Blank Articles of Incorporation Template for Florida

Understanding Florida Articles of Incorporation

-

What are the Articles of Incorporation?

The Articles of Incorporation are legal documents that establish a corporation in Florida. They outline basic information about the corporation, such as its name, purpose, registered agent, and the number of shares it can issue. This document is filed with the Florida Division of Corporations.

-

Who needs to file Articles of Incorporation?

Any individual or group looking to form a corporation in Florida must file Articles of Incorporation. This includes businesses of all sizes, from small startups to larger enterprises. If you want your business to have the legal protections and benefits that come with incorporation, this step is essential.

-

What information is required in the Articles of Incorporation?

- The name of the corporation.

- The purpose of the corporation.

- The name and address of the registered agent.

- The number of shares the corporation is authorized to issue.

- The names and addresses of the incorporators.

Providing accurate and complete information is crucial to avoid delays in processing your application.

-

How do I file the Articles of Incorporation?

You can file the Articles of Incorporation online through the Florida Division of Corporations' website or by mailing a paper form. Online filing is typically faster and more efficient. Make sure to pay the required filing fee, which varies based on the type of corporation you are forming.

-

What is the filing fee for the Articles of Incorporation?

The filing fee for Articles of Incorporation in Florida generally starts at $70. However, additional fees may apply depending on the type of corporation and any optional services you choose, such as expedited processing. Always check the latest fee schedule on the Florida Division of Corporations' website.

-

How long does it take to process the Articles of Incorporation?

Processing times can vary. Typically, online submissions are processed within a few business days, while paper submissions may take longer. If you need your incorporation completed quickly, consider choosing expedited processing for an additional fee.

-

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are approved, you will receive a confirmation from the Florida Division of Corporations. Your corporation will then be legally recognized. You should also consider obtaining an Employer Identification Number (EIN) from the IRS and setting up any necessary business licenses and permits.

-

Can I amend the Articles of Incorporation later?

Yes, you can amend the Articles of Incorporation if you need to make changes, such as altering the corporation's name or increasing the number of shares. To do this, you must file an amendment form with the Florida Division of Corporations and pay the associated fee.

-

Do I need a lawyer to file the Articles of Incorporation?

While it is not legally required to hire a lawyer to file the Articles of Incorporation, consulting one can be beneficial. A legal professional can help ensure that your documents are correctly prepared and that you comply with all state regulations.

Common mistakes

-

Incorrect Business Name: Many people forget to check if their desired business name is already in use. The name must be unique and comply with Florida naming requirements.

-

Missing Registered Agent Information: Failing to provide the name and address of a registered agent can lead to delays. The registered agent must be a Florida resident or a business authorized to conduct business in the state.

-

Inaccurate Purpose Statement: A vague or overly broad purpose statement can cause confusion. Clearly define what your corporation will do to avoid future complications.

-

Omitting Incorporator Details: Forgetting to include the names and addresses of the incorporators is a common mistake. This information is crucial for the processing of the form.

-

Improper Signature: Not signing the form or having the wrong person sign it can invalidate the submission. Ensure that the incorporator signs the document.

-

Failure to Include Initial Directors: Some forms require listing the initial directors. Omitting this information can lead to rejection of the application.

-

Incorrect Filing Fee: Submitting the wrong amount for the filing fee can delay the process. Always verify the current fee before submission.

-

Not Using the Correct Form: Using an outdated version of the Articles of Incorporation can result in rejection. Always download the most current form from the Florida Division of Corporations website.

-

Neglecting to Review the Form: Skipping a final review can lead to overlooked errors. Double-check all information before sending it in.

-

Ignoring State Requirements: Each state has specific requirements. Not being aware of Florida's regulations can lead to incomplete or incorrect submissions.

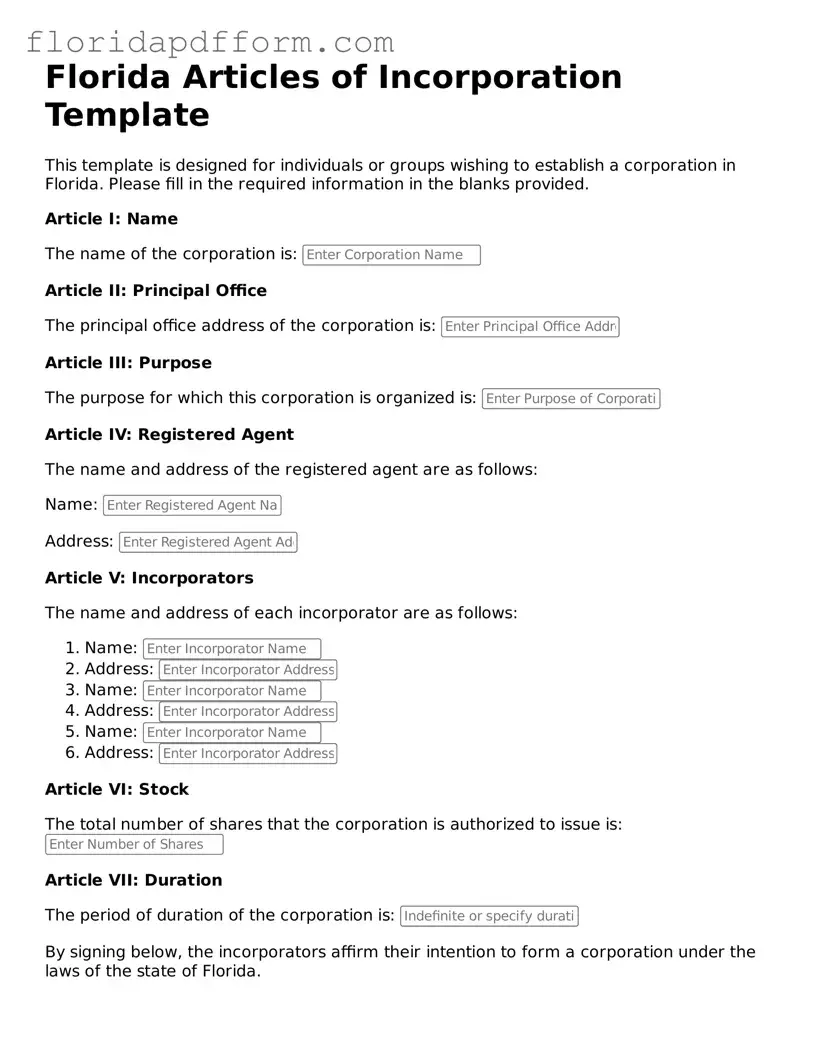

How to Use Florida Articles of Incorporation

Once you have the Florida Articles of Incorporation form in front of you, you will need to complete it carefully to ensure that your application is processed without issues. After filling out the form, you will submit it to the Florida Division of Corporations along with the required filing fee. Make sure to double-check your information for accuracy.

- Begin by entering the name of your corporation. Ensure that it complies with Florida naming requirements.

- Provide the principal office address. This should be a physical address in Florida, not a P.O. Box.

- List the name and address of your registered agent. This person or business must have a physical address in Florida and be available during business hours.

- Indicate the purpose of your corporation. Be clear and concise about what your business will do.

- Specify the number of shares your corporation is authorized to issue. Include the par value if applicable.

- Fill in the names and addresses of the initial directors. You typically need at least one director.

- Include the name and address of the incorporator. This is the person filing the Articles of Incorporation.

- Review the form for any errors or omissions. Accuracy is crucial to avoid delays.

- Sign and date the form. Ensure that the signature is from the incorporator.

- Prepare your payment for the filing fee. Check the current fee amount on the Florida Division of Corporations website.

- Submit the completed form and payment to the Florida Division of Corporations. You can do this by mail or online, depending on your preference.

Form Specifications

| Fact Name | Detail |

|---|---|

| Governing Law | The Florida Articles of Incorporation are governed by Chapter 607 of the Florida Statutes. |

| Purpose | The form is used to legally create a corporation in the state of Florida. |

| Filing Requirement | The Articles of Incorporation must be filed with the Florida Department of State. |

| Filing Fee | A filing fee is required, which is subject to change. As of the latest update, it is $70. |

| Incorporator Information | The form requires the name and address of the incorporator(s). At least one incorporator is necessary. |

| Corporate Name | The corporation's name must be unique and include a designator such as "Corporation," "Incorporated," or "Company." |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Business Purpose | The form allows for a general business purpose or specific purposes to be stated. |

| Duration | The corporation can be established for a specific duration or be perpetual. |

| Approval Process | The Articles of Incorporation must be approved by the Florida Department of State before the corporation is officially formed. |

Other Popular Florida Templates

Power of Attorney Form Florida Pdf - This document needs to be dated and signed by the principal to be valid.

Commercial Lease Agreement Template - Specifies the effects of bankruptcy on the lease.