Blank Deed Template for Florida

Understanding Florida Deed

-

What is a Florida Deed form?

A Florida Deed form is a legal document used to transfer ownership of real property from one party to another in the state of Florida. This document outlines the details of the transaction, including the names of the parties involved, a description of the property, and any terms or conditions of the transfer. Various types of deeds exist, such as warranty deeds, quitclaim deeds, and special purpose deeds, each serving different purposes in property transactions.

-

What information is required to complete a Florida Deed form?

To properly fill out a Florida Deed form, you will need the following information:

- The full names and addresses of the grantor (seller) and grantee (buyer).

- A legal description of the property being transferred, which can often be found on the property tax records or the previous deed.

- The date of the transfer.

- Any relevant details regarding the transaction, such as purchase price or special conditions.

-

How is a Florida Deed form executed?

Execution of a Florida Deed form involves several steps. First, the grantor must sign the deed in the presence of a notary public. This step is crucial as it verifies the identity of the grantor and ensures that the signature is authentic. After notarization, the deed must be recorded with the county clerk's office where the property is located. Recording the deed provides public notice of the transfer and protects the rights of the new owner.

-

Do I need an attorney to prepare a Florida Deed form?

While it is not legally required to have an attorney prepare a Florida Deed form, it is often recommended, especially for complex transactions. An attorney can provide guidance on the specific type of deed needed, ensure that all necessary information is included, and help navigate any potential legal issues that may arise. For straightforward transactions, many individuals choose to use a legal document preparer or online services to create the deed.

-

What happens after the Florida Deed form is recorded?

Once the Florida Deed form is recorded, the transfer of ownership is officially recognized. The grantee becomes the legal owner of the property, and the deed serves as proof of ownership. It is advisable for the grantee to keep a copy of the recorded deed for their records. Additionally, the county property appraiser’s office will update their records to reflect the new ownership, which may affect property taxes and assessments.

Common mistakes

-

Incorrect Names: One common mistake is failing to use the full legal names of all parties involved. Abbreviations or nicknames can lead to confusion and potential legal issues.

-

Missing Signatures: All required signatures must be present. Omitting a signature can invalidate the deed and complicate the transfer of property.

-

Improper Property Description: The property must be accurately described. Errors in the legal description can result in disputes or challenges to ownership.

-

Failure to Notarize: A deed typically requires notarization. Not having the document notarized can render it unenforceable.

-

Inaccurate Date: The date of execution should be correct. An incorrect date can create confusion about when the transfer took place.

-

Not Including Consideration: The deed should state the consideration, or payment, for the property. Leaving this out can raise questions about the legitimacy of the transaction.

-

Ignoring Local Requirements: Different counties may have specific requirements for deeds. Failing to comply with local regulations can lead to rejection of the document.

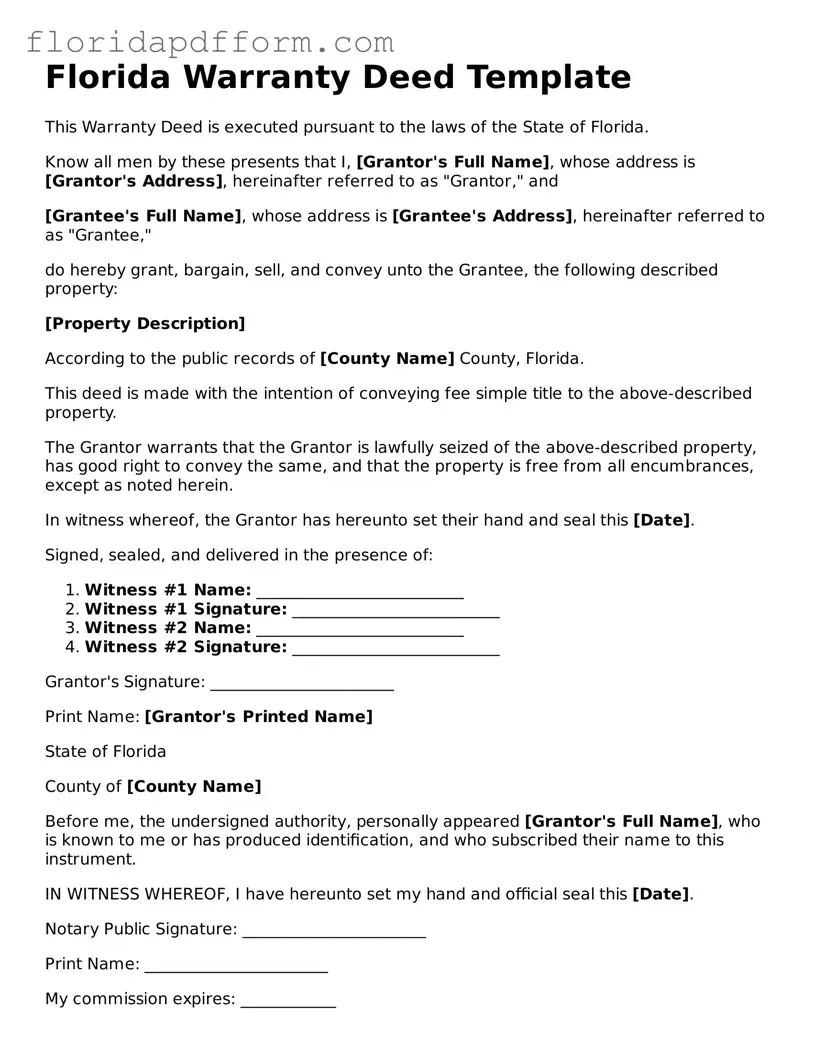

How to Use Florida Deed

Once you have the Florida Deed form in front of you, it’s important to ensure that all necessary information is filled out accurately. This will help facilitate a smooth transfer of property ownership. Follow the steps below to complete the form correctly.

- Begin by entering the date at the top of the form where indicated.

- Identify the Grantor(s) (the person or entity transferring the property). Write their full name(s) and address(es) in the designated space.

- Next, enter the Grantee(s) (the person or entity receiving the property). Include their full name(s) and address(es) as well.

- Clearly describe the property being transferred. This includes the legal description, which can often be found on previous deeds or property tax documents. Make sure to be as precise as possible.

- Specify the consideration, which is the amount paid for the property. If the transfer is a gift, indicate that as well.

- Sign the form in the presence of a notary public. Ensure that all Grantors sign the document.

- Have the notary public complete their section, which includes their signature and seal.

- Once completed, make copies of the signed deed for your records.

- Finally, file the original deed with the county clerk’s office in the county where the property is located. Be prepared to pay any applicable filing fees.

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Florida Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include Warranty Deed, Quitclaim Deed, and Special Warranty Deed. |

| Governing Law | Florida Statutes, Chapter 689 governs the execution and recording of deeds in Florida. |

| Recording Requirements | Deeds must be recorded in the county where the property is located to provide public notice of the ownership change. |

Other Popular Florida Templates

Simple Bill of Sale Florida - The document can include information about any warranties or guarantees agreed upon during the sale.

Hillsborough County Tag Office - A crucial document for estate planning to manage vehicles after someone's passing.

Self Proving Affidavit Florida - The Self-Proving Affidavit is an integral component of modern estate planning practices.