Free Business Partner Number Florida Form

Understanding Business Partner Number Florida

-

What is the Business Partner Number Florida form?

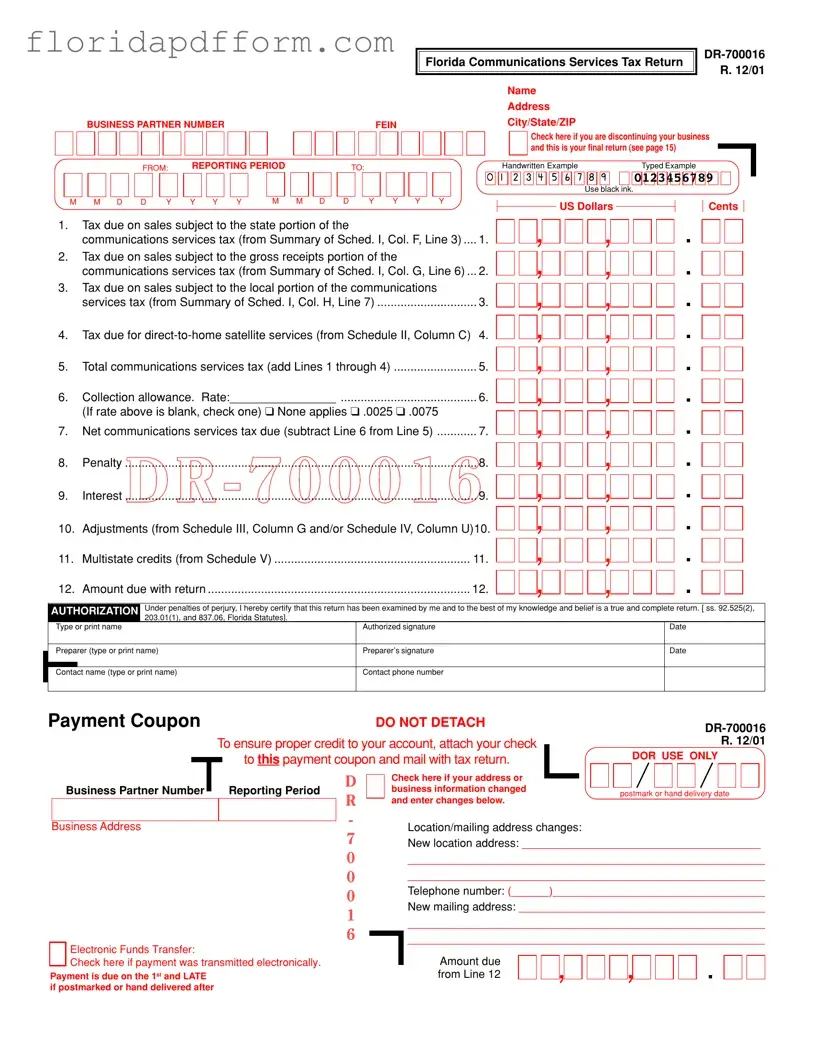

The Business Partner Number Florida form is a tax return document required for businesses operating in Florida that provide communications services. This form, known as DR-700016, helps businesses report their sales and calculate the taxes owed under the communications services tax. It includes sections for reporting taxable sales, calculating tax due, and providing necessary business information.

-

Who needs to file the Business Partner Number Florida form?

Any business that provides communications services in Florida must file this form. This includes companies involved in telephone, cable, satellite, and other communication services. If your business has been active during the reporting period, it is essential to complete and submit this form to ensure compliance with state tax laws.

-

What information is required on the form?

The form requires various details, including:

- Your business name and address.

- Your Business Partner Number and Federal Employer Identification Number (FEIN).

- The reporting period for which you are filing.

- Details of taxable sales and the corresponding tax calculations.

- Any adjustments, penalties, or interest applicable to your filing.

Accurate and complete information is crucial to avoid delays or penalties.

-

How do I submit the Business Partner Number Florida form?

You can submit the form either by mail or electronically. If mailing, ensure that you send it to the Florida Department of Revenue at the specified address on the form. If you prefer electronic submission, visit the Department's website at www.myflorida.com/dor. Filing electronically is encouraged, as it is faster and more efficient.

-

What happens if I miss the filing deadline?

Filing late can result in penalties and interest on the amount due. It is essential to submit your form by the due date to avoid these additional charges. If you believe you may miss the deadline, consider filing for an extension or contacting the Florida Department of Revenue for guidance.

-

Can I amend my Business Partner Number Florida form after submission?

Yes, if you discover an error after submitting your form, you can amend it. You will need to follow the specific process outlined by the Florida Department of Revenue for amending tax returns. Ensure that you provide accurate information and any necessary documentation to support your amendments.

Common mistakes

-

Incorrect Business Partner Number: Ensure that the Business Partner Number is accurate. A common mistake is entering the wrong number, which can delay processing.

-

Missing Federal Employer Identification Number (FEIN): Failing to provide your FEIN can lead to complications. This number is essential for identifying your business.

-

Inaccurate Reporting Period: Be sure to clearly indicate the correct reporting period. Errors here can result in miscalculations of taxes owed.

-

Using Incorrect Ink: Always use black ink when filling out the form. Using other colors can make your submission hard to read and may cause processing delays.

-

Omitting Signature: A common oversight is forgetting to sign the form. Without a signature, the form is not valid and cannot be processed.

-

Not Double-Checking Calculations: Always verify your math. Mistakes in tax calculations can lead to underpayment or overpayment, both of which can have consequences.

-

Ignoring Payment Instructions: Follow the payment instructions carefully. Failing to attach the payment coupon or sending it to the wrong address can cause delays.

-

Neglecting to Update Business Information: If your business address or contact information has changed, make sure to update it on the form. This ensures you receive important correspondence.

-

Not Filing Electronically: Many individuals miss out on the benefits of electronic filing. It’s faster and often more efficient than paper filing.

How to Use Business Partner Number Florida

Filling out the Business Partner Number Florida form is a straightforward process that requires accurate information about your business and tax obligations. After completing the form, you will submit it to the Florida Department of Revenue, along with any payment due. Ensure that all fields are filled out correctly to avoid any delays or issues with your submission.

- Obtain the form: Download the Business Partner Number Florida form (DR-700016) from the Florida Department of Revenue website or obtain a physical copy.

- Fill in your business information: Enter your business name, address, and Business Partner Number at the top of the form.

- Provide your FEIN: Input your Federal Employer Identification Number (FEIN) in the designated field.

- Specify the reporting period: Indicate the start and end dates for the reporting period in the appropriate sections.

- Complete the tax due sections: Fill in the amounts for taxes due on sales subject to various portions of the communications services tax. Make sure to refer to the Summary of Schedule I for accurate figures.

- Calculate total tax: Add the amounts from Lines 1 through 4 to determine the total communications services tax due.

- Determine collection allowance: Indicate the collection allowance rate and check the appropriate box if none applies.

- Calculate net tax due: Subtract the collection allowance from the total tax due to find the net communications services tax due.

- Include penalties and interest: If applicable, enter any penalties or interest on the designated lines.

- Fill out adjustments and credits: Include any adjustments or multistate credits, if applicable, in the specified sections.

- Sign and date the form: Ensure that the authorized person signs and dates the form. Include the preparer's information if someone else filled it out.

- Prepare for submission: Attach your payment coupon to any check, if applicable, and ensure all necessary documents are included.

- Mail the form: Send the completed form to the Florida Department of Revenue at the address provided, or consider filing electronically for faster processing.

File Specs

| Fact Name | Description |

|---|---|

| Form Purpose | The Business Partner Number Florida form is used to report communications services tax owed by businesses in Florida. |

| Governing Laws | This form is governed by sections 92.525(2), 203.01(1), and 837.06 of the Florida Statutes. |

| Filing Requirements | Businesses must file this form if they owe communications services tax for the reporting period. |

| Final Return Option | There is an option to indicate if this is the final return when discontinuing business. |

| Payment Methods | Payments can be made by check or electronically via the Florida Department of Revenue's website. |

| Collection Allowance | A collection allowance may apply, which businesses can calculate based on the provided rates. |

| Deadline for Submission | The form and payment are due on the 1st of the month and are considered late if postmarked after that date. |

Additional PDF Forms

Florida Durable Power of Attorney - Awareness of the form's requirements can aid in a seamless authorization process.

Notice to Vacate Florida - Be diligent in tracking supplemental income beyond traditional salaried jobs.