your financial responsibilities are handled properly in case of emergencies.

Cease and Desist Letter Template - A Cease and Desist Letter is a formal request for someone to stop an action that is harmful or illegal.

Simple Bill of Sale Florida - A comprehensive Bill of Sale includes all relevant details, ensuring a transparent transaction.