Free Cpe Reporting Florida Form

Understanding Cpe Reporting Florida

-

What is the purpose of the CPE Reporting Florida form?

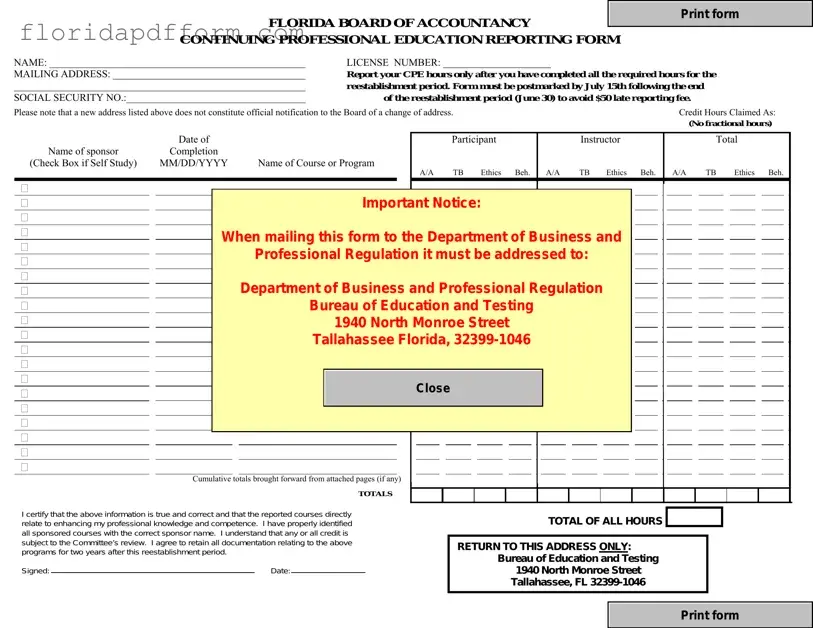

The CPE Reporting Florida form is used by licensed accountants in Florida to report their Continuing Professional Education (CPE) hours. This form must be submitted after completing the required CPE hours for the reestablishment period, which ends on June 30. It ensures that professionals meet the educational requirements set by the Florida Board of Accountancy.

-

What are the minimum CPE requirements for the reestablishment period?

For each two-year reestablishment period, licensees must complete at least 80 total CPE hours. This includes:

- At least 20 hours in accounting and auditing (A/A) subjects.

- A minimum of 4 hours in ethics.

- No more than 20 hours in behavioral subjects.

Courses in the A/A category cover topics like financial reporting and auditing, while technical business subjects include taxation and general business. Behavioral courses focus on communication and management, and ethics courses must be approved by the Florida Board of Accountancy.

-

How should I report self-study or correspondence courses?

When reporting self-study or correspondence courses, you must write the sponsor's name and mark the box next to it on the form. It is important to note that all self-study courses must be taken from sponsors approved by NASBA's Quality Assurance Service (QAS). A list of these approved sponsors can be found on NASBA's website.

-

What happens if I submit my form late?

If the CPE Reporting Florida form is not postmarked by July 15 following the end of the reestablishment period, a late reporting fee of $50 will be incurred. Timely submission is crucial to avoid additional fees and ensure compliance with reporting requirements.

-

Is it necessary to keep documentation of my CPE courses?

Yes, it is essential to retain all documentation related to the reported CPE courses for a period of two years after the reestablishment period. This documentation may be requested for review by the Committee, ensuring that all reported courses are valid and enhance professional knowledge and competence.

-

How do I notify the Board of a change of address?

To officially notify the Board of a change of address, you must do so in writing. A change of address listed on the CPE Reporting Florida form will not be recognized as official notification. It is important to follow the proper procedures to ensure that your records are up to date.

Common mistakes

-

Incomplete Information: Many people forget to fill out all required fields on the form. This includes their name, license number, and mailing address. If any part is missing, the form will be returned, causing delays.

-

Incorrect Reporting of Hours: Some individuals report fractional hours instead of whole hours. The form only accepts whole hours, so any fractions will be removed. This can lead to a misunderstanding of total hours completed.

-

Failure to Sign and Date: Another common mistake is neglecting to sign and date the form. Without a signature, the form is not valid, and it cannot be processed.

-

Not Notifying the Board of Address Changes: Changing the address on the form does not officially notify the Board. Individuals must send a separate written notice to update their address. This oversight can lead to important correspondence being missed.

How to Use Cpe Reporting Florida

Completing the CPE Reporting Florida form is essential for maintaining your professional license. This form allows you to report your continuing professional education hours accurately. Follow the steps outlined below to ensure that your submission is complete and meets all requirements.

- Print or type the form: Ensure that the CPE Reporting Florida form is filled out clearly. All requested information must be completed.

- Provide personal information: Fill in your name, license number, mailing address, and social security number.

- Report your CPE hours: Only report hours after completing all required education for the reestablishment period. List courses directly on the form.

- Check the self-study box: If any courses were self-study, mark the appropriate box next to the sponsor's name.

- Enter sponsor information: If the course was presented by an approved sponsor, include the sponsor code. Leave this blank if the sponsor was not approved.

- Claim credit hours: Indicate whether you are reporting hours as a participant or as an instructor. Remember that you can claim double credit for the first presentation of a course.

- List total hours: Report whole hours only. Any fractions must be rounded down to the nearest whole hour. Total all columns and write the overall total at the bottom of the form.

- Sign and date the form: Ensure that you sign and date the form. Include your employer or firm name as well.

- Mail the form: Send the completed form to the Bureau of Education and Testing at the address provided. Ensure it is postmarked by July 15th to avoid late fees.

- Retain a copy: Keep a copy of the completed form for your records.

By following these steps, you can ensure that your CPE Reporting Florida form is filled out correctly and submitted on time. If you have any questions during the process, don't hesitate to reach out to the Bureau of Education & Testing for assistance.

File Specs

| Fact Name | Details |

|---|---|

| Governing Law | The CPE Reporting Form is governed by Florida Statutes, specifically sections 455.203(9), 409.2577, and 409.2598. |

| Submission Deadline | Forms must be postmarked by July 15th following the end of the reestablishment period on June 30. |

| Minimum Hours Required | Each two-year reestablishment period requires at least 80 total hours of continuing professional education. |

| Ethics Requirement | At least 4 hours of the total must be dedicated to ethics courses approved by the Florida Board of Accountancy. |

| Self-Study Courses | Participants must indicate self-study courses by marking the appropriate box next to the sponsor's name. |

| Fractional Hours | Only whole hours can be reported; any fractional hours will be rounded down and removed from the total. |

| Documentation Retention | Licensees must retain all documentation related to reported courses for two years after the reestablishment period. |

| Address Change Notification | Changes of address must be reported in writing to the Board; listing a new address on the form is insufficient. |

Additional PDF Forms

Florida Franchise Tax - Utilizing electronic filing where available can simplify the process of submitting the F 1065 for partnerships.

Stay Away Order Florida - If you want to change the terms of a previously entered injunction, use this form.

Florida Durable Power of Attorney - This form can help simplify the process of transferring a vehicle title to a buyer.