Blank Affidavit of Gift Template for Florida

Understanding Florida Affidavit of Gift

-

What is a Florida Affidavit of Gift form?

The Florida Affidavit of Gift form is a legal document used to declare that a gift has been made. This form is often used in situations where property, such as real estate or vehicles, is transferred without payment. It serves as proof of the gift and can help clarify the intentions of both the giver and the recipient.

-

Who needs to complete this form?

Anyone who is giving a gift of property in Florida should complete the Affidavit of Gift form. This includes individuals transferring ownership of real estate, vehicles, or other valuable items. Both the giver and the recipient may need to sign the document, depending on the circumstances.

-

How do I fill out the form?

To fill out the Florida Affidavit of Gift form, start by providing the names and addresses of both the giver and the recipient. Next, describe the property being gifted, including any relevant details like the property’s location or vehicle identification number. Finally, both parties should sign and date the form. It's important to ensure that all information is accurate and complete.

-

Do I need a notary public to sign the form?

Yes, in Florida, the Affidavit of Gift form typically needs to be notarized. A notary public will verify the identities of the signers and witness the signing of the document. This adds an extra layer of authenticity and can help prevent disputes in the future.

-

Is there a fee associated with filing this form?

There is no fee for completing the Affidavit of Gift form itself. However, if you are transferring real estate, there may be recording fees when you file the document with the county clerk's office. Additionally, if you require the services of a notary public, there may be a fee for that service as well.

-

What should I do after completing the form?

After completing the Florida Affidavit of Gift form, both parties should sign it in the presence of a notary public. Once notarized, the giver should provide a copy to the recipient. If the gift involves real estate, file the form with the county clerk's office where the property is located to officially record the transfer.

-

What happens if I don’t use this form?

If you do not use the Florida Affidavit of Gift form, there may be confusion regarding the ownership of the gifted property. Without proper documentation, disputes could arise, and the recipient may face challenges in proving their ownership. It is always best to have a clear record of any gift to avoid potential legal issues in the future.

Common mistakes

-

Incomplete Information: Many individuals forget to fill out all required fields. This can include missing names, addresses, or dates. Ensure every section is completed to avoid delays.

-

Incorrect Signatures: The form requires signatures from both the donor and the recipient. Some people overlook this requirement, which can invalidate the affidavit.

-

Failure to Notarize: A common mistake is not having the affidavit notarized. Notarization is often necessary for the document to be legally recognized.

-

Wrong Date: Entering the wrong date can lead to confusion. Make sure the date of the gift is accurate and matches the date of signing.

-

Omitting Gift Description: The affidavit should clearly describe the gift. Some people forget to include specific details about the item being gifted.

-

Ignoring State Requirements: Each state may have different requirements for affidavits. Failing to check Florida's specific rules can result in a rejected form.

How to Use Florida Affidavit of Gift

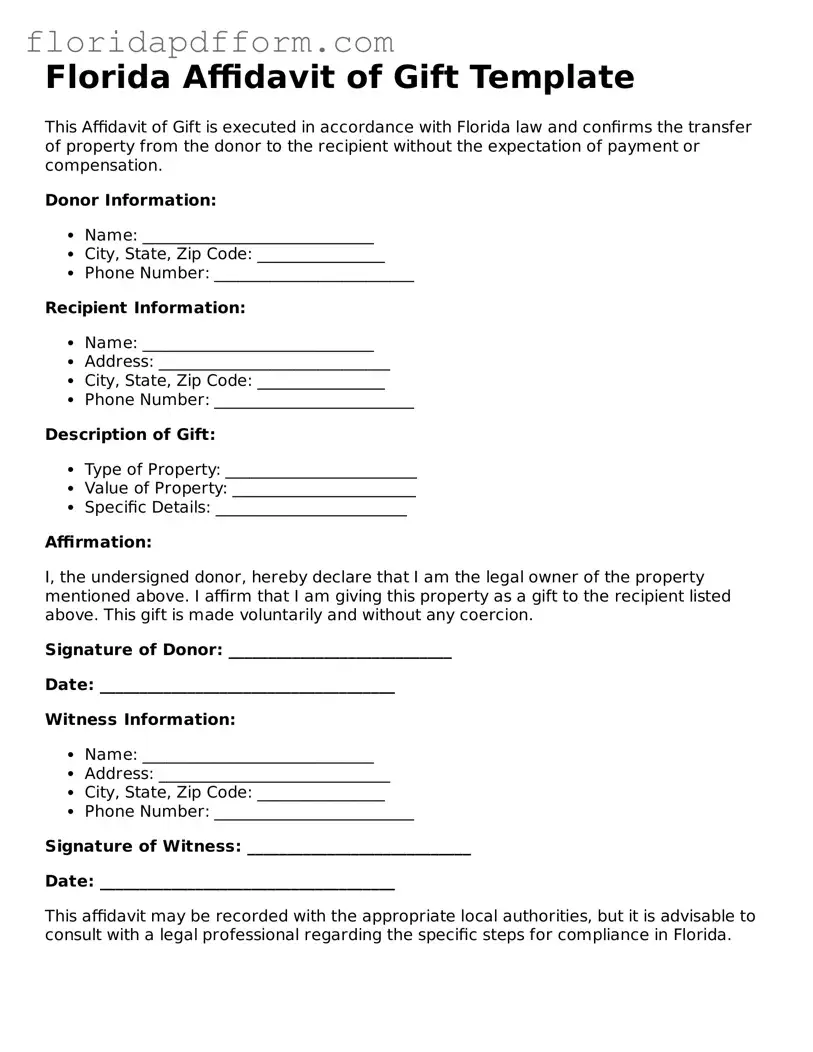

Filling out the Florida Affidavit of Gift form is a straightforward process that requires careful attention to detail. Once you have completed the form, you will be able to submit it as part of your documentation for the transfer of a gift. Below are the steps to guide you through filling out the form accurately.

- Begin by downloading the Florida Affidavit of Gift form from a reliable source or the official state website.

- In the top section, enter the name and address of the donor, who is the person giving the gift.

- Next, provide the recipient's name and address in the designated area. This is the person receiving the gift.

- Indicate the date of the gift. Be sure to use the correct format for clarity.

- Describe the gift in detail. Include specifics such as the type of gift, its value, and any identifying information if applicable.

- Sign the form in the appropriate section. The donor's signature is required to validate the affidavit.

- Have the form notarized. This step is important as it adds an extra layer of verification to the document.

- Make copies of the completed and notarized form for your records and for the recipient.

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Florida Affidavit of Gift form is used to document the transfer of property or assets as a gift from one person to another. |

| Governing Law | This form is governed by Florida Statutes, specifically Chapter 709, which pertains to the transfer of property and gifts. |

| Signatures Required | The form must be signed by both the donor and the recipient to validate the gift transfer. |

| Notarization | Notarization of the signatures is recommended to ensure the authenticity of the document. |

Other Popular Florida Templates

Florida Notary Acknowledgement Form 2023 - The form is often needed for business agreements.

Marital Settlement Agreement for Simplified Dissolution of Marriage - Ensures that both parties have a clear understanding of their obligations.